Walmart (WMT) still holding up well. Watch for a possible retest of the breakout level for a secondary entry.

WMT down 20% from all-time highs! WMT stock has continues to pullback from its all-time highs of late. One of the most beloved stocks of the last few years, Walmart (WMT) has quickly seen sentiment deteriorate. In this video, I analyze WMT chart, using technical analysis, and consider whether the potential exists for a move

The holiday season presents unique opportunities for swing traders who understand the market's behavior during these low volume periods. Thanksgiving and the Christmas/New Year period in particular exhibit some of the most reliable trading patterns of the year, offering swing traders distinct advantages when properly understood. Thanksgiving Week Trading Patterns Thanksgiving week has historically provided

Bitcoin $BTC.X crashing & breaking the rising trend-line off of the January lows. $LNG Rising parallel channel, with a hard bounce off the lower channel band. Looking for a move back to the upper channel band from here. Pullback to the rising trend-line in place seems to be the most logical area to target a

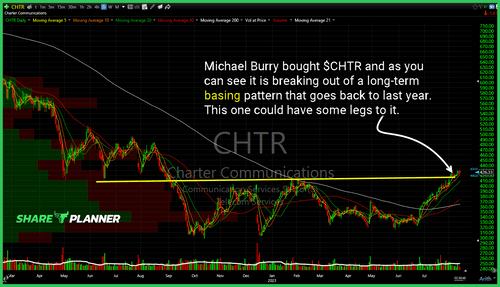

Michael Burry bought $CHTR and as you can see it is breaking out of a long-term basing pattern that goes back to last year. This one could have some legs to it. $VIX still can't break above resistance. Volatility shorts continue crushing the index with every bounce. Strong bounce so far today for $SMH, but

China Large Cap ETF (FXI) broke its declining trend-line and then simultaneously tested its short-term rising trend-line and broken resistance. While both held, it hasn't been able to get much detachment from the trend-line. Poland ETF (EPOL) very similar to the US market in that it has been basing/trading sideways for the past 11 months.

Adobe (ADBE) rising trend-line is broken, and now price falls back into the Nov/Dec chop area, where price could really get churned up. Russell 2000 (IWM) breaking below long-term support and a creating a lower-low in the short-term. Looking under the Robinhood (HOOD), it still hasn't broken out of the declining trend-line and threatens short-term

$COIN coming up on critical support that bulls need to pray holds.

$C starting to break that declining channel on the hourly.

$NVDA This is a major support area that I’ll be paying close attention to in the coming weeks, if it starts to test.