Watch this major support level in Coinbase Global (COIN) going back to '22. Potential landing spot for the stock. Potential landing spot for Riot Platforms (RIOT) following the hard sell-off from $17, at the rising trend-line. So far for Walt Disney (DIS) a nasty head-fake on the chart.

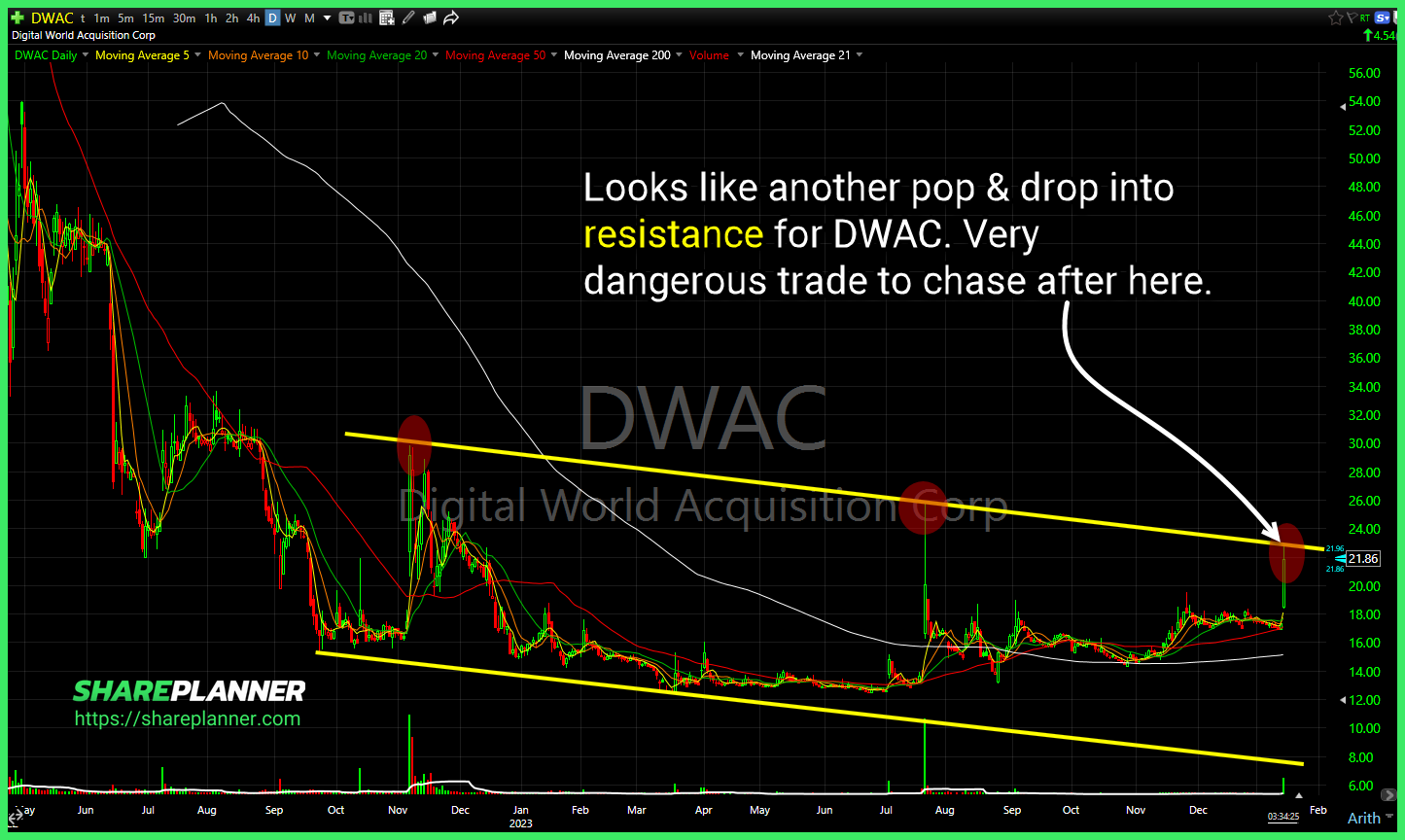

Looks like another pop & drop into resistance for $DWAC. Very dangerous trade to chase after here. $SPY bearish wedge trying to confirm. Essentially an inverse head and shoulders forming on $PYPL. Some potential support here today could come from the 50-day moving average as well.

$TGT up against resistance on the weekly, and could be setting up for a break through and a run back to $181. Pullback to a key support level, and attempting to bounce here. Huge risk however if the ETF doesn't get approved. $BTC.X Solid bounce so far off of the rising trend-line for $SNPS. A

$VIX still refusing to break through this basing pattern over the last 1.5 months. Heading back towards the December lows with another volatility crush. $RIOT possible short-term head and shoulders forming, but not confirmed. $SMCI breaking out of its sideways channel today.

Strong move out of $PTON, but needs to show it can clear resistance. Similar pattern in mid '23 that resulted in another leg lower. Big base breakout for $QS today from its base. Not something I would want to chase here, except if it could consolidate at current levels in the form of a bull

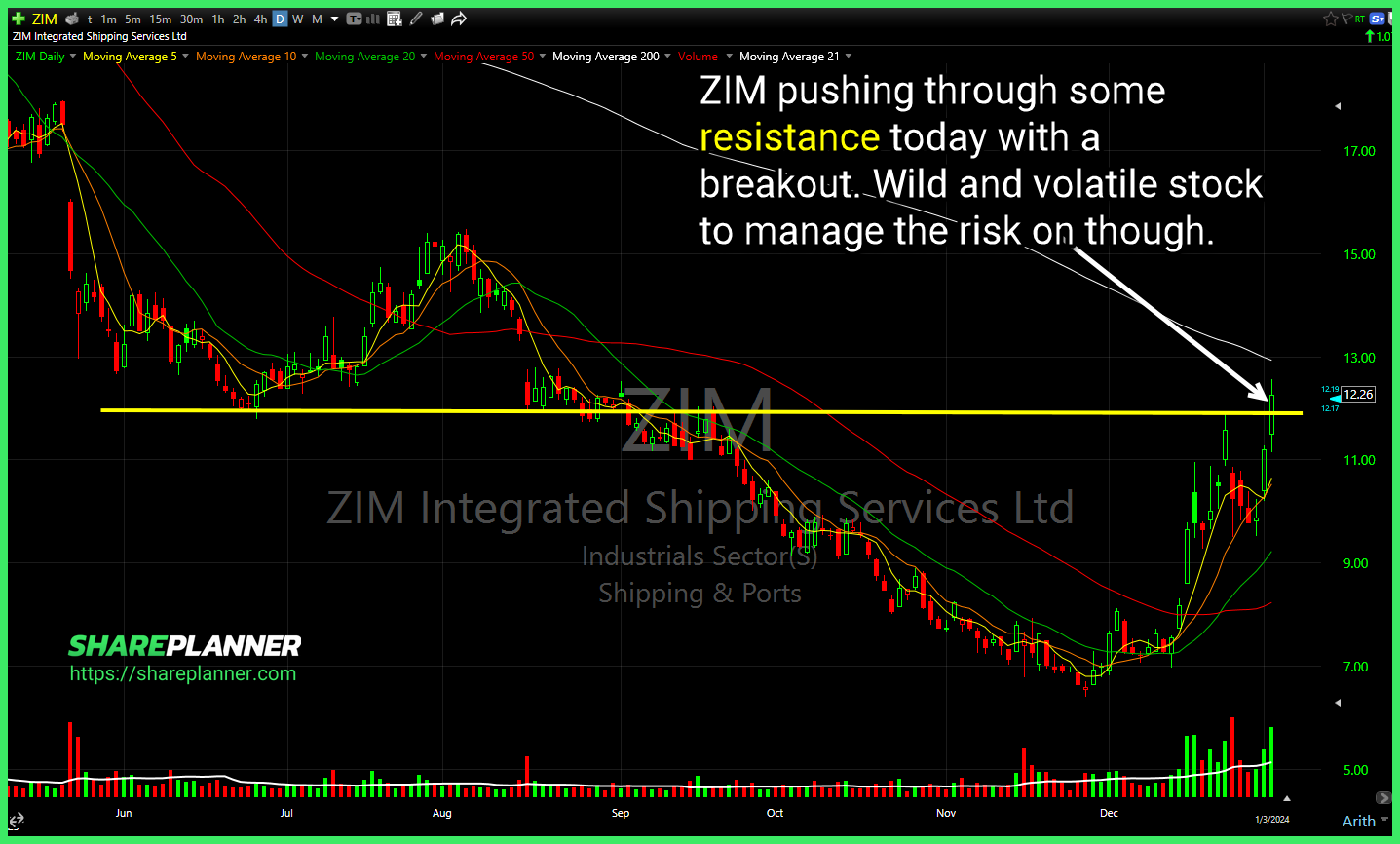

$ZIM pushing through some resistance today with a breakout. Wild and volatile stock to manage the risk on though. Short-term you have $MPLX breaking through some resistance but long-term there is a much bigger layer of resistance to be mindful of. $PSTG seeing declining channel band push back on the breakout attempt this morning. Difficult

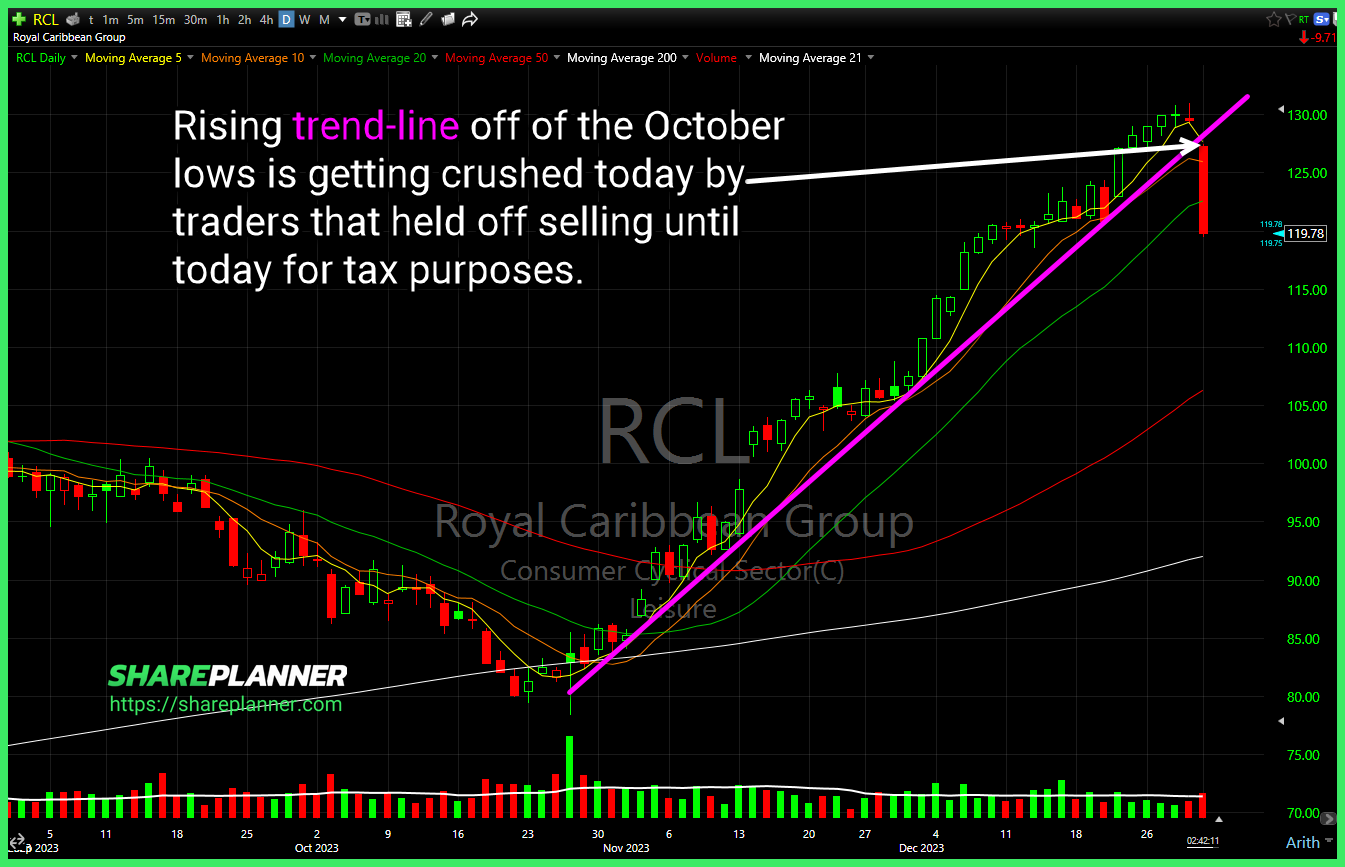

$RCL rising trend-line off of the October lows is getting crushed today by traders that held off selling until today for tax purposes. $ALGT holding the rising trend-line off of the November lows, despite breaking below it intraday. Will be key for it to hold this level into the close. $NEM pullback to its breakout

DIS bull flag pattern, but also playable is the bounce off of the 50-day and 200-day moving averages. Keep watching the bull flag in NFLX...not in play today, but could be in the new year. T2108 (% of stocks above their 40-day moving average) remains extremely overstretched and seeing some divergence in the last three

$EG parallel channel where price is testing the lower channel band looking for a bounce. $VSCO bull flag re-test. Needs to bounce here, if it is going to continue the breakout from last week. $PEAK long-term declining trend-line nearing a break to the upside. Solid consolidation underneath keeping a good risk/reward intact.

Be leery of rising resistance that has consistently pushed back on Tesla (TSLA) of late. SPDR Gold Trust (GLD) pushing through multi year resistance dating back to 2020. Fortune Brands Innovations (FBIN) bull flag working in the short-term, but long-term there could be some resistance that pushes back some. Not sure how difficult