Episode Overview In this podcast episode Ryan provides some simple solutions to focusing in on what is moving in the stock market on a daily basis and debunking the claim that following sector movements is a method of trading that is behind the curve of trading. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights &

$CEG trading in a perfect channel since inception. Tested the upper band yesterday, but couldn't push through. More risk lower than reward higher here. . $ALB declining trend-line off of December highs, followed by a break in short-term support to new lows. If looking to short this, I think time is on your side to

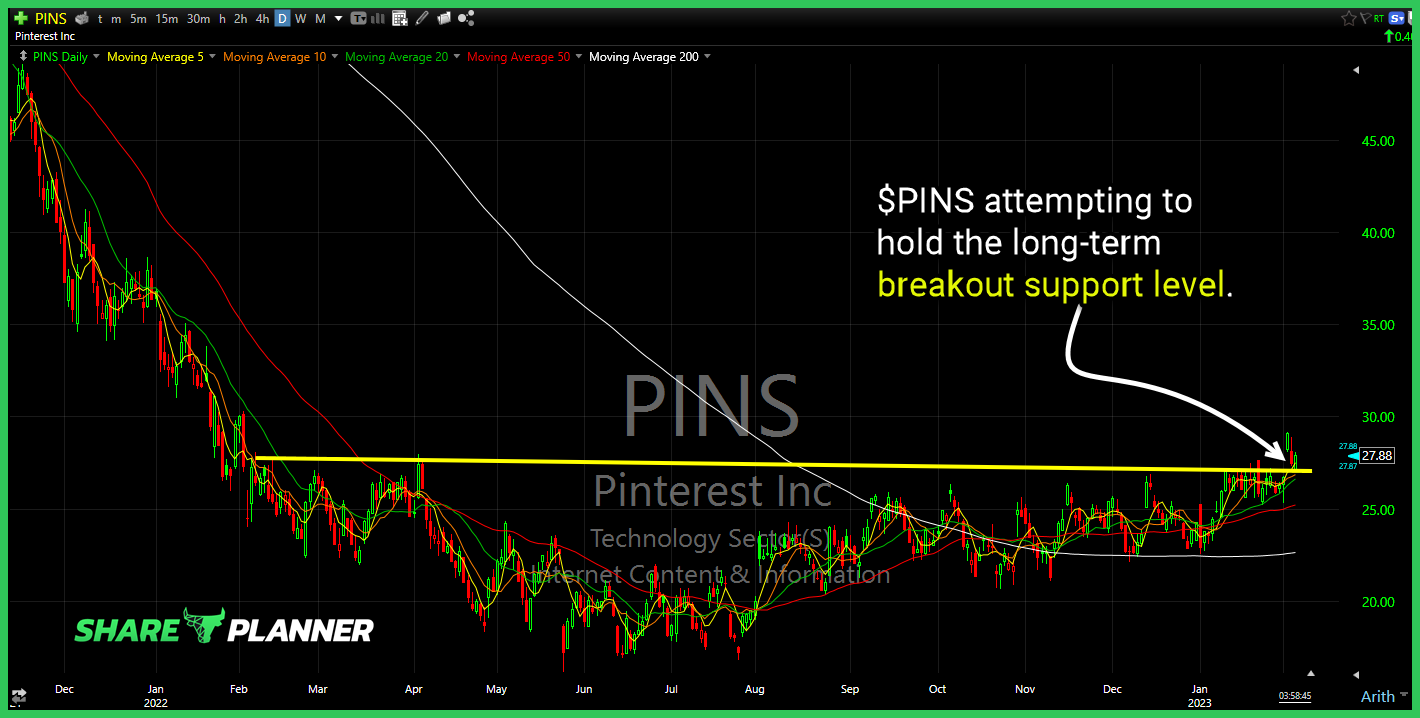

$WYNN rolling over and breaking a key support level here. Watch declining resistance for potential push back on $MRNA $PLUG running hard into an area of resistance that make complicate the bounce off its lows. $PINS running into the underside of broken trend-line support. A break back above would put it in the gap. Strong

$PINS attempting to hold the long-term breakout support level.

$PINS finally breaking through some major resistance.

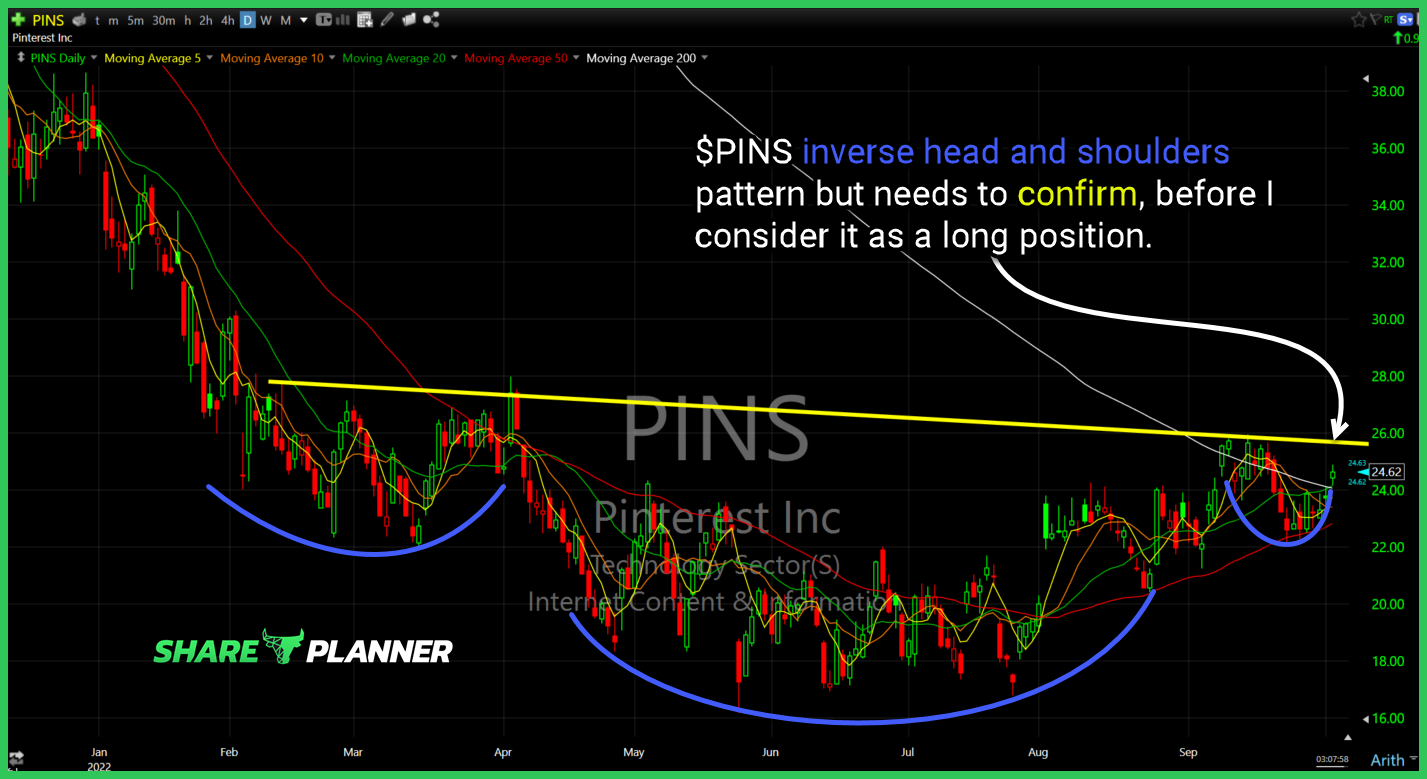

$PINS inverse head and shoulders pattern but needs to confirm, before I consider it as a long position.

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of

As a new feature to SharePlanner, I'm going to roll out, the SharePlanner Notebook, where I essentially "clear out my notebook" of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading