The Risks of Following Roaring Kitty's Meme Stock Mania The return of Roaring Kitty has reignited the meme stock mania, with GameStop (GME) and AMC Entertainment (AMC) experiencing significant price surges. However, blindly following the hype can be a risky endeavor for traders. I've also provided a video where I'll explore the dangers of meme

Fast stock market reversals present unique opportunities for traders to capitalize on quick changes in market direction. By understanding how to identify and trade these reversals, you can potentially generate quick profits in a short period. In this article, we’ll explore effective strategies for trading fast stock market reversals. It’s crucial to understand what stock

Don't Chase Stocks Gapping Up! When swing trading, it's crucial to be aware of the potential pitfalls that can derail your strategy. One common mistake many swing traders make is chasing stocks gapping up significantly higher at the open. While it may be tempting to jump on board, hoping to catch a ride on the

Learn how to effectively use the Anchored Volume Weighted Average Price (or Anchored VWAP) indicator during a stock market bounce Key Takeaways: Identifying a stock market bounce & using Anchored VWAP Strategies for applying Anchored VWAP during a market recovery Real-world examples using current trade setups For those who don't know what Anchored VWAP (Volume

The Trade Desk (TTD) on the weekly chart, it's possible that a double top is starting to form. I don't see a clear edge at all on the daily for a long play. Also in play is ultimately a return to its long-term trend-line. Atlassian (TEAM) retesting the rising trend-line again, but doing so without

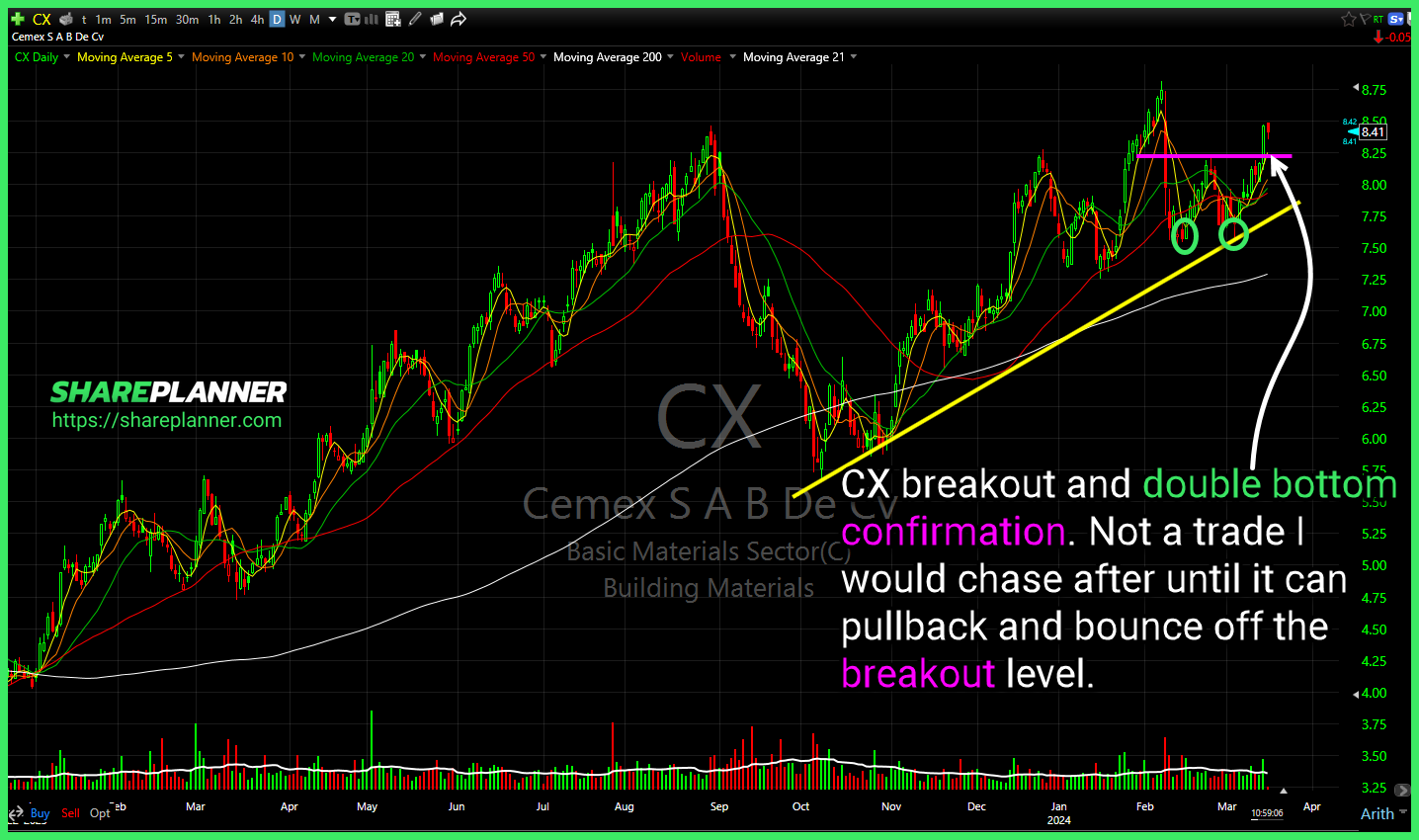

Cemex (CX) breakout and double bottom confirmation. Not a trade I would chase after until it can pullback and bounce off the breakout level. Microsoft (MSFT) with a pullback to the breakout level. Extreme volume at the open though is concerning that it will be able to hold. Could see a pullback to the rising

Little in the way of support for Affirm (AFRM) on the weekly until it comes back down to where it originally broke out at (27.50), which is also in line with the 200-day MA on the daily. Compelling bounce play here in Apple (AAPL) if it weren't for the declining resistance just above. Better to

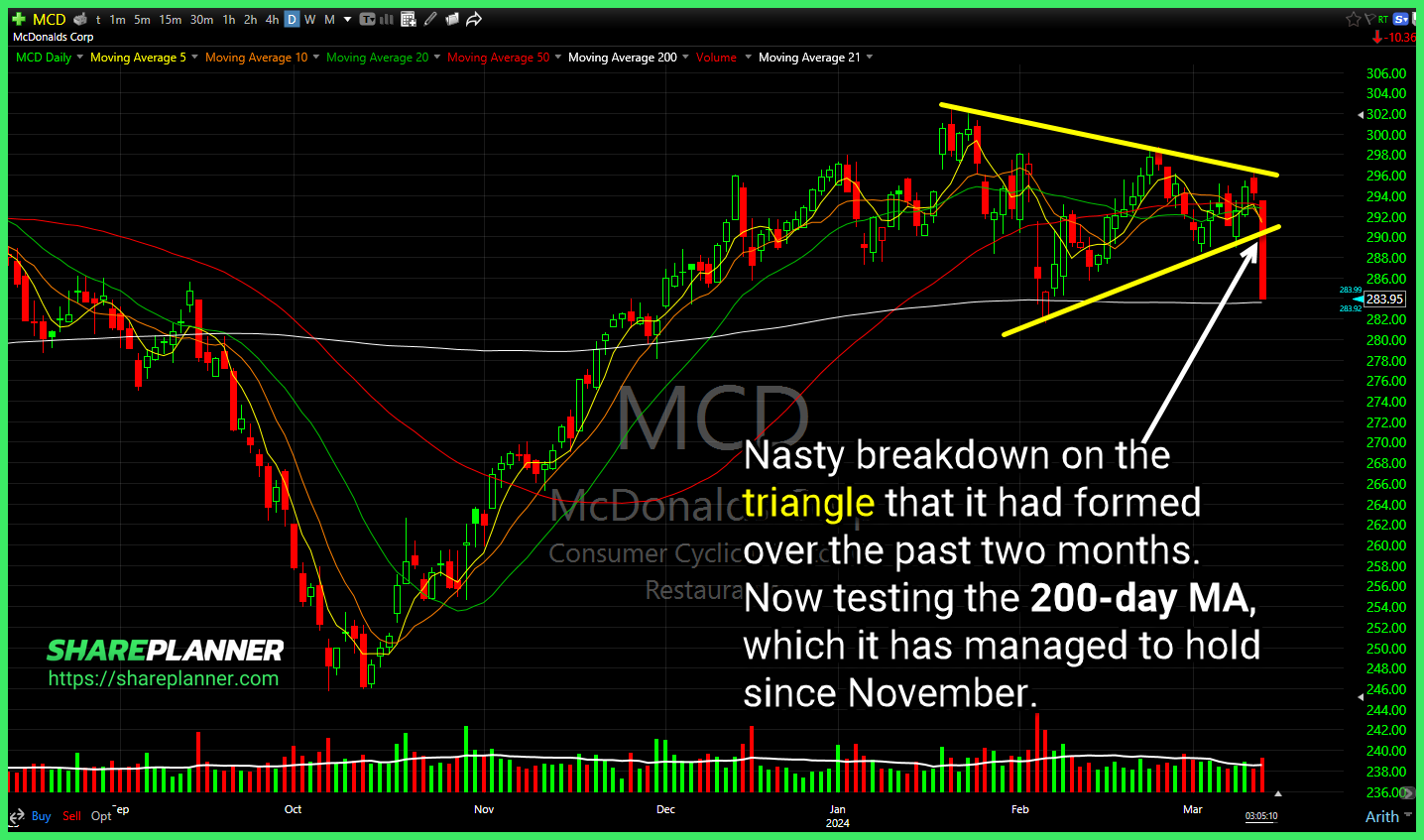

Nasty breakdown on McDonalds (MCD) with the triangle that it had formed over the past two months. Now testing the 200-day MA, which it has managed to hold since November. SoFi Technologies (SOFI) wedge break following a breach of the rising trend-line looks at a potential move back down to its lower channel band.

JFrog (FROG) remains in an uptrend, and has recently formed a triangle which it is close to breaking out of. FTAI Aviation (FTAI) strong bounce off of the rising trend-line. Rising channel on Boeing (BA) a broken yesterday, and strong continuation to the downside today. Huge headline risk as well, No reason to even go

Microsoft (MSFT) holding the rising trend-line here, but not quite getting much in the way of a bounce so far. Semiconductor ETF (SMH) attempting to find some support here on this pullback. Boeing (BA) breaking below the lower channel band that goes back to October '22