Palantir (PLTR) – Earnings Beat & Technical Setup Palantir (PLTR) delivered a huge earnings beat today — not just on revenue and EPS, but with forward guidance that far exceeded Wall Street’s expectations. Q4 2025 Numbers: Revenue: $1.41B (vs. $1.33B expected) Adj EPS: $0.25 (vs. $0.23 expected) Q1 2026 Guide: $1.53B–$1.54B (vs. $1.34B expected) FY

Palantir (PLTR) so far, isn't getting much of a bounce off of this key support level. A break could signal a top is in.

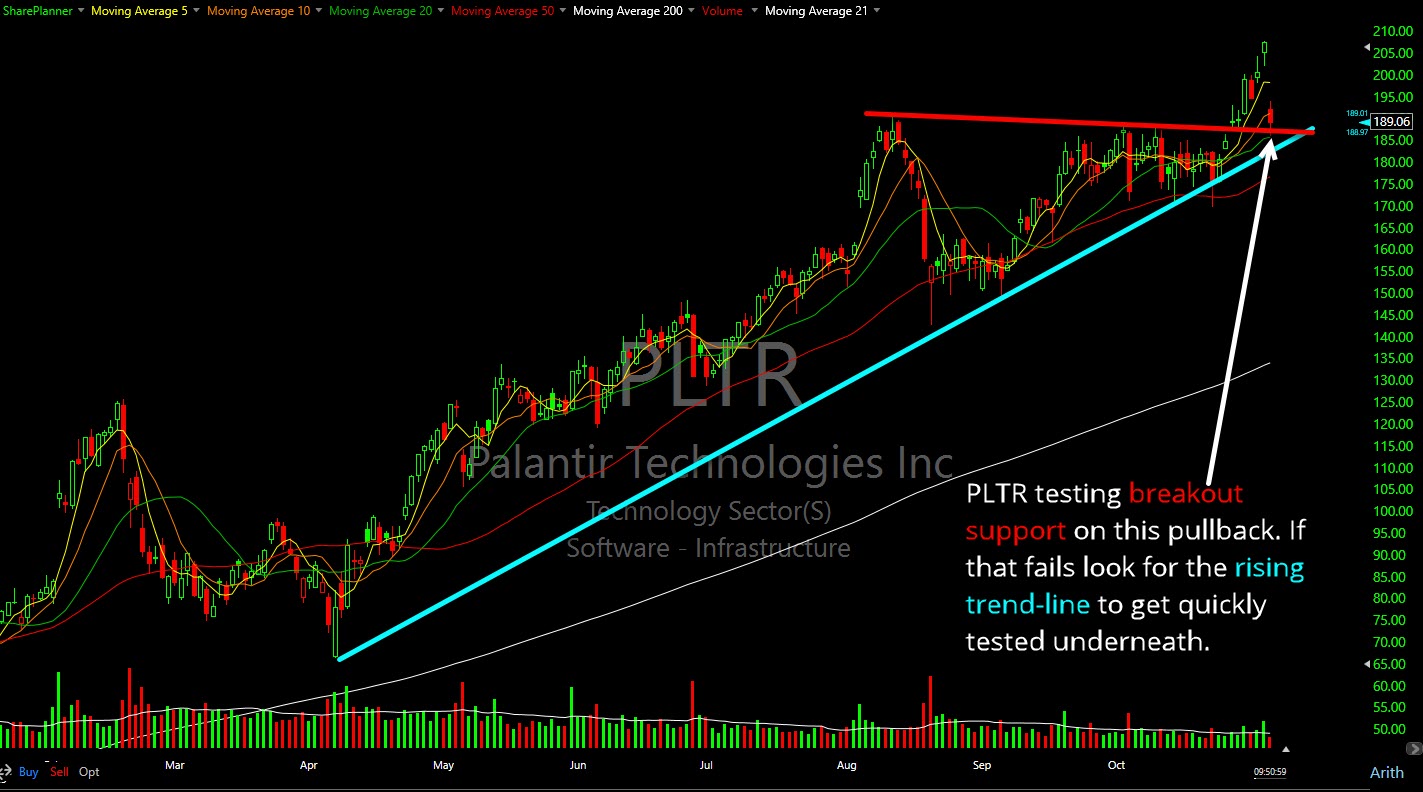

Palantir Technologies (PLTR) testing breakout support on this pullback. If that fails look for the rising trend-line to get quickly tested underneath.

PLTR – What Earnings Did and What Traders Should Do Next Palantir Technologies (PLTR) has just reported its earnings, and there’s a lot happening on the chart from a technical standpoint. With the earnings out of the way, we can get back to the technicals of the chart; where the stock could pull back, where

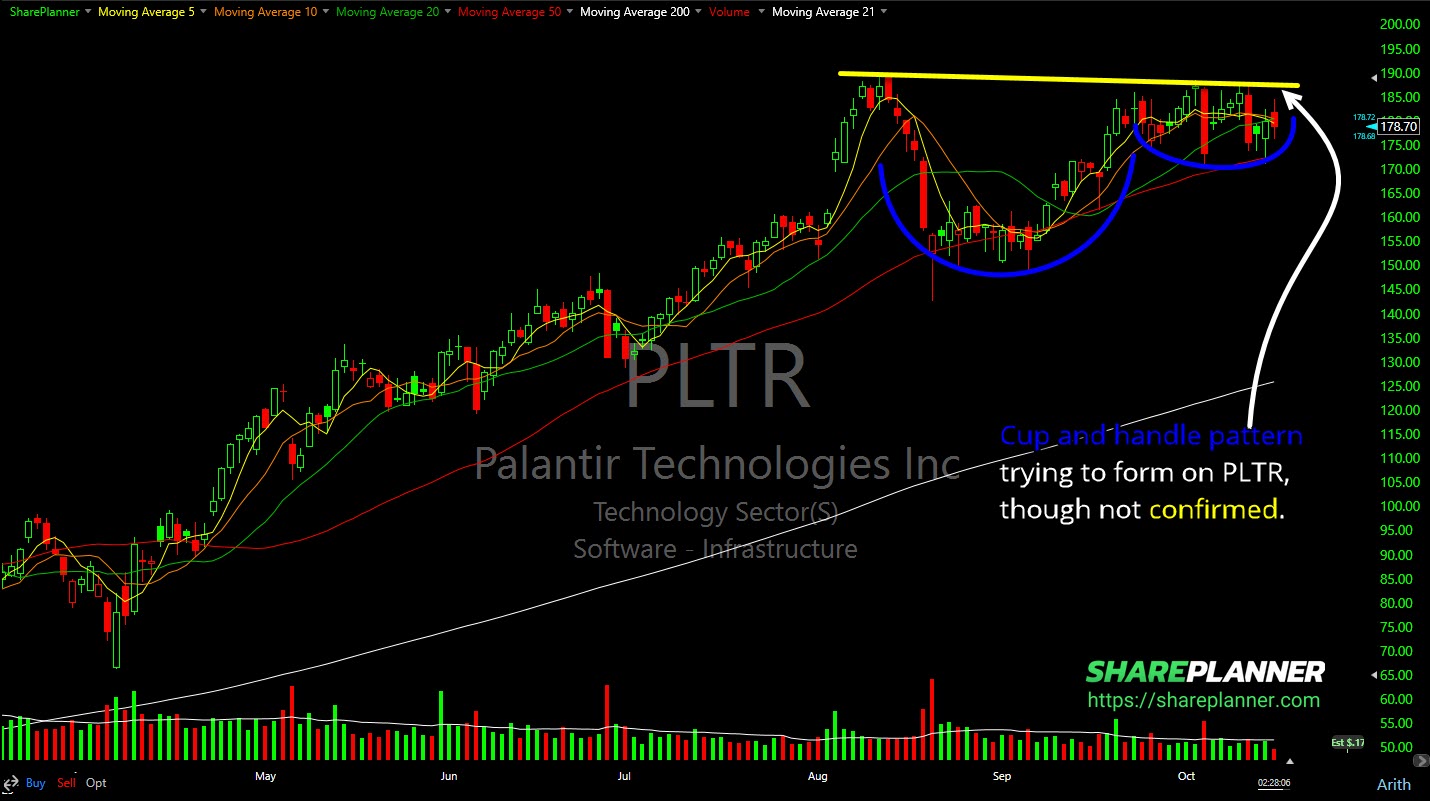

Palantir Technologies (PLTR) hasn't confirmed the cup and handle but it is brewing.

Solid bounce so far off of support for Palantir Technologies (PLTR).

Is it time to buy PLTR on the dip here? As one of the most important AI plays right now, Palantir Technologies (PLTR) has pulled back significantly here. In this video, I break down: The key support levels PLTR is approaching Why this pullback could be an opportunity Volume and trend structure to watch

Is Palantir Technologies giving us a warning, on an other wise bullish day, with that nasty shooting start candle?

PLTR Stock – Is There Still Room to Run? Palantir (PLTR) has been making a steady move higher recently, with traders still YOLOing their life savings into the stock looking to ride the continued momentum in the AI space. But with this recent rally, the question becomes: is there still room to run, or is

PLTR Selling Off in After Hours Palantir Technologies (PLTR) reported strong Q1 2025 earnings, with revenue rising 39% year-over-year to $883.9 million and adjusted EPS at $0.13, surpassing analyst expectations. Despite this, the stock fell over 9% in after-hours trading due to concerns over high valuation and potential government contract risks. In this video, I