$UNH rejection at the broken trend-line, waiting for a pullback to key support.

Episode Overview Ryan Mallory digs into the topic of adding to his positions after he got into the trade. Furthermore he talks about using leverage in the portfolio for stocks with low volatility. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] Revisiting Barry’s Trading JourneyRyan introduces a follow-up email from Barry in

Another breakout for $GOOGL looking really strong here against this tape today.

Heavy sell-off yesterday in $NFLX has price completely reversed and attempting to break out of the bull flag pattern.

Episode Overview How do you deal with problems that arise from getting stopped out of a profitable trade, only to see the stock reverse and go even higher? How does one avoid keeping too tight of stops that will expose traders to unnecessary and untimely exits from really good trades? In this episode, Ryan tackles

$WW looks like a double top on its way to continued trek towards $0. lol

Q&A session going over the stock market price action over the past week, and the impact that 0DTE traders are having on the overall market.

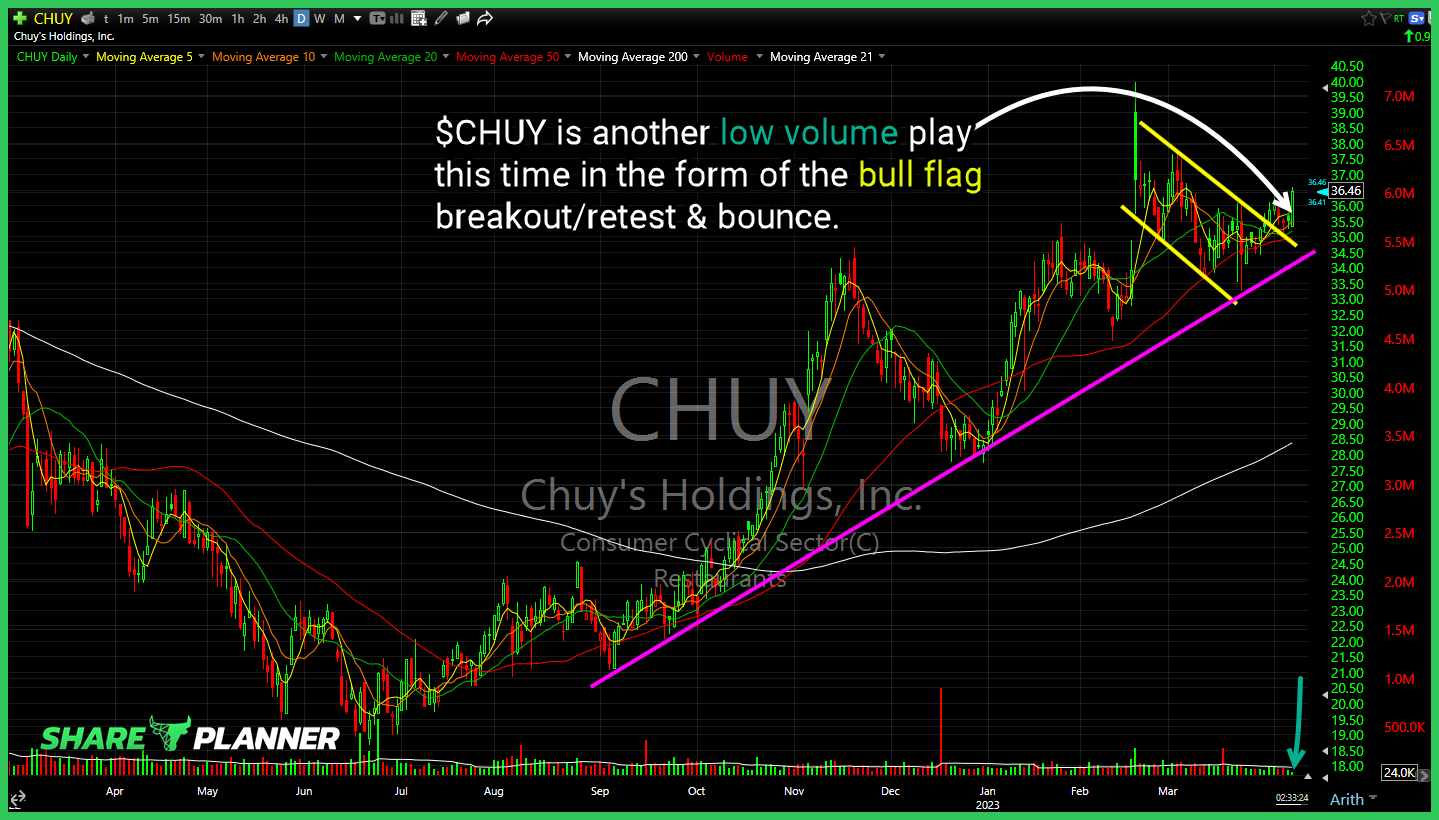

$CHUY is another low volume play this time in the form of the bull flag breakout/retest & bounce.

$NVDA attempting to the rising trend-line from the January lows and bounce and back to new recent highs.

Episode Overview How do you avoid the regret of getting out of a trade too early only to watch it run to new highs and beyond. In essence, how can you place yourself in the best position to extract the most amount of profits in each of your swing trades? In this episode, Ryan Mallory