Episode Overview How do you fight the urge of FOMO (Fear of Missing Out) in your swing trading when you see stocks like Tesla (TSLA) trading over 100% higher in just a month? How does one resist such urges, and are there instances where you should chase after moves? Plus, Ryan follows up on his

Watch $BLDR and the potential for a bull flag breakout.

Episode Overview Let's talk more about trailing stops with swing trading because the questions keep coming in on these and I think it is important to continue talking about as long as you all have questions about them. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan opens the podcast by diving

Discretionary ETF (XLY) coiling above key breakout support. Bulls will need to hold this one in the coming days, to keep control. Technology ETF (XLK) Consolidation over the last five trading sessions still has tech sector holding key support. Robinhood (HOOD) coiling just below major resistance. Airbnb (ABNB) nearing a test of significant resistance that

Stock market pullback back lasted for the past two days. Using technical analysis, is now the time to buy the dip, or wait for stocks to sell off even further before considering buying stocks?

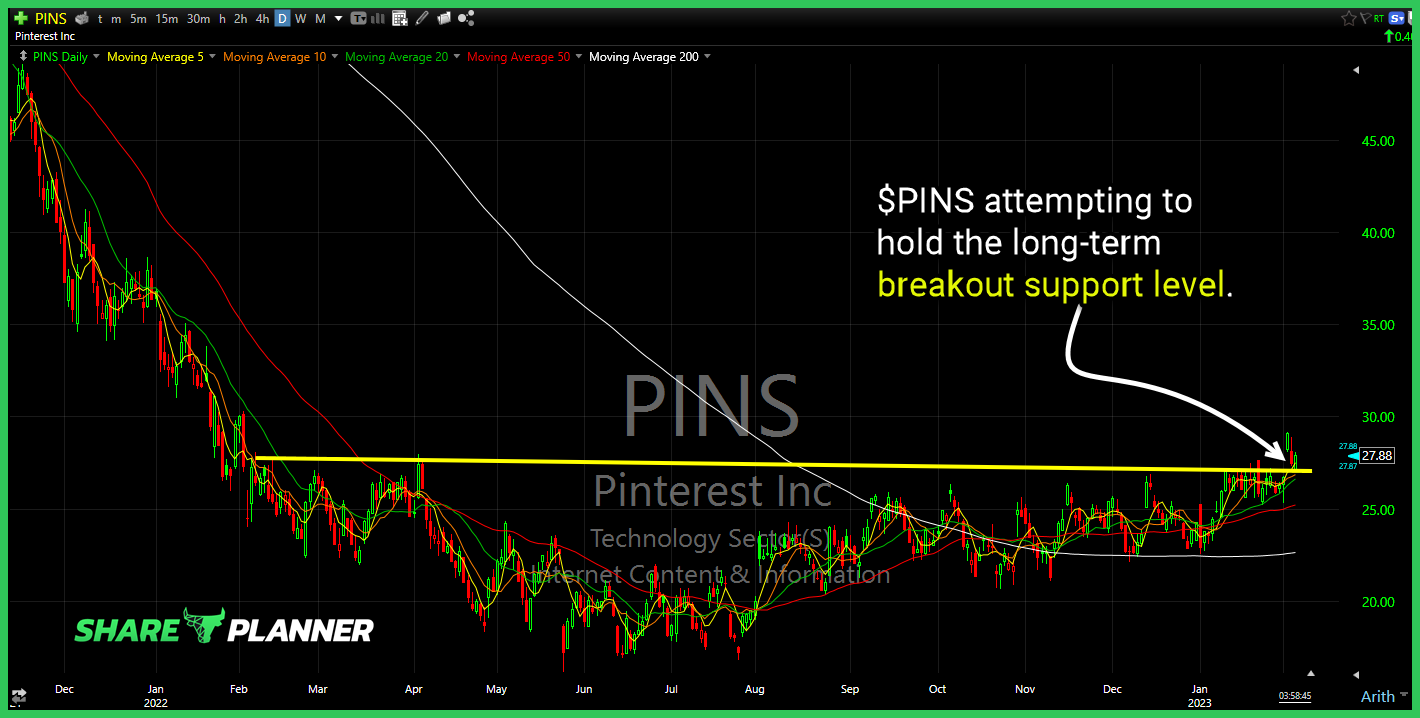

$PINS attempting to hold the long-term breakout support level.

Episode Overview Ryan talks about using trailing stops versus manual hard stops, and the benefits of the latter over the former. He also briefly talks about Jesse Livermore as a trader and whether his principles still applies today in swing trading. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off

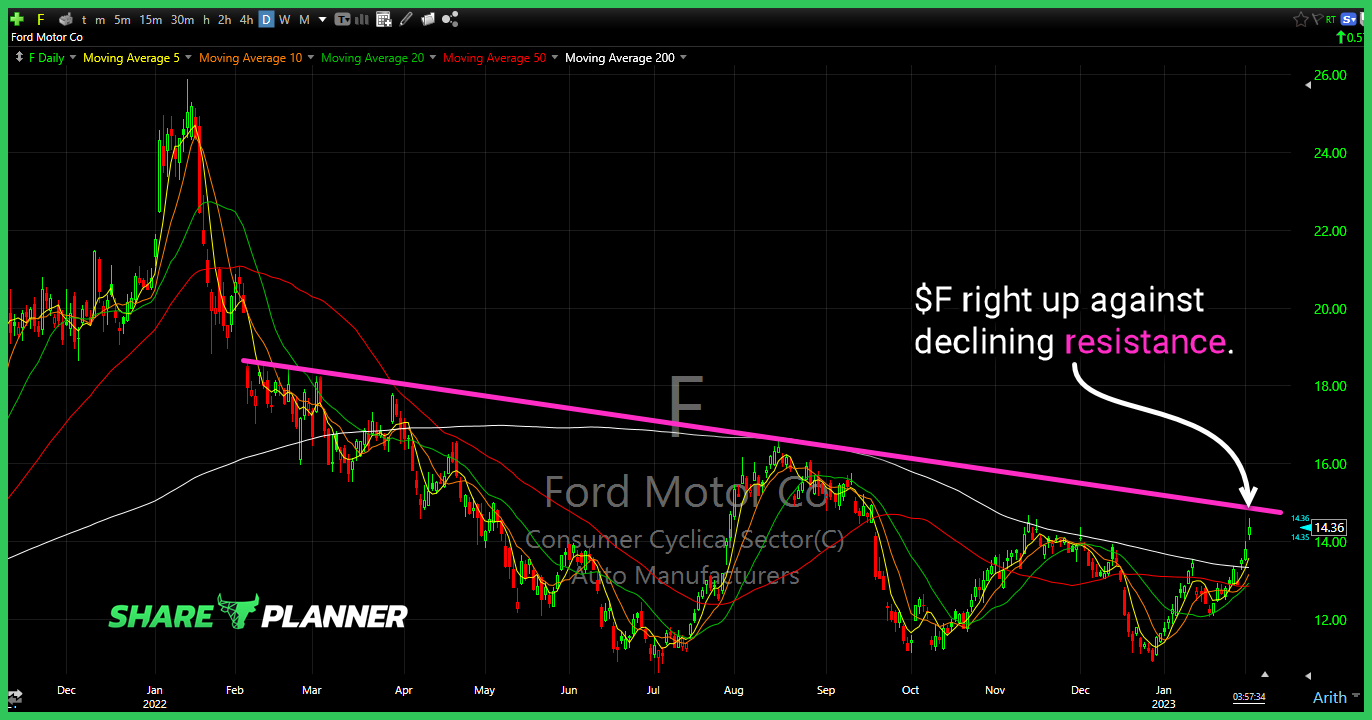

$F right up against declining resistance.

Episode Overview Should you hedge your positions in ETFS, or even stocks with index ETFs that go in the opposite direction of your positions? What are the benefits and downfall to doing this, plus Ryan addresses an easy way to avoid being stopped out prematurely from your swing trades. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube