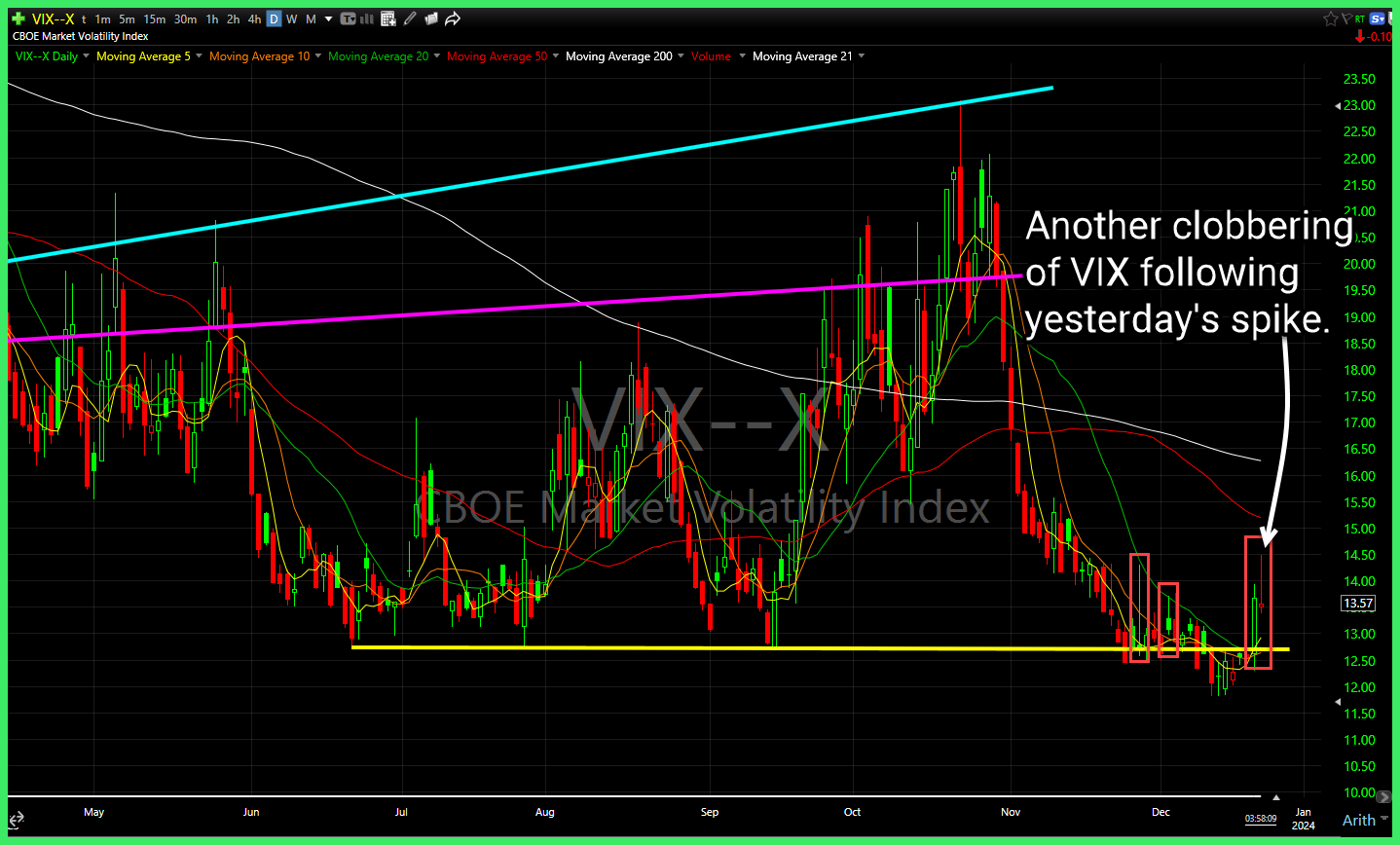

$VIX once again killed. $MP Strong breakout today for MP through resistance. $RCL recapturing the steep rising trend-line following CCL earnings coming in strong.

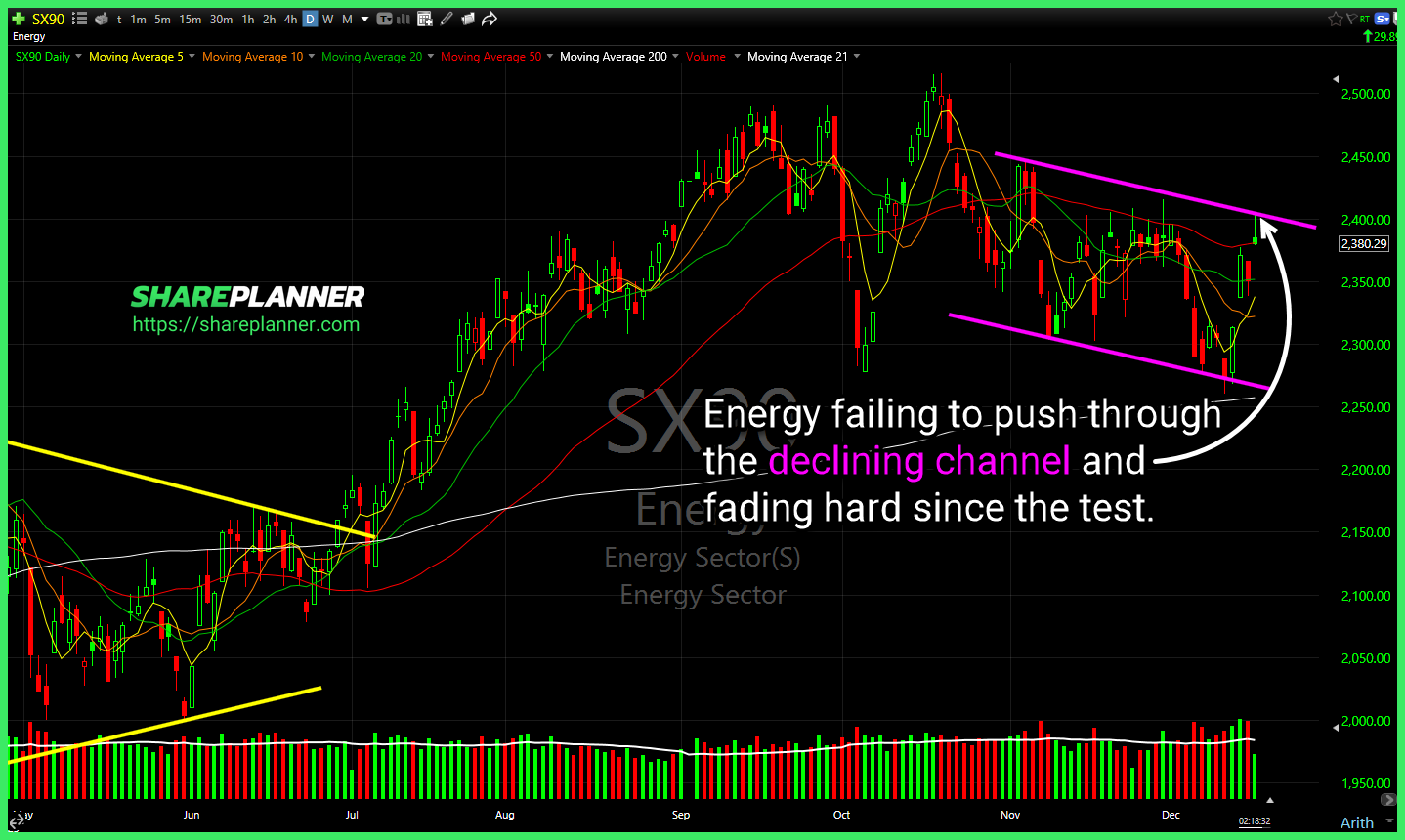

Energy sector failing to push through the declining channel. $XLE $GPCR these days there's no limits to what the bulls won't go to, to buy the dip. This time off of a -50% push lower & bounce off the rising trend-line. Gap and crap on $NIO following the gap higher. Watch to see here whether

Head and shoulders nearing a confirmation on $DKNG What changed in from 11 straight weeks of declines for $BA where nobody wanted the stock to 7 straight weeks of dramatic price increases and a 50% rally where no one can get enough of this stock? $COST: A perfect example of FOMO taking over a stock

TSLA clean break of declining resistance with old-trend-line resistance now looming, has previously struggled to push through in the past. Triangle pattern starting to break here, but just underneath it is testing the rising trend-line off of the March lows. Make or break moment for LLY. RIVN keep an eye this morning on a test

$GLD attempting to put in a new higher-low, following FOMC. $SLV bouncing off of the rising trend-line, suggesting it doesn't believe inflation is over. $PFE breaking through some major support dating back to 2015 this morning.

Costco Wholesale (COST) reports earnings on the 14th and people are chasing this 44 P/E stock right higher still. Total lunacy! As Luckin Coffee (LKNCY) continues to sell-off look for a pullback & buy opportunity at the lower channel band here. Major support looms for Oracle (ORCL) to be tested at $98. Could

Nice base forming on $NIO daily. Watch for the breakout above resistance. $GS currently testing the declining trend-line & on the verge of pushing through here. Financials are higher risk plays with FOMC on Wednesday.

$CRSP attempting to hold the declining trend-line following a massive sell-off today. Watch for a potential bounce here. $SOFI pushing through the declining channel to the upside. Little resistance until $9.15. $MS attempting to breakout of overhead resistance. Has already broke through the declining trend-line.

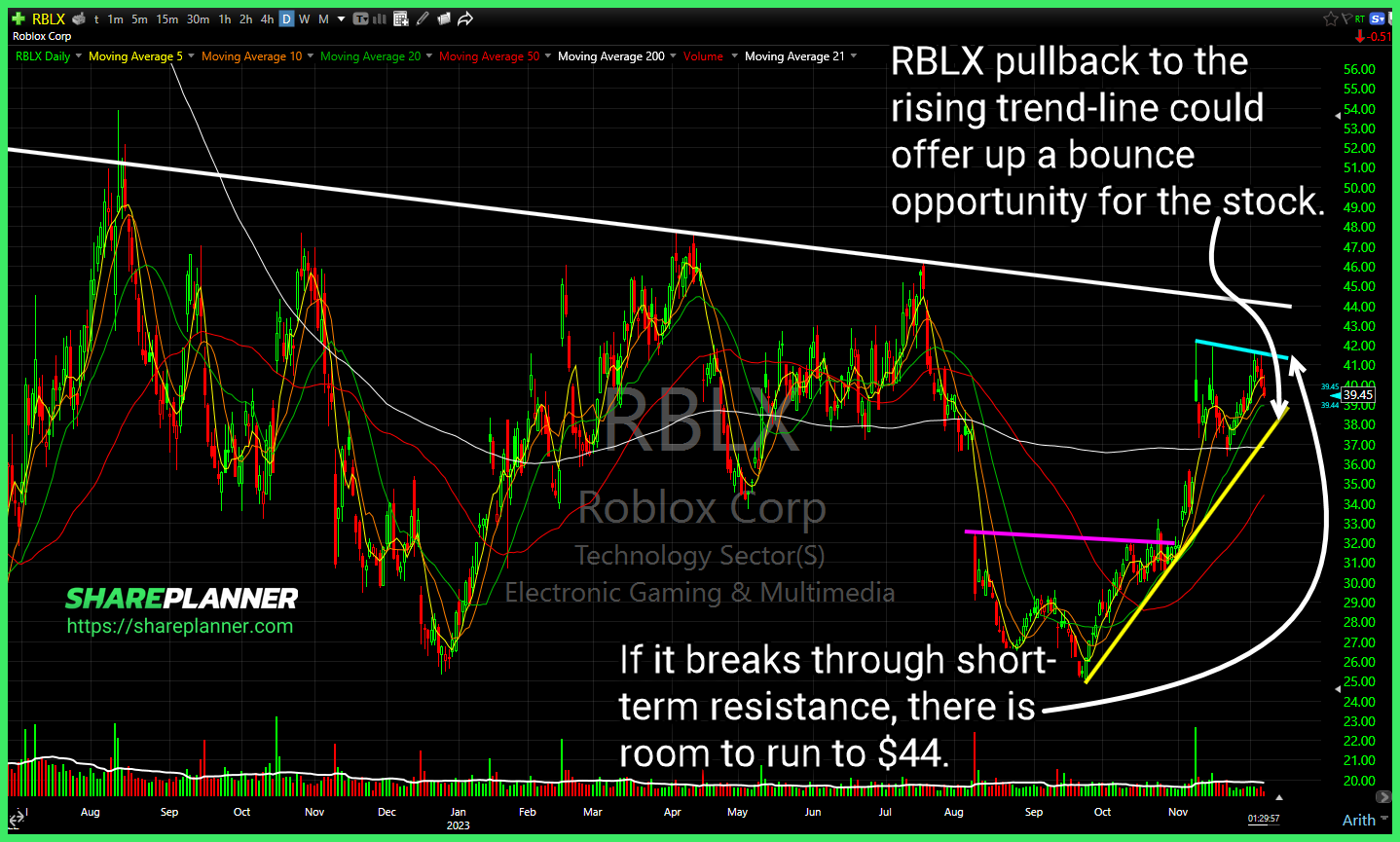

Roblox (RBLX) pullback to the rising trend-line could offer up a bounce opportunity for the stock. Darling Ingredients (Dar) breaking out of its base with room to run to $51 before encountering much resistance. Chewy (CHWY) Hard bounce off of support following a large gap lower this morning. Some support attempting to be found for

10 year yield is now testing a major long-term rising trend-line, after selling off almost two months $TNX Similar pattern continues to emerge on $PYPL, and each time it has resolved itself to lower prices here. Huge red flag if that trend-line breaks down again