Today is really about the market holding on to yesterday’s Labor Day Sell-Off Yes, I realize the stock market was closed yesterday, but that doesn’t mean the futures were, which more often than not, will usually trade a half a day, at least, when the stock market is closed. Yesterday saw the market give up

My Swing Trading Strategy I’m under the threat of a hurricane today, so that makes trading a little dicey for me today. Power could go out, internet/cell coverage could go down. As a result, my focus today will likely be to manage the existing positions and nothing else. Indicators Volatility Index (VIX) – A 6.2% pop

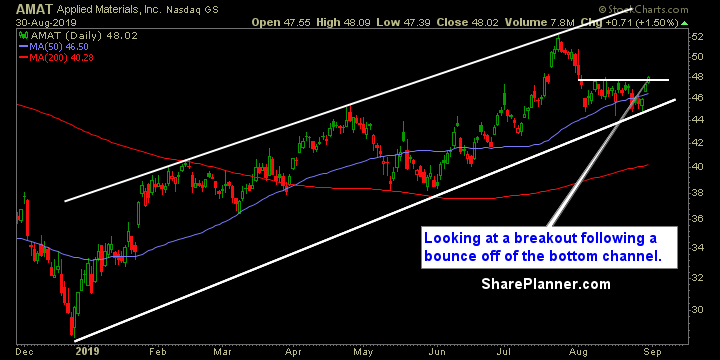

Monday’s Swing-Trades: AMAT, WDC and SEE Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Applied Materials (AMAT)

My Swing Trading Strategy Closed out my two short positions early yesterday, and flipped the script and added two long positions to my already existing long position. I may add one additional long position today, depending on how the market performs. Indicators Volatility Index (VIX) – It surprises me that the VIX isn’t dropping more than

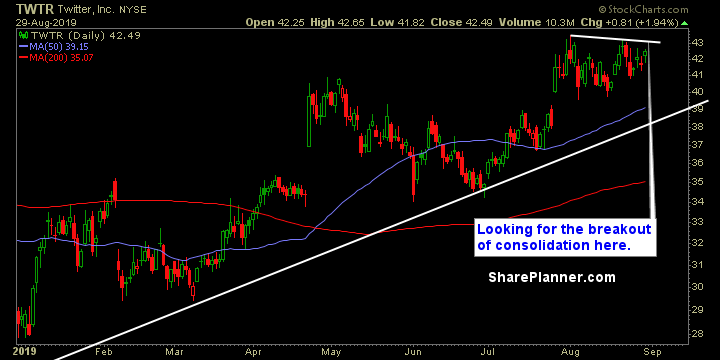

Friday’s Swing-Trades: $TWTR $HES $PCAR Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Twitter (TWTR)

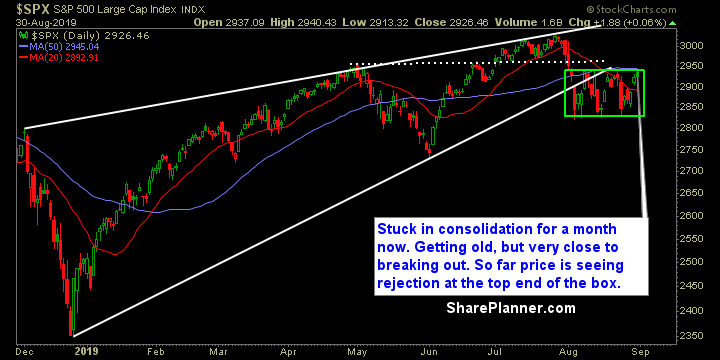

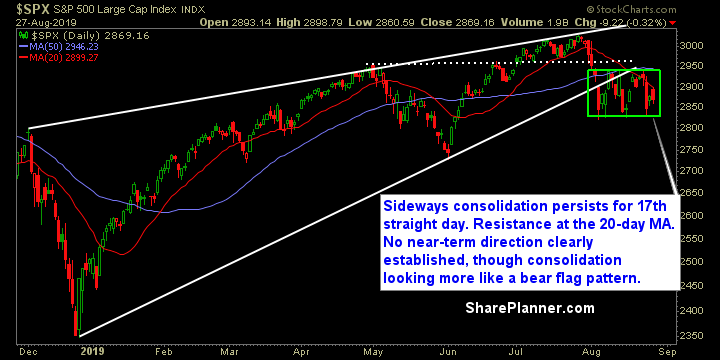

My Swing Trading Strategy I’m likely to be forced out of my two short positions, while riding my one long position higher. I am open to add one to two new long positions, but until we break out of this four week consolidation pattern, I am not going to put a lot of confidence in

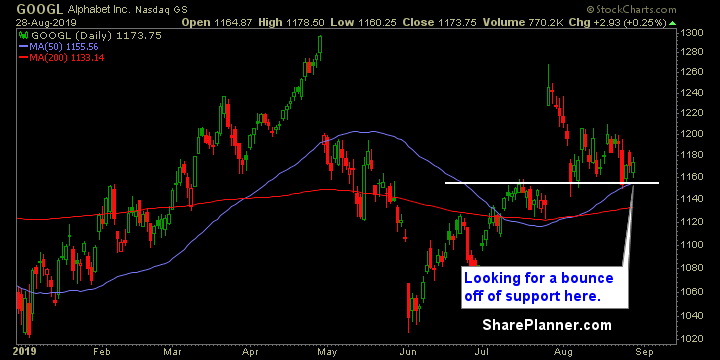

Thursday’s Swing-Trades: $GOOGL $AMAT $UNP Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Alphabet (GOOGL)

My Swing Trading Strategy I added one additional short position yesterday to the portfolio, while keeping the existing portfolio and balance the same. I won’t look to add any additional short exposure here, until we get confirmation that the market wants to break down and out of the current trading range that price finds itself

Wednesday’s Swing-Trades: $AMD $KO $FDX Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Advanced Micro Devices (AMD)

The stock market market is heading for a three-day weekend, with Labor Day quickly approaching. Considering what we have seen so far in the month of August, no one is going to argue with the extra time off. However, the market is quickly fading today, and looks to be giving its best shot at ending