Panic selling on the $TICK

3 straight days 10 year yield is holding breakout support. Looking for a move higher from here going forward. $TNX

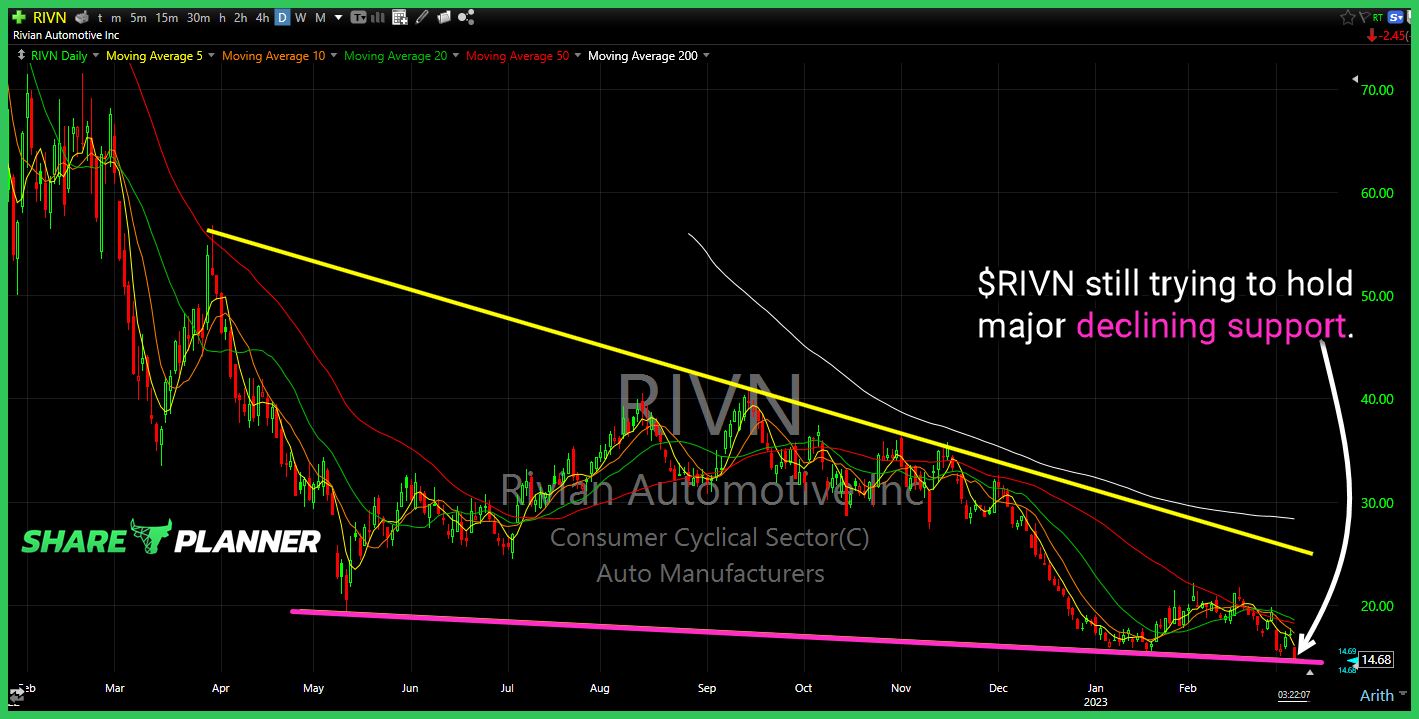

$RIVN still trying to hold major declining support.

Episode Overview When faced with uncertain markets that trade sideways or unpredictable manner, what are the do's and don'ts of trading that will help to keep trading errors to a minimum, and to avoid a nasty drawdown, as one waits for better clarity in market direction as swing traders. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube

$IWM bull flag breakout today.

$IWM bull flag breakout today.

$CLF inverse head and shoulders pattern testing the neckline for a potential breakout here.

$NIO key long-term support getting a major test today. So important that it bounces right here.

$SPY afternoon sell-off was a nasty one that saw price close at the lows of the day.

Episode Overview Should you take bigger risks when you have a backstop of income? Perhaps it is your fulltime job, or perhaps you are a trust fund baby that can just keep pulling from an account to mask the lack of quality swing trading outcomes. In this episode, Ryan talks about how you have to