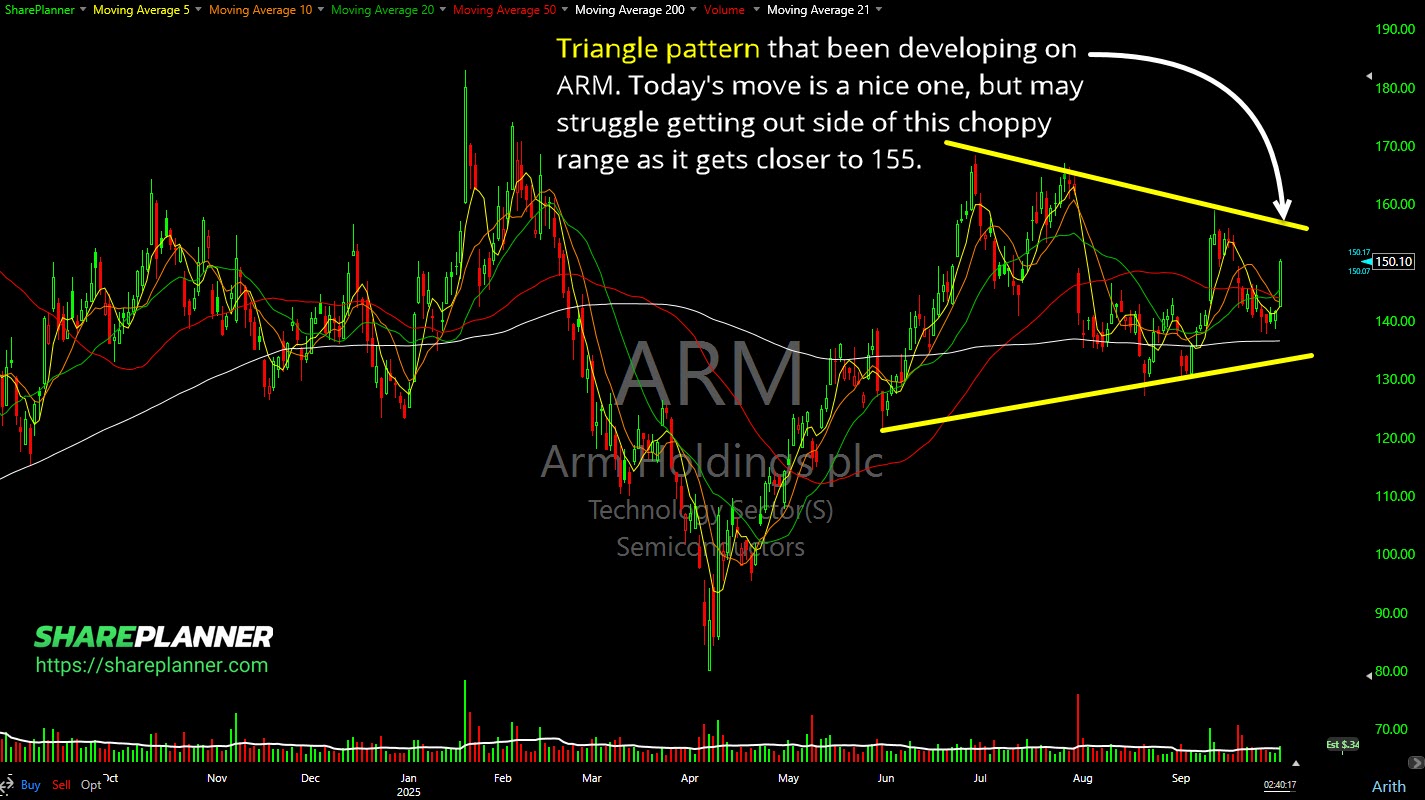

I think Arm (ARM) may struggle here to break through this symmetrical triangle range.

ASML (ASML) double bottom off of the 50-day moving average Solid bounce off of the rising trend-line for Arm (ARM) with follow through today. Confluent (CFLT) a lot of bearishness on this chart from the old trend-line rejection in December, to the head and shoulders and the current downtrend pressing hard on any

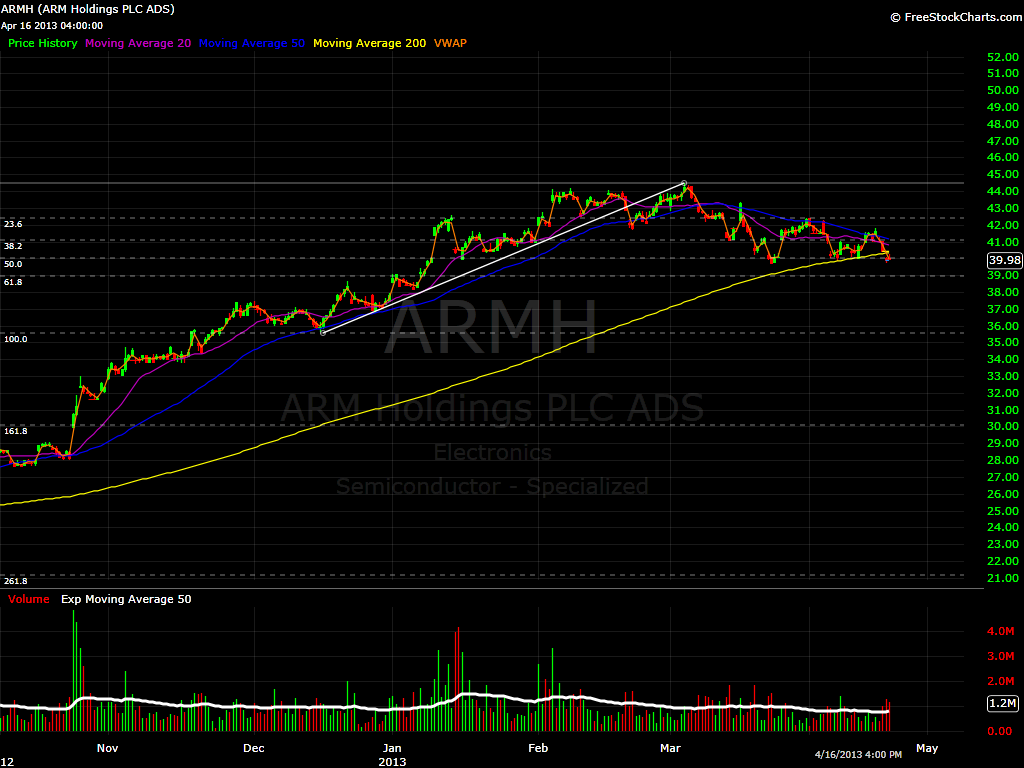

Cannabis and US Cannabis ETF (MSOS) specifically rolling over. I expect a retest of the $6's. Arm (ARM) continues to trend lower following its IPO which is what is to be expected with pretty much any IPO. Best to wait at least 6 months before buying for the long-term. Microsoft (MSFT) pulling back

The market is having a difficult time here in March, but not so with the SharePlanner Splash Zone. So do yourself a favor and start profiting consistently in the stock market by signing up for the SharePlanner Splash Zone out that comes with a Free 7-Day Trial. With your membership, you will receive all of my

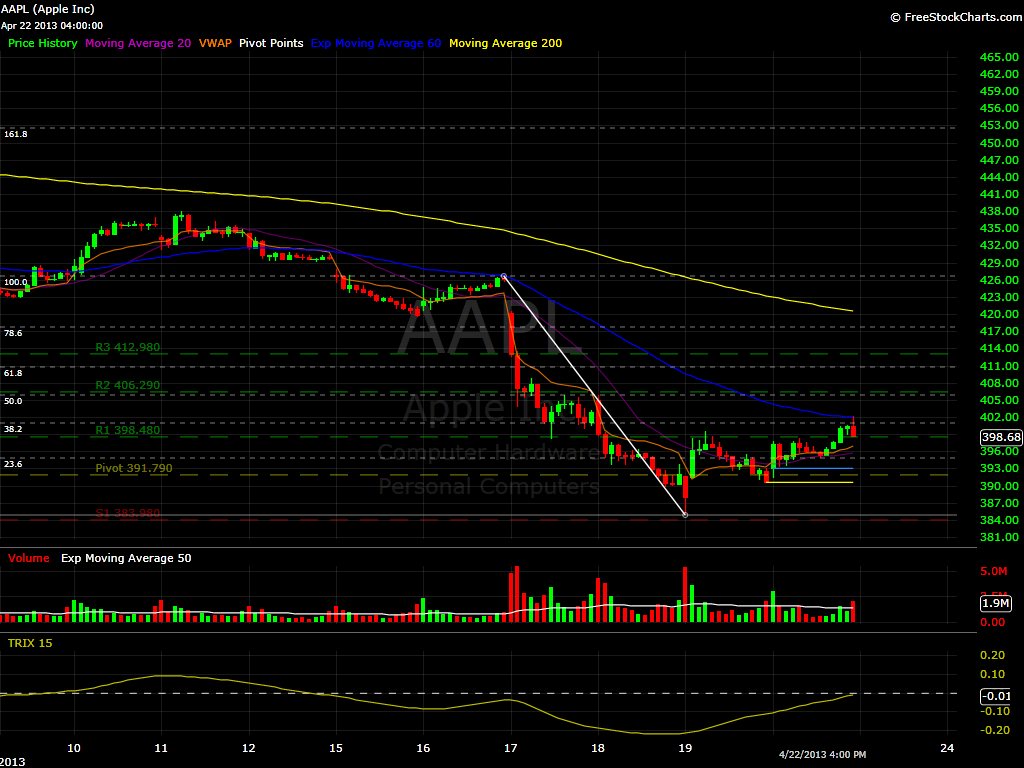

Apple (AAPL) 3 Day Chart - Nice move from the 385 level, that I tweeted about last week. It is currently above 400 which on a short term basis, correspond to the 38.2% Fibonacci Level. So as long as it stays above 400.90, it is a good long. Amarin (AMRN) 4 Hour - I want

Arm Holdings (ARM) 4 Hour Chart - Insignificant gap on pre-market, most likely it will re-test 40 (50% Fibonacci Level), and nose dive to the 61.8% level represented by38.99. ASML (ASML) 2 Hour Chart - Gaping 2 Fibonacci levels at the same time. Watch for it to hold the 50% at 71.63. If

$ALXA 4 Hour Chart - Gaping up practically 3 Fibonacci Levels. For this move to have legs, it needs to hold above 4.74. $ARMH Daily Chart - Gaping up just above a fib level. Needs to stay above 42.37, if it doesn't then it will be a short. $ASTX 8 Day Chart - This stock

$ARMH 2 Hour Chart - Seems to be holding well the 41 level. Gaping higher today. The gap still puts the stock in the middle of two Fibonacci Levels. $ARNA Daily Chart - Mild gap but put it very close to yesterday's highs. Could be a runner today. $BBRY Daily Chart - Talk about a

$ACAD Weekly Chart - I really thought it was going to reach it's 8.98 target last week which represents the 50% Fibonacci Level, but it did give up so close. Today it is openining high. This one should be interestingtoday. $APOL Daily Chart - Nice pop in this name. It needs to hold strong over