Ideal entry on Viper Energy Partners (VNOM) would be a bounce off of its lower channel band. Palantir Technologies (PLTR) heavy fade back to the lower channel band. With earnings today, it becomes a high-risk trade to paly any bounce. Bear flag on Tesla (TSLA) confirming to the downside, with additional continuation today.

Energy $XLE has the potential to shine here if it can break out of this declining channel. Some much needed consolidation this week. . $XLB tight and well constructed bear flag in the materials sector and toying with a confirmation over the past couple of weeks. $ALB huge support going back to November, with bounces

$VIX still has this massive base from November ongoing. Two attempts to breakout of it has been quickly crushed. But potentially setting up for another attempt here. . Bull flag breakout on $CDNS but the history with the upper channel band is a concern, considering the # of false breakouts that have occurred.

Three recent hits up against resistance on $JPM to be watchful of. If it pulls back, a break below $172 would confirm a bearish wedge. . ON $SLB: 1. Inverse cup and handle nearing confirmation. 2. If support hold it could result in a triple bottom, but support is going to need to hold, and

$DENN is nearing a break of consolidation. However heavy resistance looms in the $11's. . $SNAP remains in a promising bull flag but with earnings 2/6 you may not have enough time to see it play out. Definitely one stock I would never hold through earnings as well. Watch upper channel band for resistance on

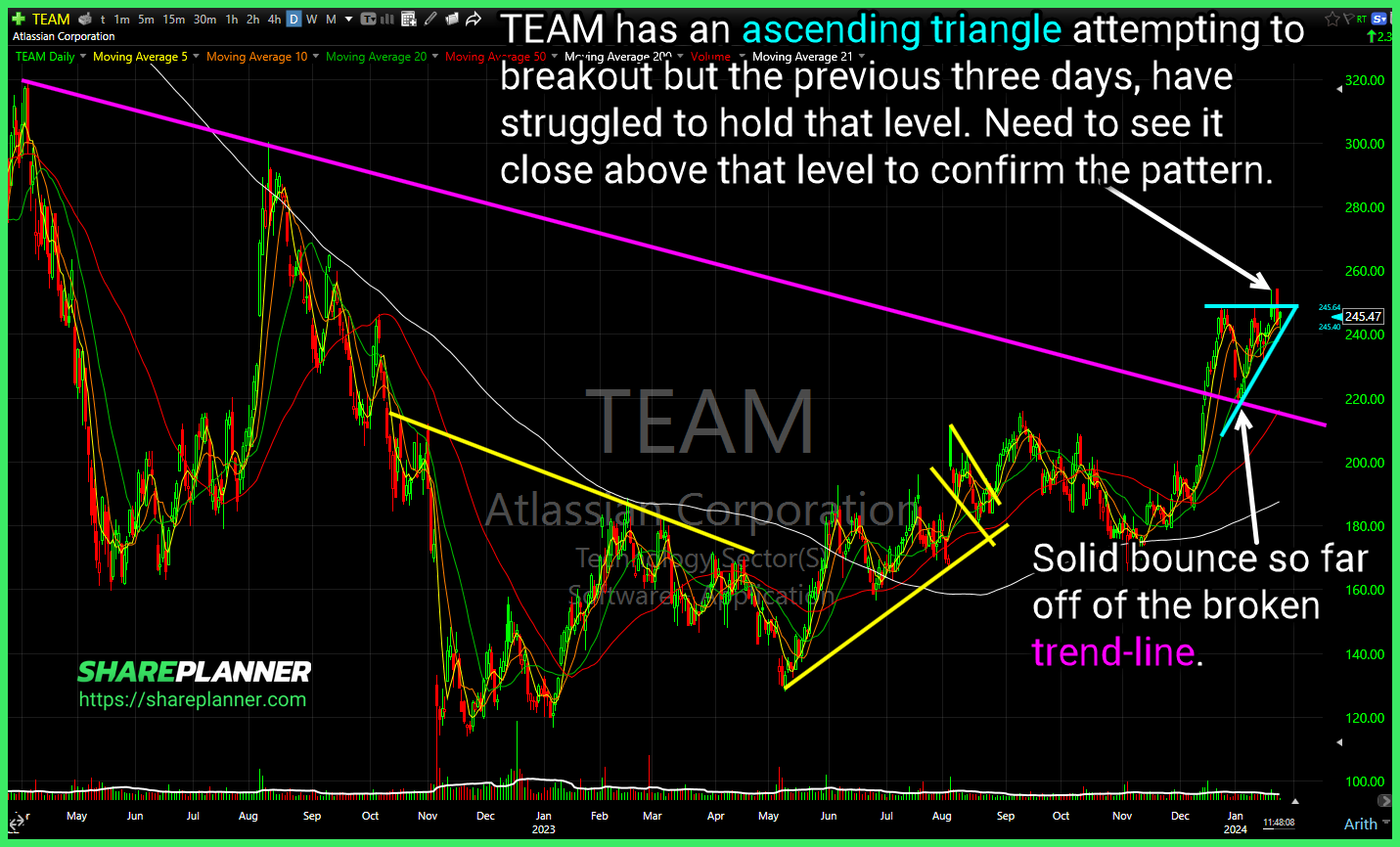

Atlassian (TEAM) has an ascending triangle attempting to breakout but the previous three days, have struggled to hold that level. Need to see it close above that level to confirm the pattern. Tesla (TSLA) breaking a major support level and the October '23 lows. Here's the sector returns so far with S&P 500

$MCD holding the breakout level above $299. Solid consolidation and potentially looking for another move higher. . $DIS not the best price action over the last two days, but could simply be consolidating here. Too early to know for sure, but certainly worth watching. Potential landing spot for $DHI at the 50% Fib retracement and

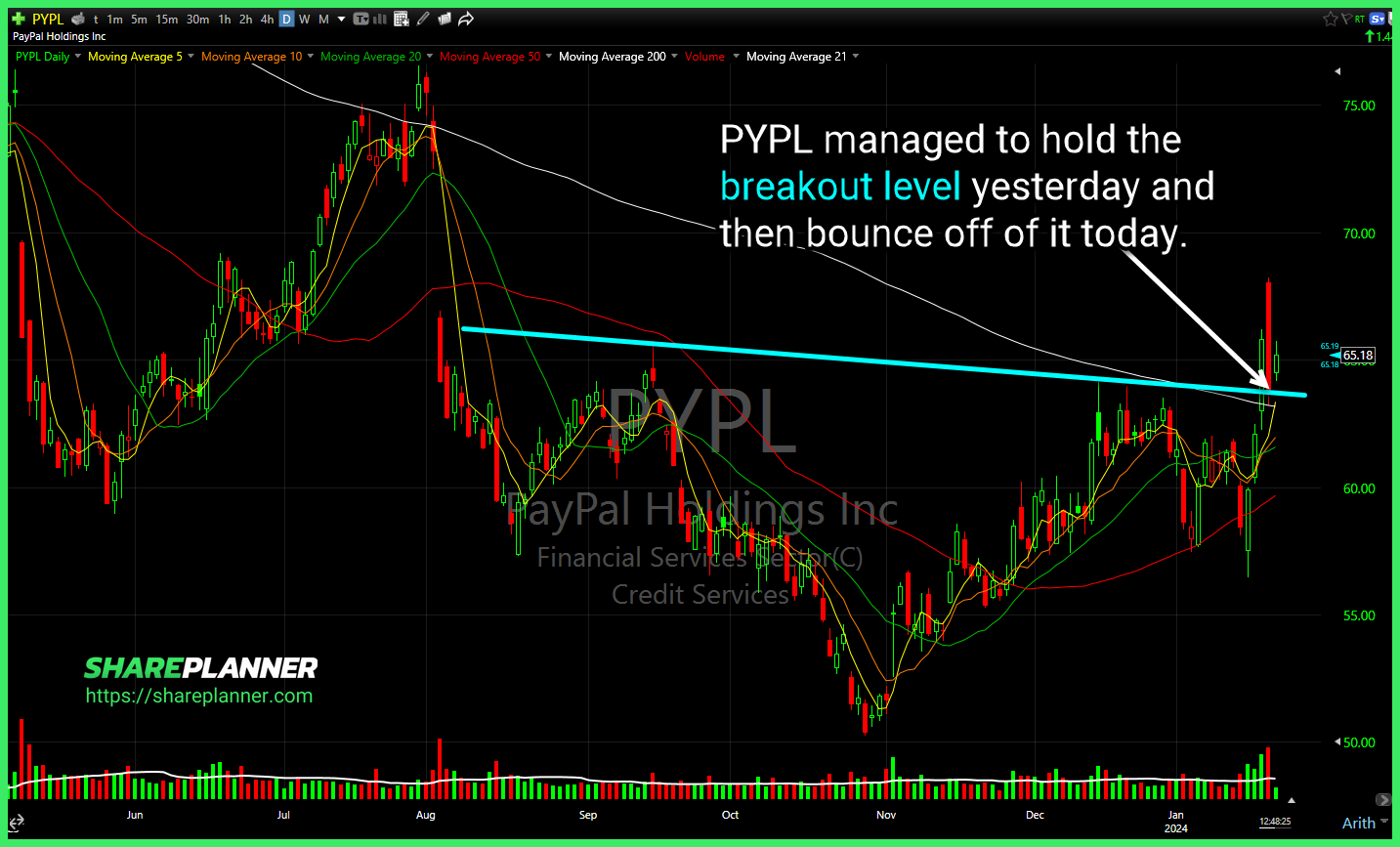

$PYPL managed to hold the breakout level yesterday and then bounce off of it today. . Earnings gave $UAL a boost right back through the resistance that was holding it back. $BTC.X 3 support levels to watch as bitcoin has broken short-term support levels and now in a free fall here.

United Airlines (UAL) couldn't push through resistance, and instead resumed its current downtrend. Sets up well for a retest of the lower $30's. Advanced Micro Devices (AMD) despite pulling back about 5% today, for me it's not worth playing until it retests its rising trend-line and holds. The ideal way for me to play PayPal

ASML (ASML) double bottom off of the 50-day moving average Solid bounce off of the rising trend-line for Arm (ARM) with follow through today. Confluent (CFLT) a lot of bearishness on this chart from the old trend-line rejection in December, to the head and shoulders and the current downtrend pressing hard on any