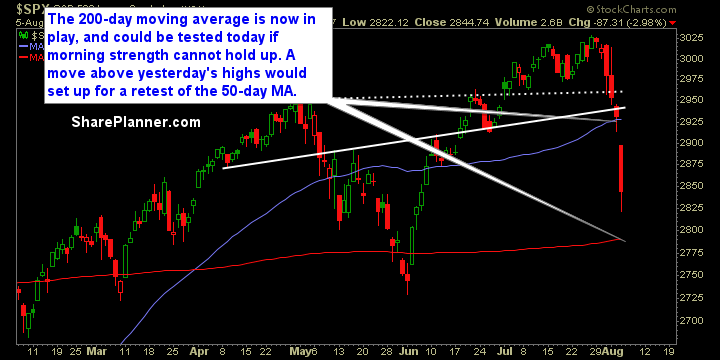

My Swing Trading Strategy I kept my positions the same heading into the weekend,and means I am still short on this market, and at the very least, the open,should be quite favorable today. I may consider adding more short exposure depending on the price action in the early going, and the overall breadth and volume

The market is trying to crash again like what we saw back in Q4 of last year, how are you going to be swing-trading it and most importantly preserving profits along the way. I go over the possibilities of a market crash, my swing-trading update, and the technical analysis of the most important stocks currently

My Swing Trading Strategy I stayed in cash most of the day, until then end, when I added a short position to the portfolio. Yesterday’s rally was impressive, but technically, it is doing little to fix the charts that were so heavily damaged last week and again this past Monday. The gaps down/up/down/up/down have made

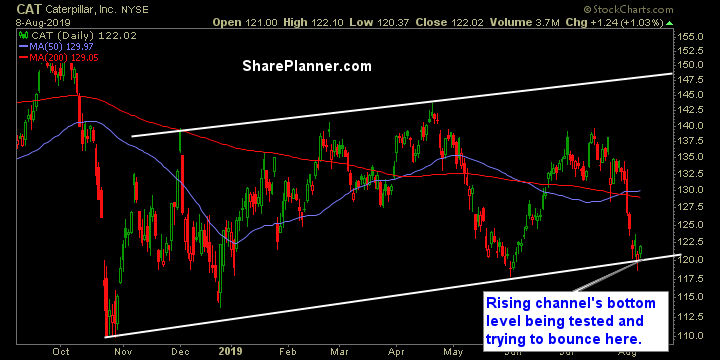

Friday’s Swing-Trades: $CAT $LRCX $RCL Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Caterpillar (CAT)

My Swing Trading Strategy I’m coming into today 100% in cash. Tried shorting the intraday bounce yesterday, but quickly realized that wasn’t going to work, while also booking profits in McDonalds (MCD) too. To say the least, I am quite suspicious of this market bounce, and highly doubt that the worst is behind us at this

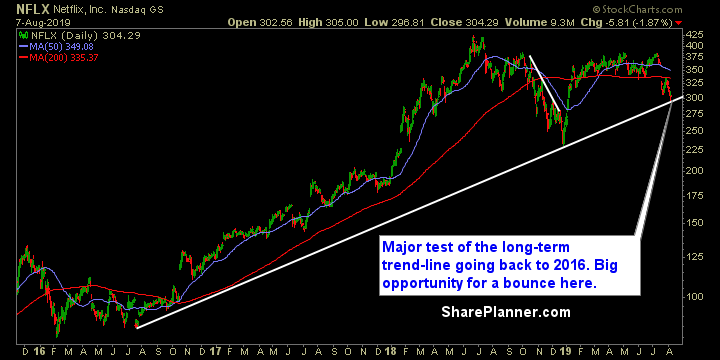

Thursday’s Swing-Trades: $NFLX $DVA $FAST Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Netflix (NFLX)

My Swing Trading Strategy It was my third straight day without creating a new position. Why is that? Because, I wasn’t going to short the market when it was already down 100 points, and certainly didn’t find enough reason to buy the market yesterday. I’ve managed to profit off of the recent market selling with

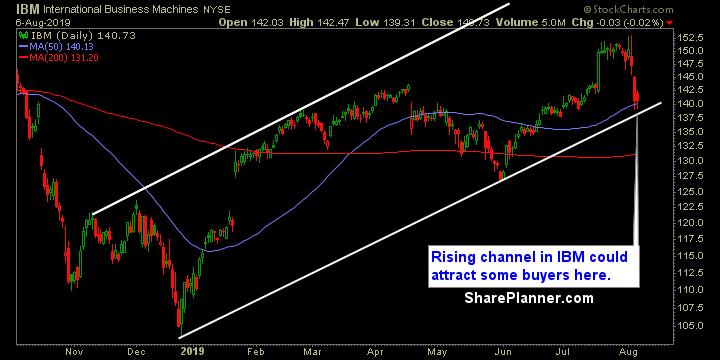

Wednesday’s Swing-Trades: $IBM $LHX $CMA Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: International Business Machines (IBM)

Volume has returned and the Trade War with China has made shorting stocks great again! Sure get excited about the dip buying today, but under the surface this market rally is anything but impressive. Breadth is okay, but with the walloping the market took yesterday, if this was a bottom for the market, we should

My Swing Trading Strategy I didn’t touch the market yesterday. I wasn’t overly crazy about shorting a market that gapping down over 40 handles on SPX. Though it would have been a profitable trade, the risk/reward wasn’t there. Today sets up for a potential gap and crap, so it is very much worth