My Swing Trading Strategy

I went more conservative yesterday, adding a utility play while also being stopped out of my software play. The market is showing a sketchiness towards growth plays this week, so far, and I’ll be looking to avoid such plays until the market can steady itself.

Indicators

- Volatility Index (VIX) – Downtrend in VIX since the May highs were established looks to break to the upside today with the morning weakness in equities. Look for a possible challenge of the July highs to establish new higher-highs for the first time since May decline started.

- T2108 (% of stocks trading above their 40-day moving average): A 4% decline yesterday, pushed the indicator down to 61%. The indicator sets up for more in declines, and remains as a bearish divergence as SPX was just hitting all-time highs on Friday, while the indicator remains below the high from earlier this month.

- Moving averages (SPX): SPX currently trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Even with Technology seeing immense weakness in software, it still could not beat the weakness in Energy as the latter managed to be the weakest sector yet again, with the Financials. Discretionary has managed to hold up quite well and in a good position to push through its May highs. But overall, capital was flowing into the safe sectors yesterday like Utilities and Real Estate as investors are getting nervous ahead of the FOMC Statement on Wednesday.

My Market Sentiment

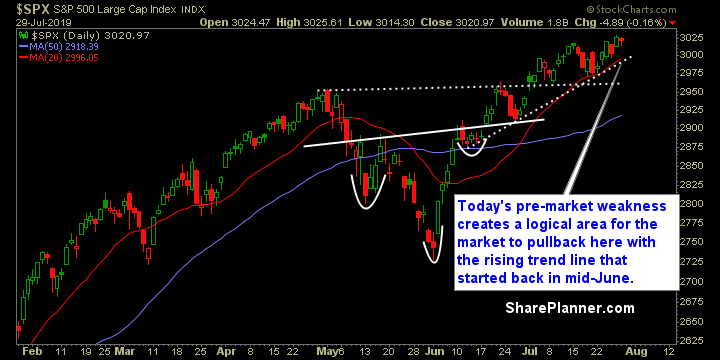

Short-term rising trend-line is in play today, and it is worth watching the 20-day moving average, as the last two times it has been tested, has resulted in a market bounce.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 long positions.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Which trading platform in 2026 should you be using? In this podcast episode Ryan talks about all the major platforms out there from TC2000 to TradingView, to TrendSpider and the Bloomberg Terminal. What are the perks and benefits to each one, and Ryan will also go over his lower-tier platforms that you might want to consider as well.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.