Tesla (TSLA) pullback and bounce off of the base breakout level. Airbnb (ABNB) wedge pattern formed that could provide some short-term resistance for ABNB, which trades inside of a much bigger channel pattern. Dollar General (DG) pulling back to breakout support. So far holding it. Will need a hard bounce here to keep the setup

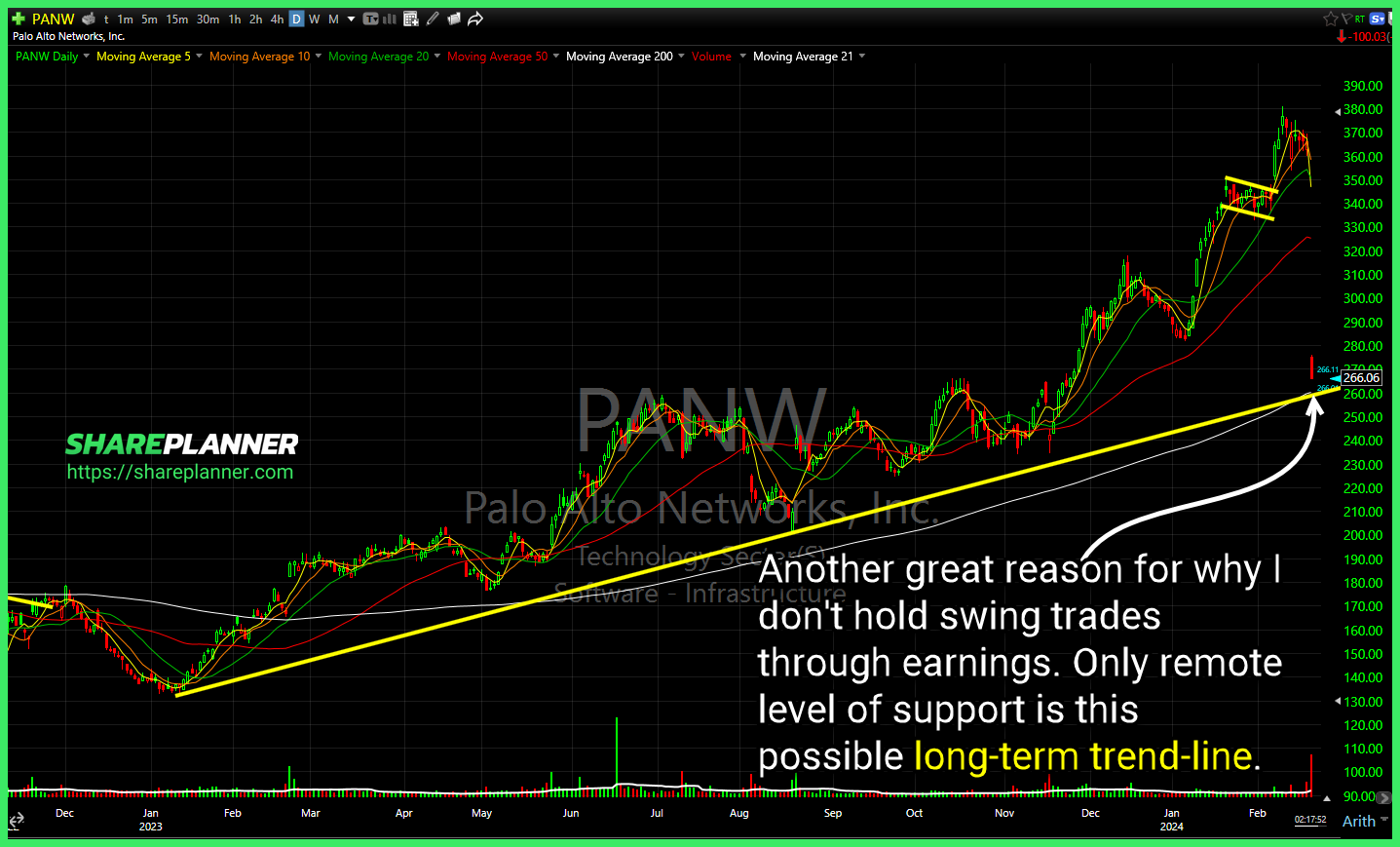

PANW - Another great reason for why I don't hold swing trades through earnings. Only remote level of support is this possible long-term trend-line. AAPL managed to hold the trend-line into the close yesterday, and now attempting to bounce off of it today. Possible it sees some push back from the 200-day MA

Mastercard (MA) pulling back here to the rising trend-line. Watch for whether it can hold & bounce. . Alphabet (GOOGL) buying the dip off the rising trend-line today.

$NFE with a break in the declining trend-line while holding support underneath. . $SMCI with a massive bearish engulfing candle so far today. $HOOD broke through the upper channel band.

Tesla (TSLA) inverse head and shoulders most prominently seen on intraday charts and now trading in the gap from 1/25 Airbnb (ABNB) with solid short-term rising support underneath, but you want to pay close attention to the resistance above that it isn't part of a bearish wedge that is forming. History often rhymes Super Micro

$MA Continuation triangle in play here, and holding strong despite heavy market selling today. . $ALT Inverse cup and handle forming, and testing confirmation here. $JPM bearish wedge formed and testing rising support here. A break below $172.90 would confirm the bearish wedge here.

Two day pop out of $VIX following a test of rising support, but still range bound and doesn't mean much in terms of future direction. . $AI descending triangle breakout, following a non-stop, 25% move off the lows of the pattern, making it a difficult one to tightly manage the risk on. Double top on

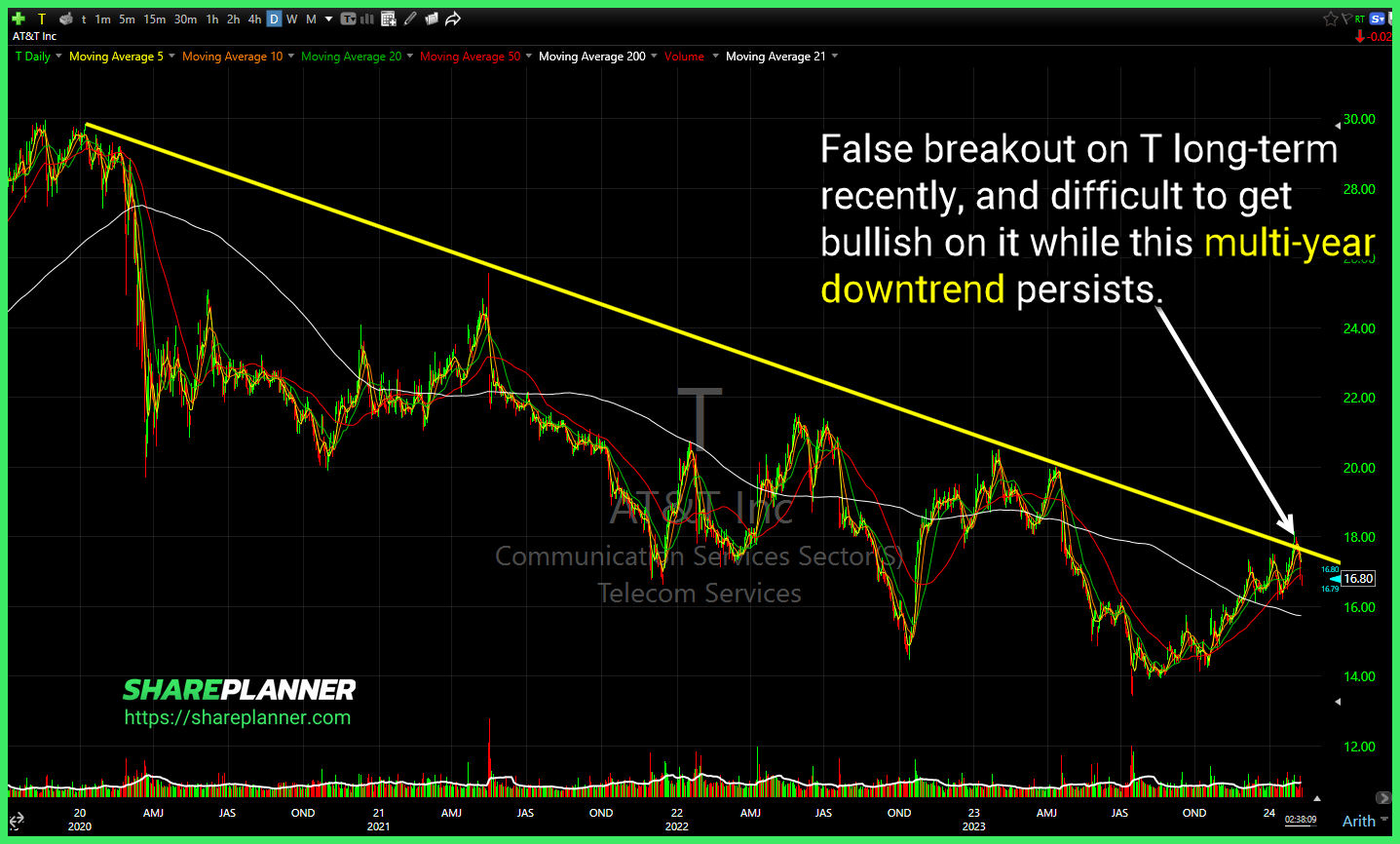

False breakout on $T long-term recently, and difficult to get bullish on it while this multi-year downtrend persists. . $AMGN pullback looking to test support at $285, watch for whether it can base and bounce. Possible $GEO finds support at the rising trend-line, which still has room to fall before testing, but heavy volume pouring

$TNX nearing a breakout again, watch as it approaches the 4.2% area. . $MARA price action will be heavily dependent of Bitcoin price action going forward, but technically, MARA weekly has very little resistance until the low-$30's. $HAL so far holding the rising trend-line, but would prefer it make a higher-high first, before retesting.

$CEG trading in a perfect channel since inception. Tested the upper band yesterday, but couldn't push through. More risk lower than reward higher here. . $ALB declining trend-line off of December highs, followed by a break in short-term support to new lows. If looking to short this, I think time is on your side to