My Swing Trading Strategy I closed out my position in QID for a +2% profit. Not thrilled about the ultimate outcome of that trade, especially considering how well the futs were performing Sunday night, but that is the stock market for you, what the current situation happens to be doesn’t denote its ultimate outcome. I

Tuesday’s Swing-Trades: $SWK $MCD $CGC Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Stanley Black & Decker (SWK)

I was split between equal longs and equal shorts coming into today. However, I was wanting more downside, because that is where the easy money would be if this market could ever just give us a solid pullback.This consolidation over the past three weeks, and even more so, the constant headlines, tweets, and reports about

My Swing Trading Strategy I added QID on Friday one the initial dump following Trump’s tweets. I held over the weekend, as well as my one long position too. Obviously futures are all over the place, and the only thing I can do here is tighten up my stops and see where price action wants

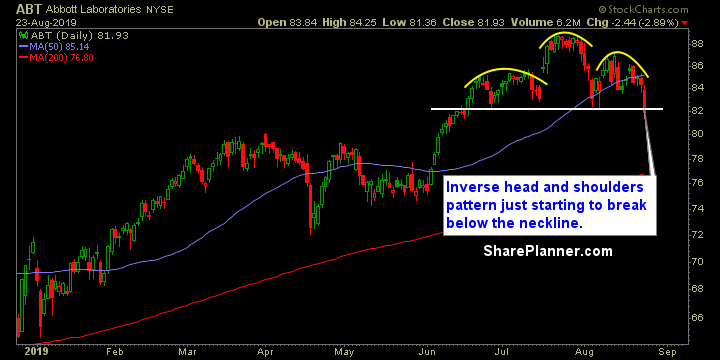

Monday’s Swing-Trades: $VRSN $ABT $K Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Short: VeriSign (VRSN)

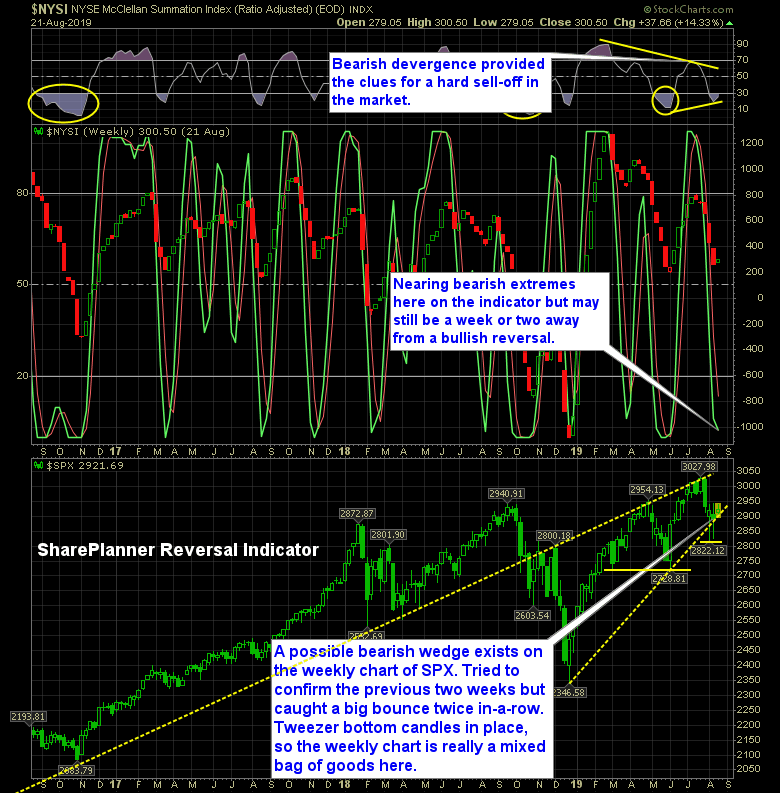

The trade war with China is creating a massive amount of tension in the stock market, as is the Federal Reserve and its comments out of Jackson Hole. Add to it the Trump tweets that are driving the market lower without warning, and you have a market in chaos and possibly on the brink of

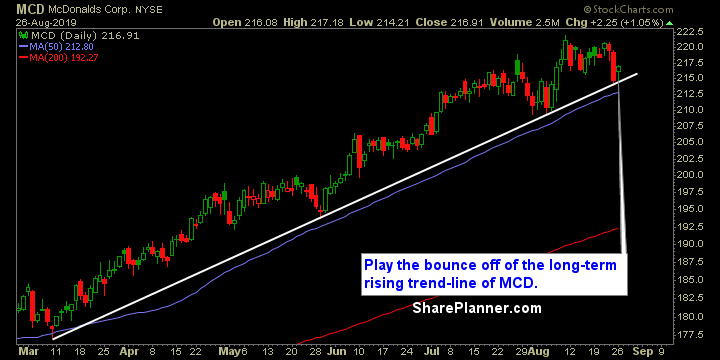

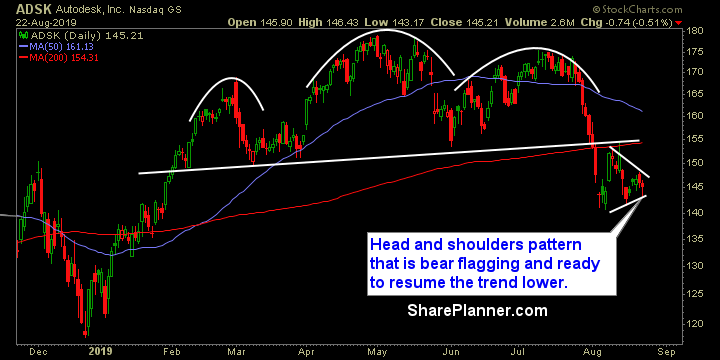

Friday’s Swing-Trades: $MCD $UPS $ADSK Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: McDonalds (MCD)

My Swing Trading Strategy I sold Twitter (TWTR) yesterday for a +2.4% profit. I still have one long position, but am looking to add a short position depending on the outcome of the Jackson Hole speech today. Staying light is the best approach to this market. Indicators Volatility Index (VIX) – A 5.6% spike yesterday off of the 50-day

Probably a couple of weeks away from a bullish reversal on the indicator. The month of August has had its downs, but more than that, it has been extremely choppy, leaving little room for direction that traders can seize upon. For three weeks now the stock market has been nothing more than a royal chop-fest.

My Swing Trading Strategy I booked profits yesterday afternoon in Shopify (SHOP) for a +9.1% profit. It was a trade that I had been riding since last Friday. I still have two other positions, but may be cautious about adding another long setup to the portfolio ahead of the Fed’s Jackson Hole meeting tomorrow morning. Indicators Volatility