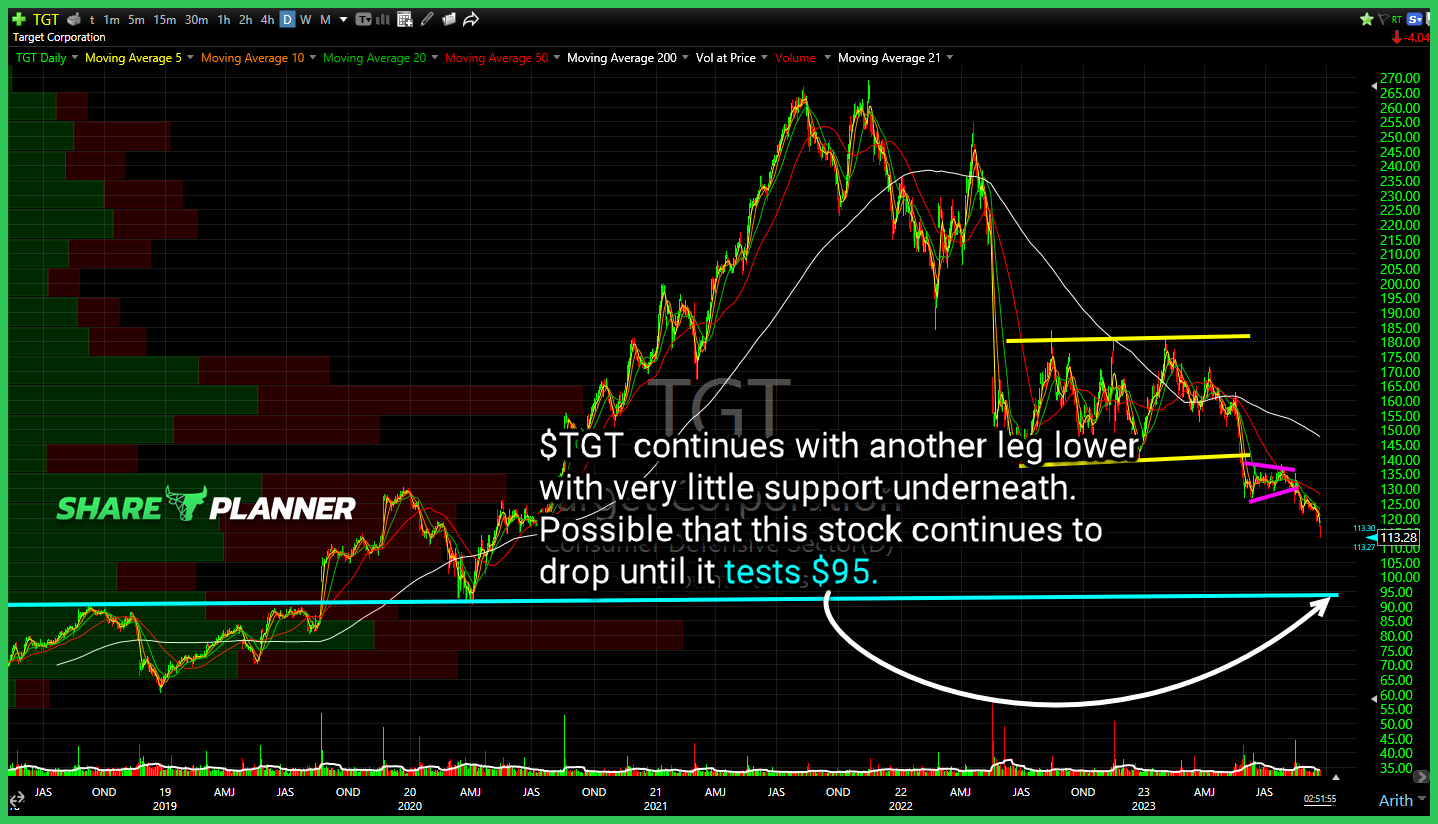

$TNX 10 year yield suggests we may very well hit 5% before the end of the year - very scary scenario for the entire economy, and a resistance level that goes back to 2001. Looking more and more like $TGT will ultimately, get to $94 for a test of long-term support. I won't looking to

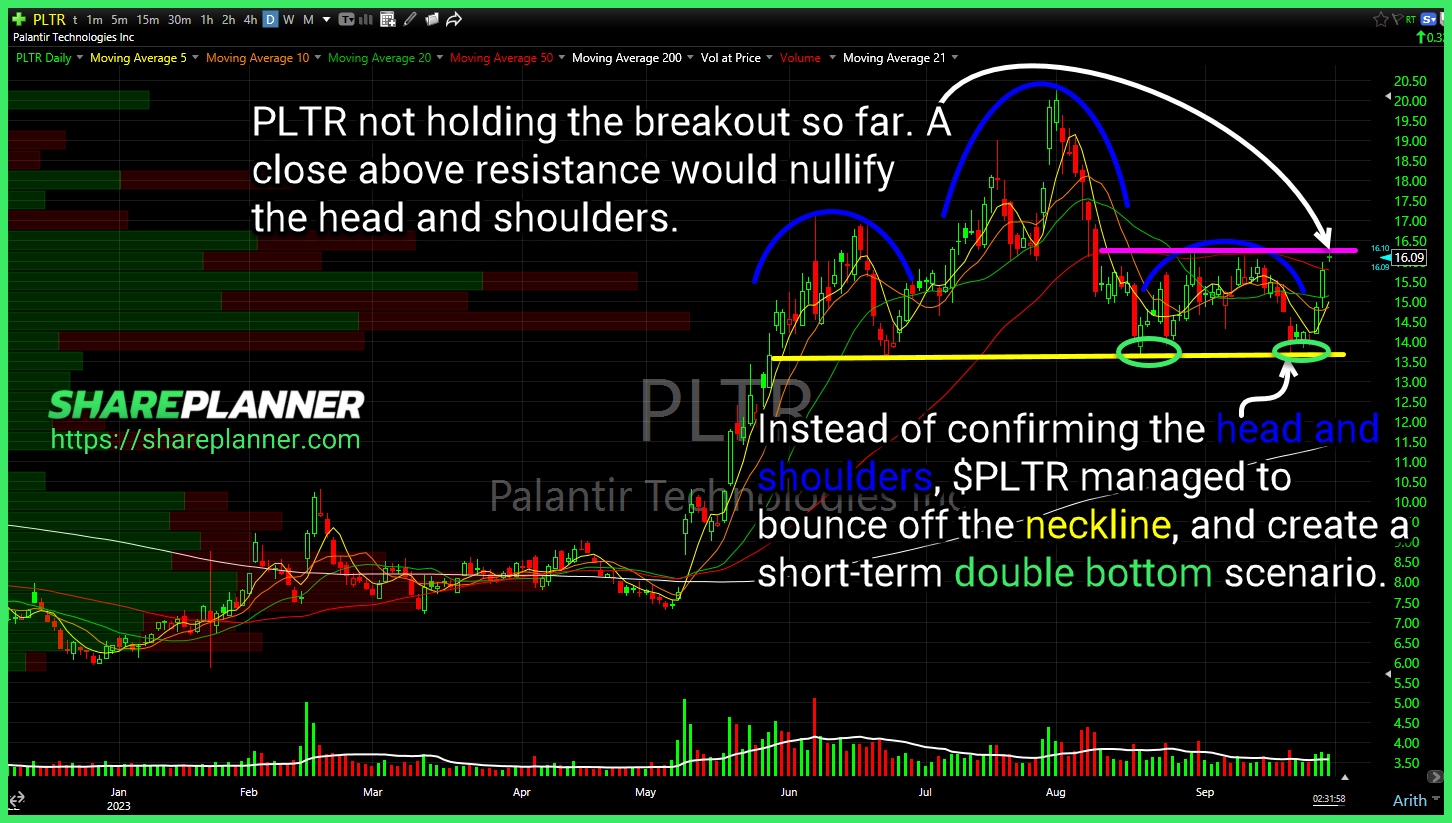

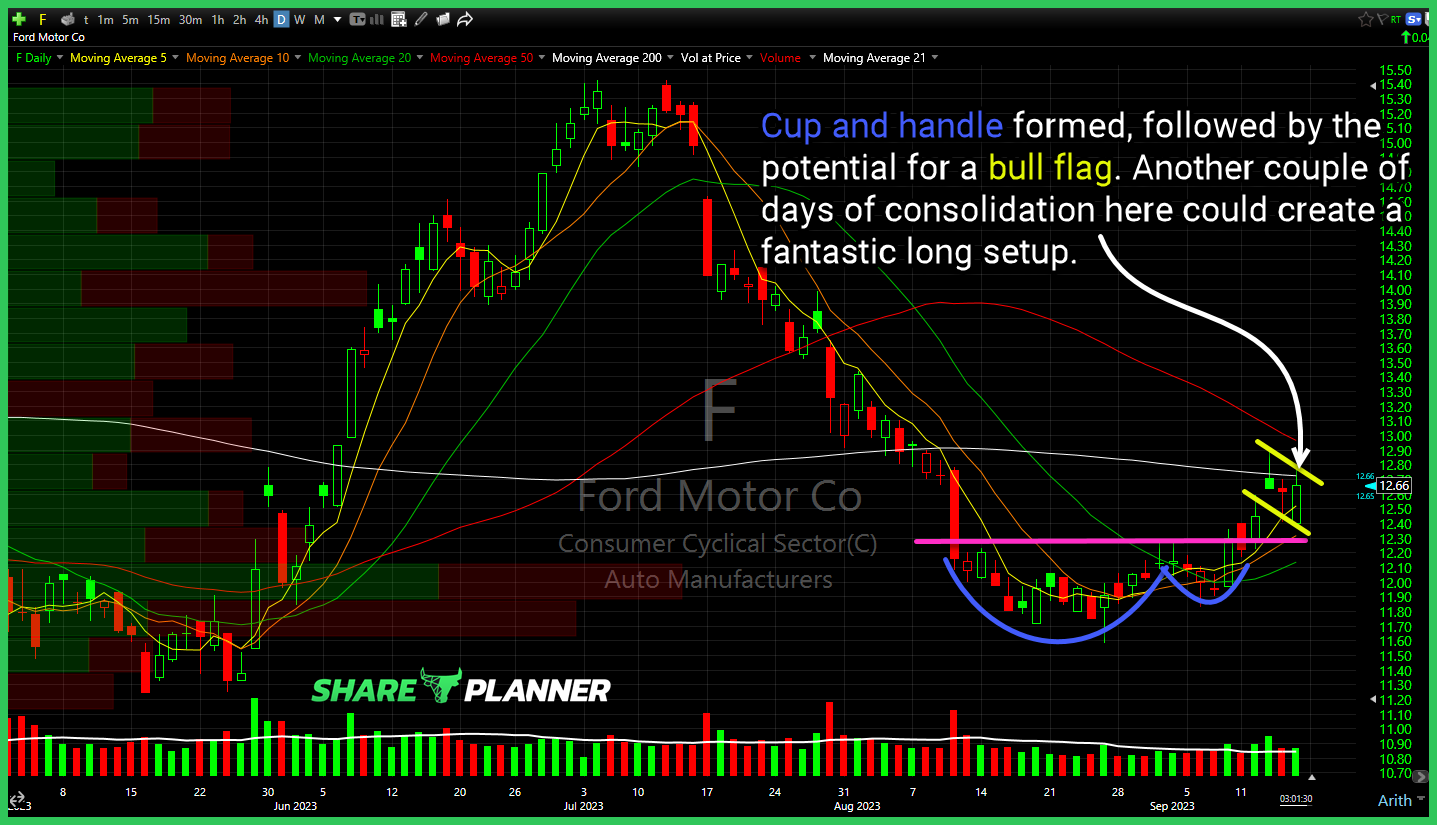

Instead of confirming the head and shoulders, $PLTR managed to bounce off the neckline, and create a short-term double bottom scenario. $F has a promising setup if it can break through short-term consolidation, but it is also dealing with heavy rejection at the 200-day moving average. $CCL needs to hold key support here at $13.70,

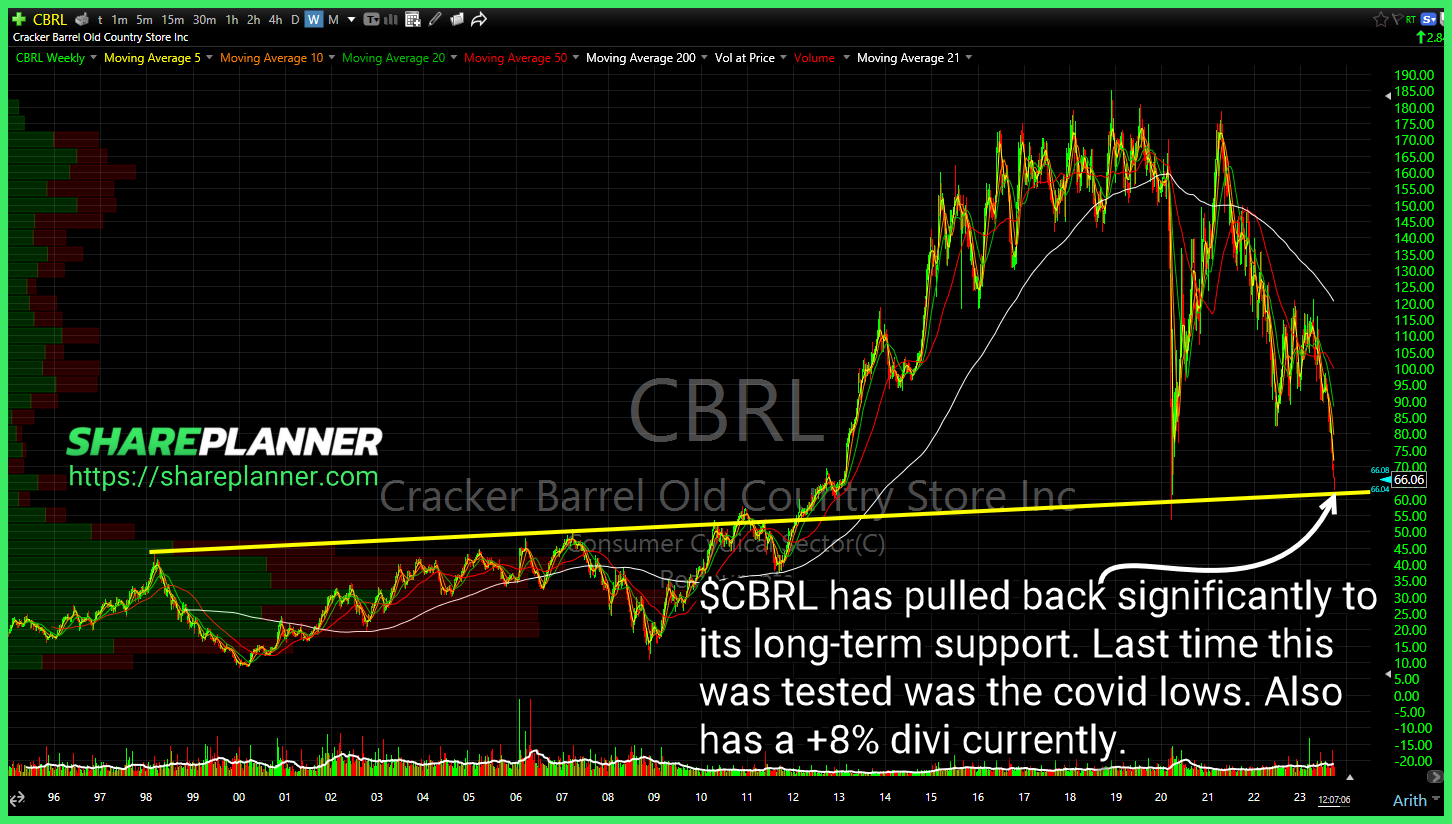

Cracker Barrel Old Country Store (CBRL) has pulled back significantly to its long-term support. Last time this was tested was the covid lows. Also has a +8% divi currently. GameStop (GME) couldn't hold the break above the declining trend-line. UnitedHealth (UNH) Retest of the declining trend-line and subsequent bounce from there. May encounter some resistance

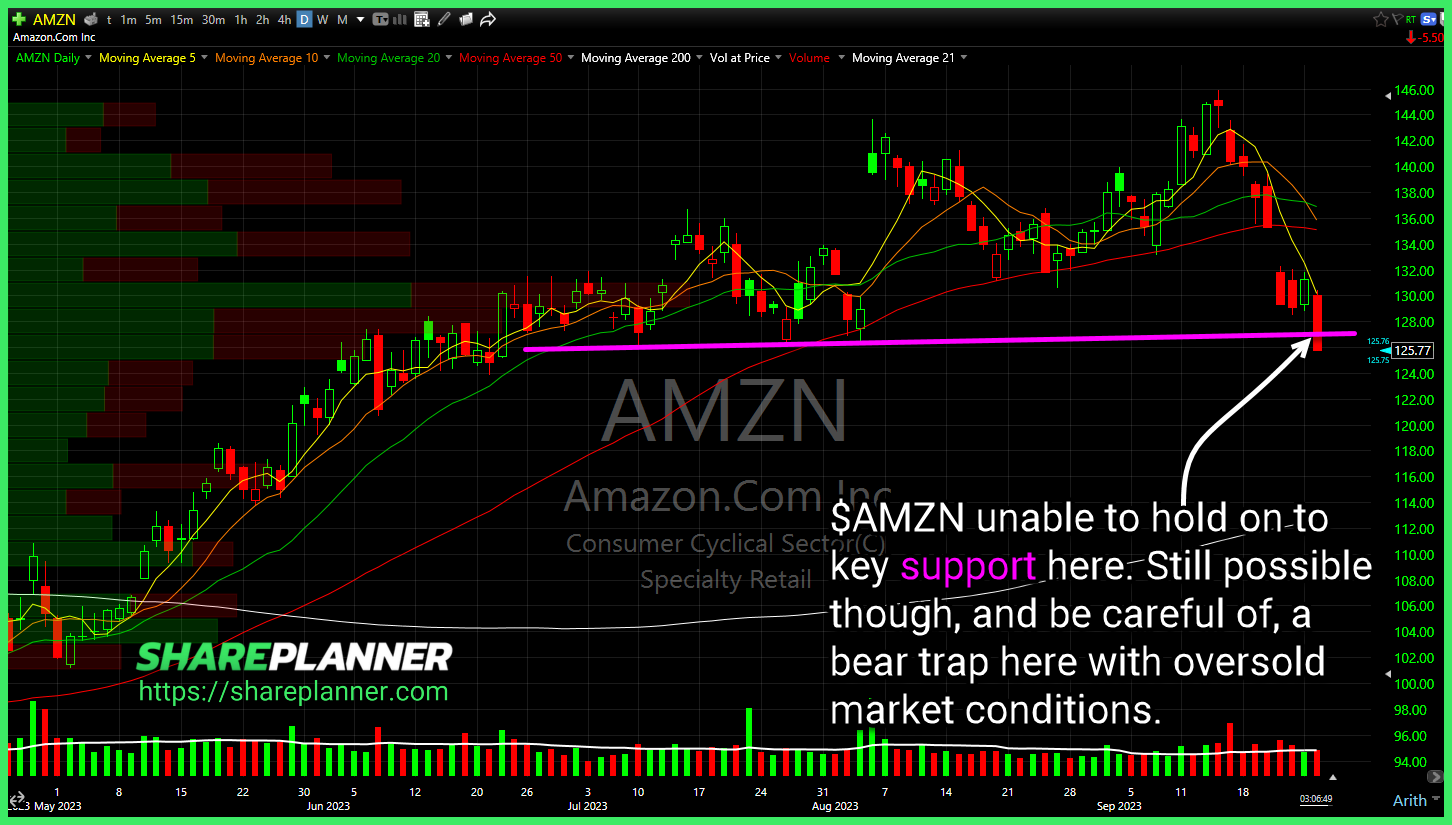

Amazon (AMZN) unable to hold on to key support here. Still possible though, and be careful of, a bear trap here with oversold market conditions. Ideal conditions for Uranium ETF (URA) entry would be on a pullback to the rising trend-line once a bounce materializes. Buying here at overextended levels, creates a high risk scenario

$TGT continues with another leg lower with very little support underneath. Possible that this stock continues to drop until it tests $95. $SOFI confirming that head and shoulders, with little support underneath. Next level is $6.50 followed by $5.25. $RCMT testing key resistance. A push above would create a breakout scenario.

If $YALA continues this run higher, you'll want to be mindful of the longer-term resistance overhead, and not too far away. Nice bull flag in $CMPR weekly forming, and also testing the 200-day MA. Be aware though, if it starts to run of the declining resistance that goes back to 2018 $MTG continuation triangle formed,

Ford Motor (F) Cup and handle formed, followed by the potential for a bull flag. Another couple of days of consolidation here could create a fantastic long setup. CBOE Market Volatility Index (VIX) hard bounce off price level support, now testing declining resistance. Advanced Micro Devices (AMD) breaking below its rising trend-line that goes back

ARM Stock IPO came out and traders are trying to determine whether or not to buy the ARM IPO. In this video, I provide my technical analysis on ARM and look at the history of hyped up IPOs and how that may impact ARM IPO as well.