Roblox (RBLX) breaking below its long-term AVWAP off the '24 lows.

Broken trend lines creates resistance Something you want to watch for is the resistance that forms when a stock breaks below its trend-line. For most traders, once a trend line is broken, the trader simply dismisses the trend-line and forgets it never existed. However to the contrary, broken trend-lines creates a new layer of resistance.

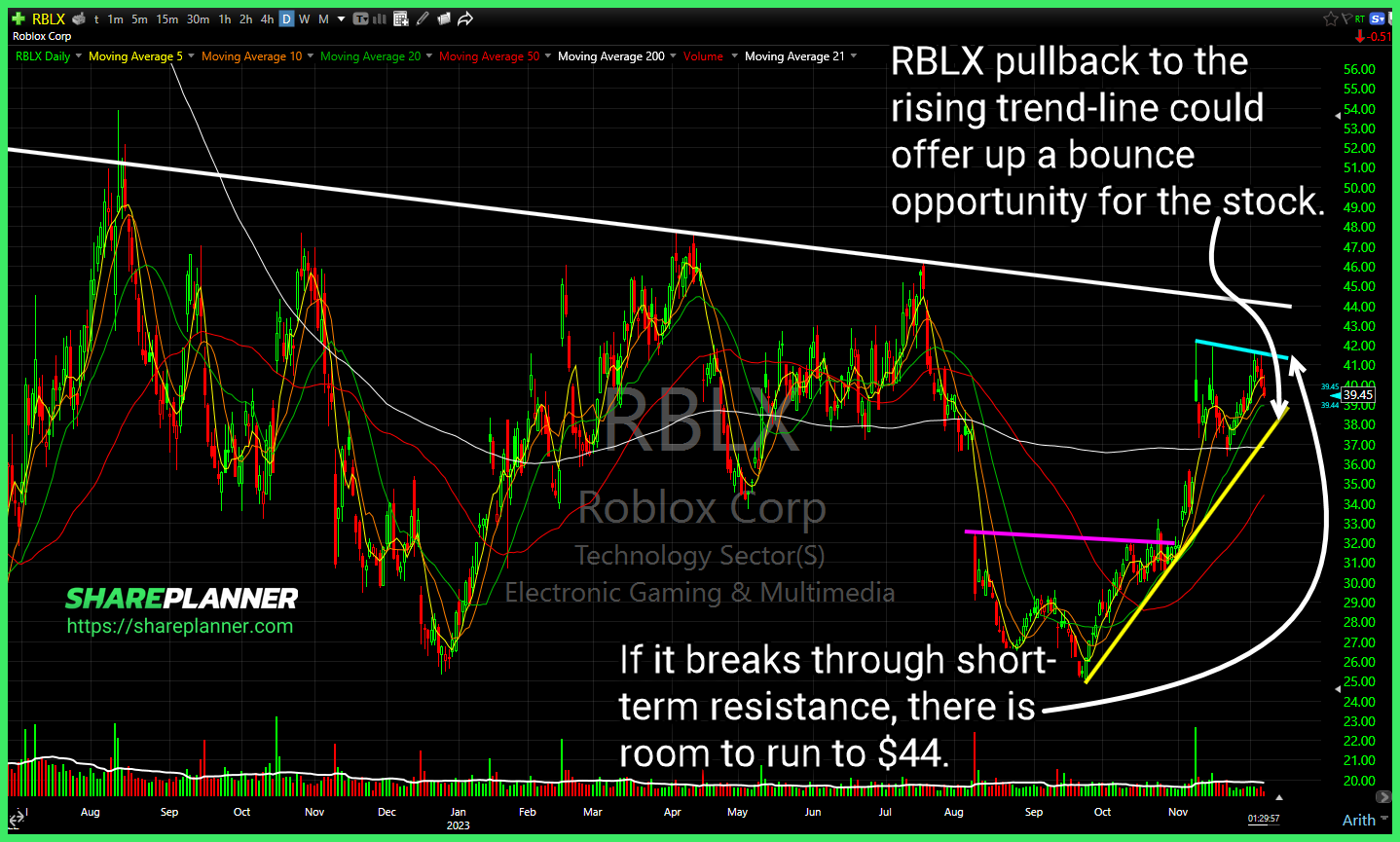

How long can Roblox (RBLX) continue this massive climb? Still holding the rising trend-line though.

Episode Overview In this podcast episode Ryan provides some simple solutions to focusing in on what is moving in the stock market on a daily basis and debunking the claim that following sector movements is a method of trading that is behind the curve of trading. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights &

Roblox (RBLX) pullback to the rising trend-line could offer up a bounce opportunity for the stock. Darling Ingredients (Dar) breaking out of its base with room to run to $51 before encountering much resistance. Chewy (CHWY) Hard bounce off of support following a large gap lower this morning. Some support attempting to be found for

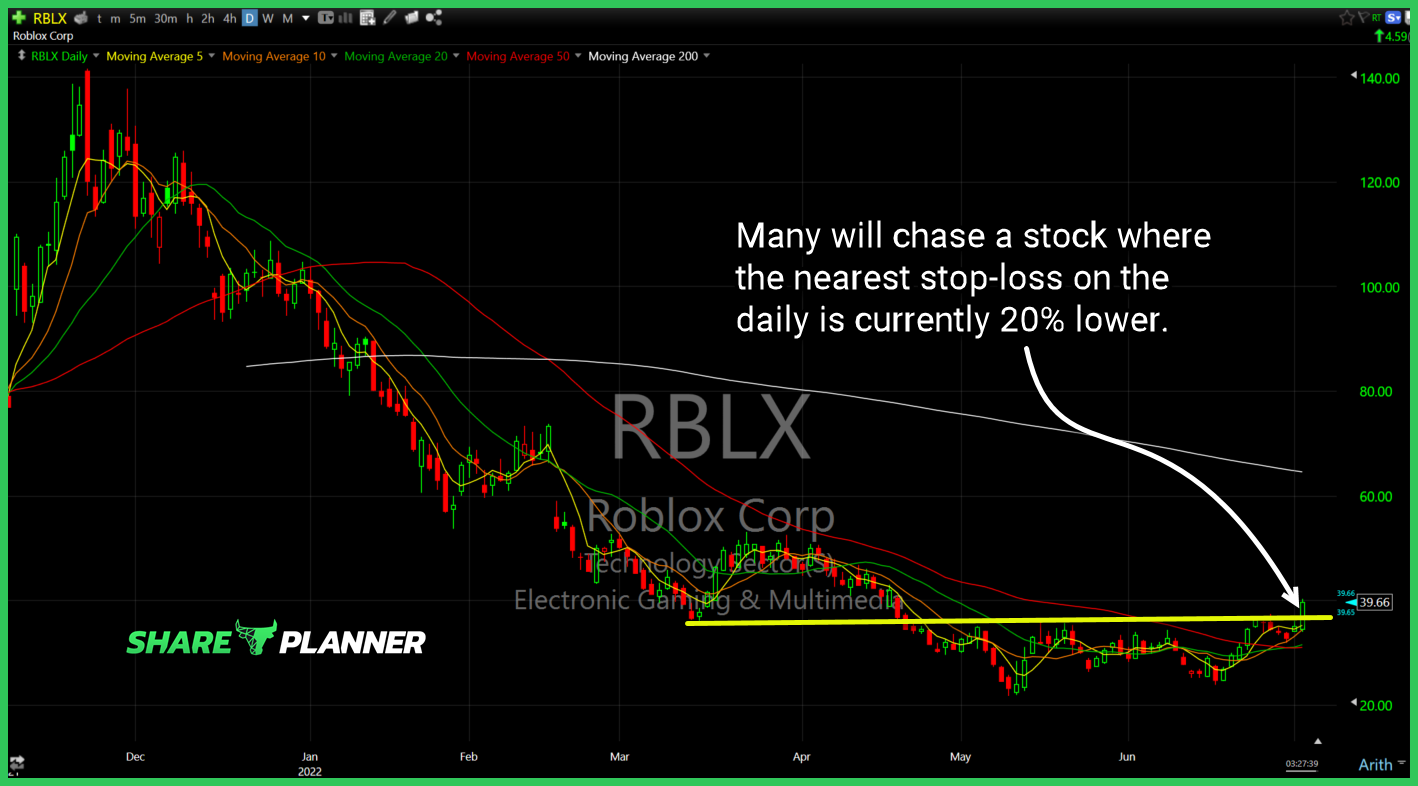

That massive sideways channel attempting to break with a push below support on ARK Innovation (ARKK) Rising channel in the short-term saw a huge break today for Netflix (NFLX). Adobe Systems (ADBE) nearing a triple top confirmation. Major breakdown of support here for Roblox (RBLX).

$SCHW with double top confirmed on the intraday post earnings.

$RBLX Many will chase a stock where the nearest stop-loss on the daily is currently 20% lower.

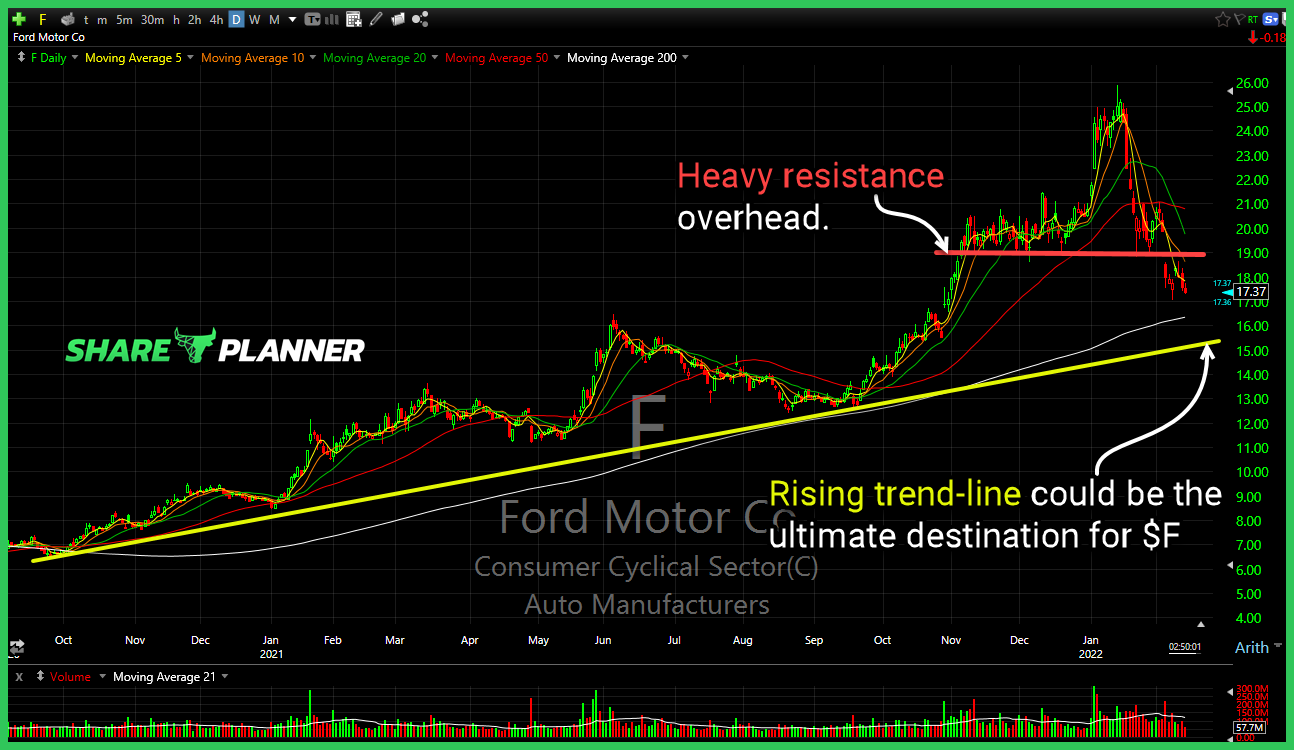

$F has room to fall before any substantial support kicks in.

Each night I provide a recap of the charts and technical analysis of some of the most intiruging market development. Call it "cleaning out of the notebook" per se. Here you will get a hodge-podge of analysis on different stocks, sectors, ETFs, and market indices. Some of them, may have been requests from members of