$MARA on a gap higher like this, gotta take some profit off the table in order to reduce risk. 5-day moving average would be my key on the trade. A close or hard move below and I would exit the trade. This resistance has been strong against price when it comes to $SLV. Fourth straight

Crude Tanking! $CL_F $SYK testing resistance for a potential breakout here. Break higher would help to create new higher highs on the existing trend-line. $CPNG attempting to bounce off of key support. Declining resistance overhead and essentially in a narrowing range since mid'22. Still room for a meaningful bounce here. Below the support would negate

$RIVN downward channel bands remain in place. Potential for a base breakout within the channel though. Careful chasing $SNAP here at the upper end of this channel band. So far seeing some push back at resistance. Better to wait for consolidation and then a break through it. Extremely overbought here. $NVDA key support level breaking

$PLTR - major gap still left unfilled, and a pullback to one of the two support levels underneath would be the best opportunity to me. $XHB consolidation prior to the the break through resistance, sets up well for higher prices with tight risk management. $IWM two hard rejections off of the 200-day moving average Heavy

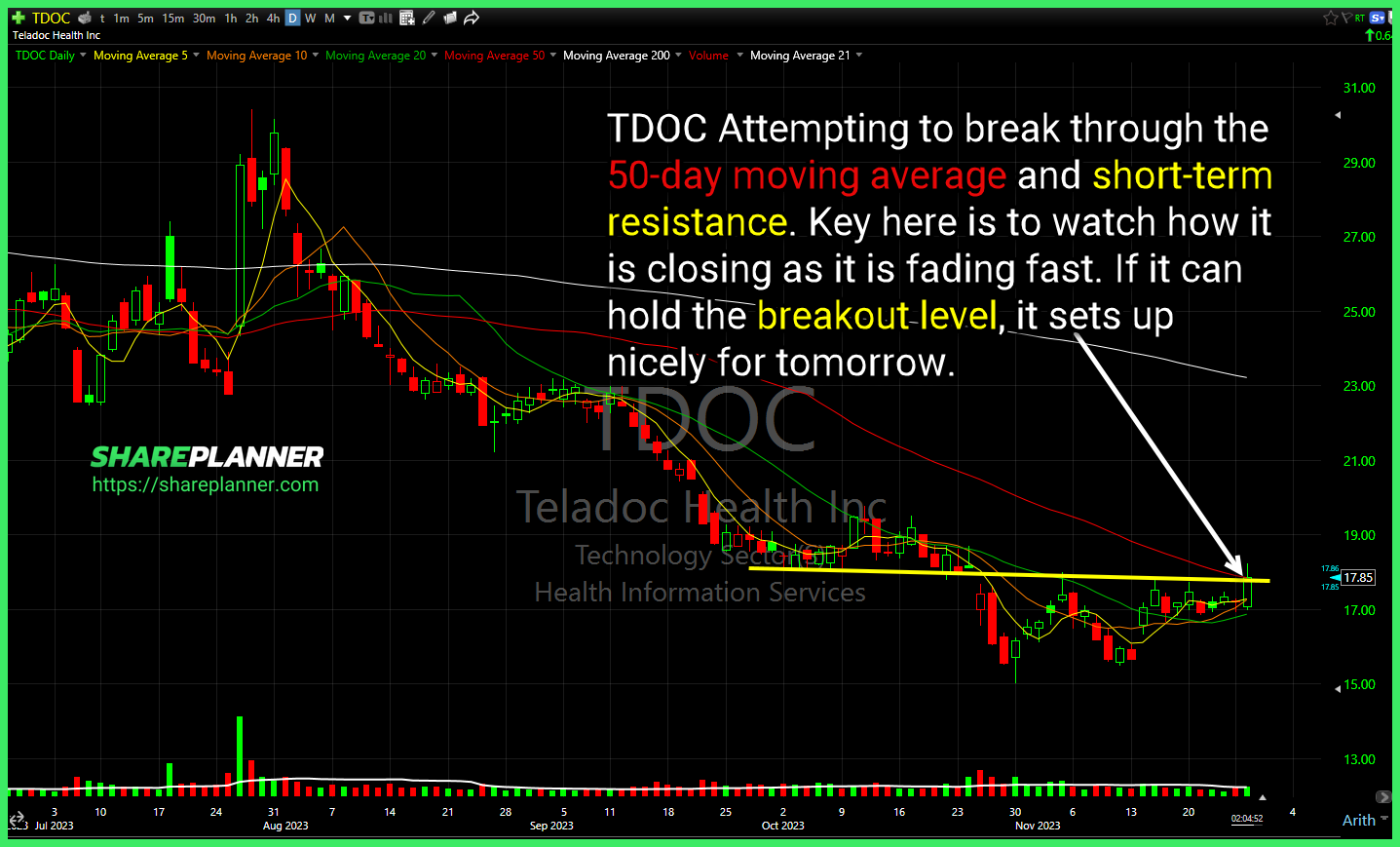

$TDOC Attempting to break through the 50-day moving average and short-term resistance. Key here is to watch how it is closing as it is fading fast. If it can hold the breakout level, it sets up nicely for tomorrow. Price on $SPY testing major resistance here. $GDX setting up for a test of the inverse

Continuation triangle in play on $WFG that it is currently testing a potential breakout here... some scant support underneath as well, just above $75 $CNP nearing an ascending triangle breakout here. Never worth front running these, and best to wait for the breakout to get long. $PWR bull flag for a potential continuation of

$MARA cup and handle pattern forming but still needs to push through and close above the 200-day moving average first. $PLTR attempting to break through a long-term resistance level as well as confirm a multi-year cup and handle pattern. Next stop would be upper-$20's. Since Tuesday, $QQQ has been all consolidation - going sideways since

$SMCI nearing a triangle breakout. $IWM declining trend-line getting tested here, with a massive gap underneath.

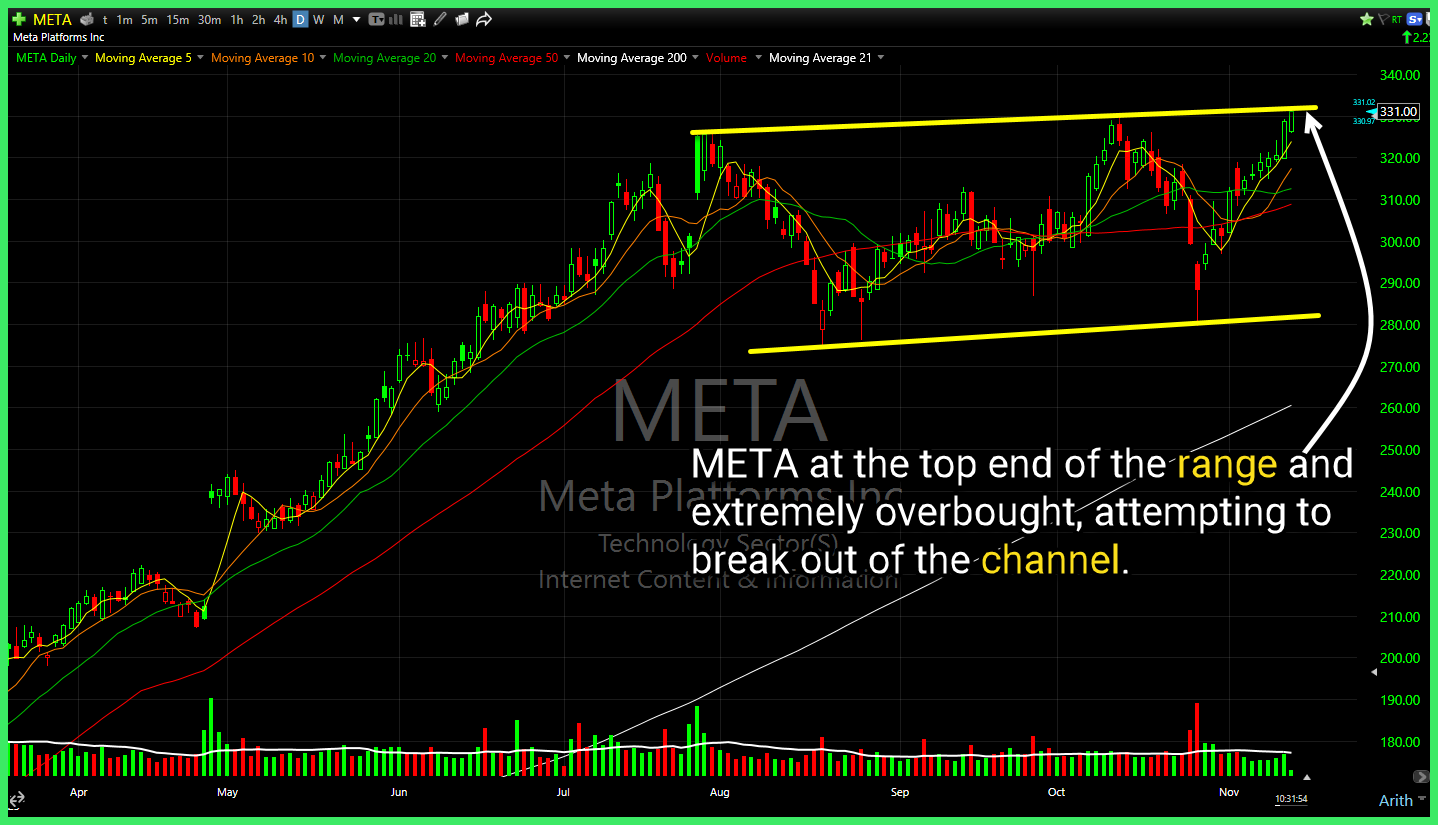

$META at the top end of the range and extremely overbought, attempting to break out of the channel. $MDT working on a potential base. A breakout would occur just underneath $74. Some resistance overhead to be aware of though, and earnings scheduled for 11/21.

$SOFI attempting to bounce off of declining support but still faces overhead resistance. $PLTR breaking out of a declining resistance $AIG may be forming a wedge pattern to play the breakout on, but resistance overhead remains a problem.