My Swing Trading Strategy The market decided to throw a temper-tantrum on Friday, with above average volume, and sell-off that wiped out one of my long positions. Should the market want to shake off the sell-off, I am more than open to adding a new long position, however, I am also poised to short this

Monday’s Swing-Trades: $GH $CBLK $PKI Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Guardian Health (GH)

My Swing Trading Strategy I was stopped out of my Disney (DIS) trade yesterday, primarily due to the heavy influence from the Netflix (NFLX) earnings miss. However, I added two additional trades following the stop-out, and will consider adding a third position if the early morning strength can hold. Indicators Volatility Index (VIX) –

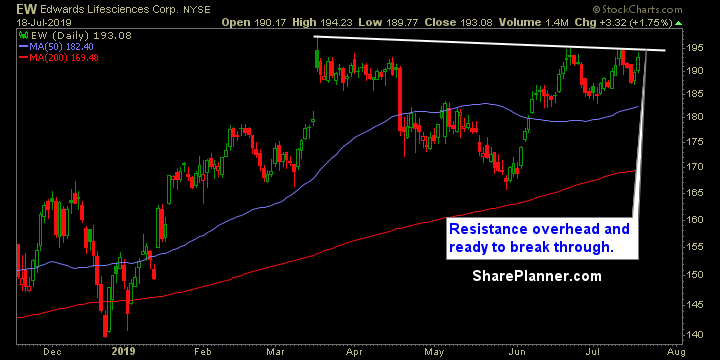

Friday’s Swing-Trades: $EW $MAR $W Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Marriott Int’l (MAR)

We are all familiar with traditional stock market cycles, but what about the market cycle within a bull market rally and what does that look like? More importantly what clues does the market provide within a bull market that can help us better understand when the rally is going to be coming to an end?

My Swing Trading Strategy I booked some profits yesterday with a +2.4% profit in Nike (NKE) and +2.1% in Twitter (TWTR). I had a day-trade in Square (SQ) that started out great, but couldn’t hold the gains into the close, so sold it for a small profit of +0.3%. I only have one position coming into today, so

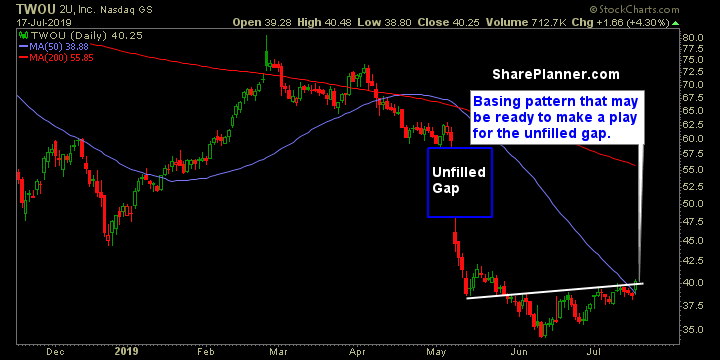

Thursday’s Swing-Trades: $TWOU $CLX $RCL Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: 2U (TWOU)

My Swing Trading Strategy Closed out two trades yesterday, but managed to keep and raise the stops on three other positions. I’ll look to add 1-2 new trades to the portfolio today if the market decides to bounce. Momentum plays took a hit yesterday, so there’ll be plenty of them ready to bounce today. Indicators

Wednesday’s Swing-Trades: $AMD $ARNC $WLL Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: C.H. Robinson Worldwide (CHRW)

First day in the red in over a week, but no major technical damage with the selling.