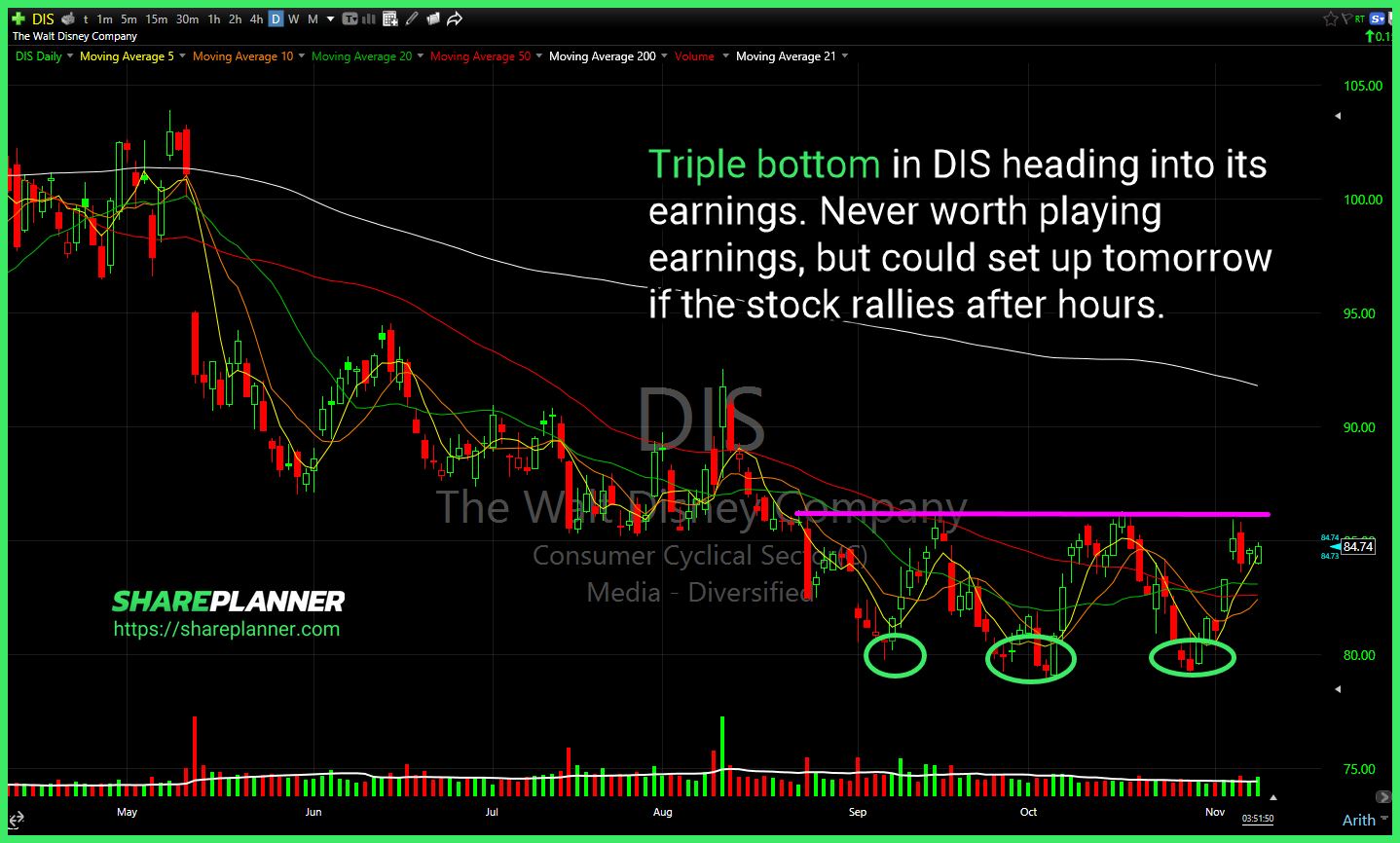

$AMC remains absolute dog-water, being down 92% since December. Bulls are going to want to hold on to hold on to this key support level, or more turmoil should be expected. $GME declining trend-line off of the June highs remains well intact and continues to reject price on every test. $DIS currently sitting at heavy

Triple bottom in $DIS heading into its earnings. Never worth playing earnings, but could set up tomorrow if the stock rallies after hours. $NVDA breaking the declining trend-line here, rallying 19.3% in 7 days. Playing a breakout with that steep of a rally prior to, doesn't create an ideal reward/risk ratio. $DLTR cup and handle

$COST back to testing major resistance. Previous attempts led to sharp rejections. $SMH right there on the upper channel band trying to break through here. $CELH with a heavy sell-off today. Watch these two key support levels.

Chevron (CVX)Analysis 1) Short-term support broken, setting up for a retest of long-term trend-line. 2) Declining trend-line above creating lower-highs. 3) Short-term trend-line also broken. First Solar (FSLR) declining channel remains perfectly intact and seeing a hard rejection off the upper channel band today. Apple (AAPL) starting the week by pressing up against declining resistance.

Major support where $MSOS is attempting to bounce higher from. Any play to the upside is worth being aggressive with profit taking. $VZ pushing up against two significant layers of resistance: 1) Declining trend-line, and 2) price level resistance. Currently being tested, but neither broken as of yet. $ELF textbook bear flag breakdown confirmed to

Long-term support on Ford Motor (F) broken today. This is a scenario where trying to guess at where support might loom is not worth it. Best to let the stock start to base first instead of guessing where it might bounce. Financial Sector (XLE) nearing a potential bounce area here. Alphabet (GOOGL) slicing

MO getting steamrolled post earnings, but may find some support here off of long-term rising trend-line at $36. A lot of chasing taking place in SAVA over the last two days, but you'll want to be mindful, if long, that there is some heavy resistance looming above. LLY looks like it is on a crash

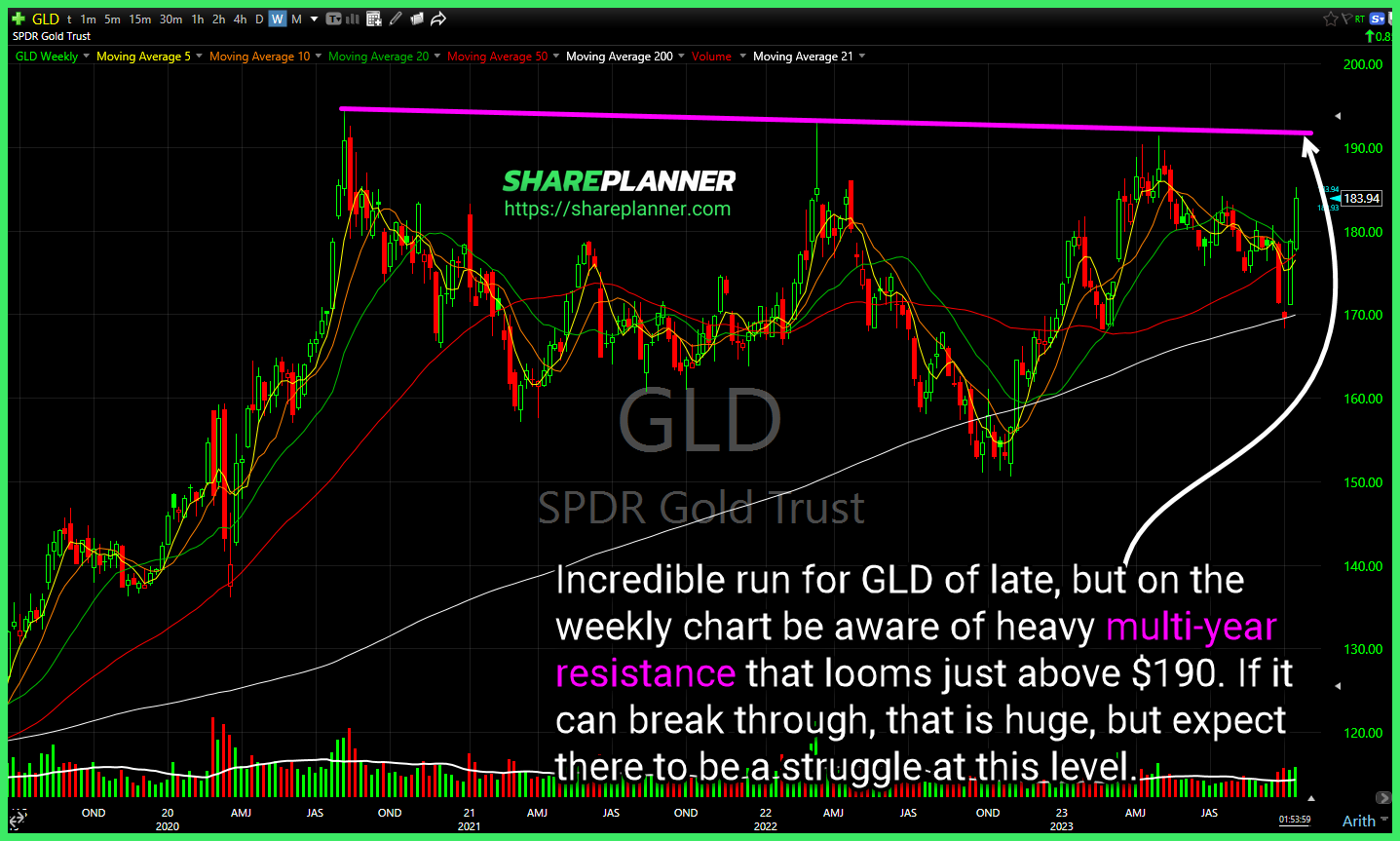

Incredible run for $GLD of late, but on the weekly chart be aware of heavy multi-year resistance that looms just above $190. If it can break through, that is huge, but expect there to be a struggle at this level. Just when you think $PYPL can't go any lower, it breaks another important support level,