Nasdaq 100 (QQQ) 30 min chart will zero chill in it. Another breakout attempt unfolding on Russell 2000 (IWM) today. A solid push through resistance so far. If US Global Jets ETF (JETS) breaks out of the continuation triangle, then it has to immediately contend with long-term declining resistance. A no-go for me. Heavy resistance

Tesla (TSLA) pullback and bounce off of the base breakout level. Airbnb (ABNB) wedge pattern formed that could provide some short-term resistance for ABNB, which trades inside of a much bigger channel pattern. Dollar General (DG) pulling back to breakout support. So far holding it. Will need a hard bounce here to keep the setup

Tesla (TSLA) inverse head and shoulders most prominently seen on intraday charts and now trading in the gap from 1/25 Airbnb (ABNB) with solid short-term rising support underneath, but you want to pay close attention to the resistance above that it isn't part of a bearish wedge that is forming. History often rhymes Super Micro

CBOE Volatility Index (VIX) hitting declining support here. Have seen a few bounces, but nothing substantial of late. Airbnb (ABNB) testing price level resistance, nice consolidation underneath. Watch for channel resistance on Expedia (EXPE) even if it does manage to break out of the bullish wedge. Enphase Energy (ENPH) with a hard rejection at the

This move in Technology ETF (XLK) over the past month blew right through its rising channel and never looked back. MercadoLibre (MELI) short-term rising channel in play - looking for a bounce back towards 1400, if it holds. Cameco (CCJ) pushing through huge resistance as it breaks out of a long-term triangle. Not a huge

Multiple support levels on Airbnb (ABNB) breaking yesterday and today. Potential for a sub-100 move from here. Alphabet (GOOGL) breakout above resistance was a big one today. Anheuser-Busch (BUD) with bull flag pattern forming, following an impressive rally off the March lows. I'm watching for Charles Schwab (SCHW) to retest the rising trend-line for '12

Discretionary ETF (XLY) coiling above key breakout support. Bulls will need to hold this one in the coming days, to keep control. Technology ETF (XLK) Consolidation over the last five trading sessions still has tech sector holding key support. Robinhood (HOOD) coiling just below major resistance. Airbnb (ABNB) nearing a test of significant resistance that

Here's why I try to avoid trading the moves that come from FOMC day. Tons of reversals. SPY & SPX Airbnb (ABNB) confirming the wedge pattern with a breakdown today. Converging support levels to watch on a pullback in Healthcare ETF (XLV). Watch declining resistance on DraftKings (DKNG). Big test here for the stock.

Not much going for Airbnb (ABNB) until it can break out of the ascending triangle pattern. Chevron (CVX) breaking through multiple layers of resistance today. Plug Power (PLUG) breaking the rising trend-line going back to May isn't a good look for this stock going forward. Netflix (NFLX) gapped through resistance and into the gap.

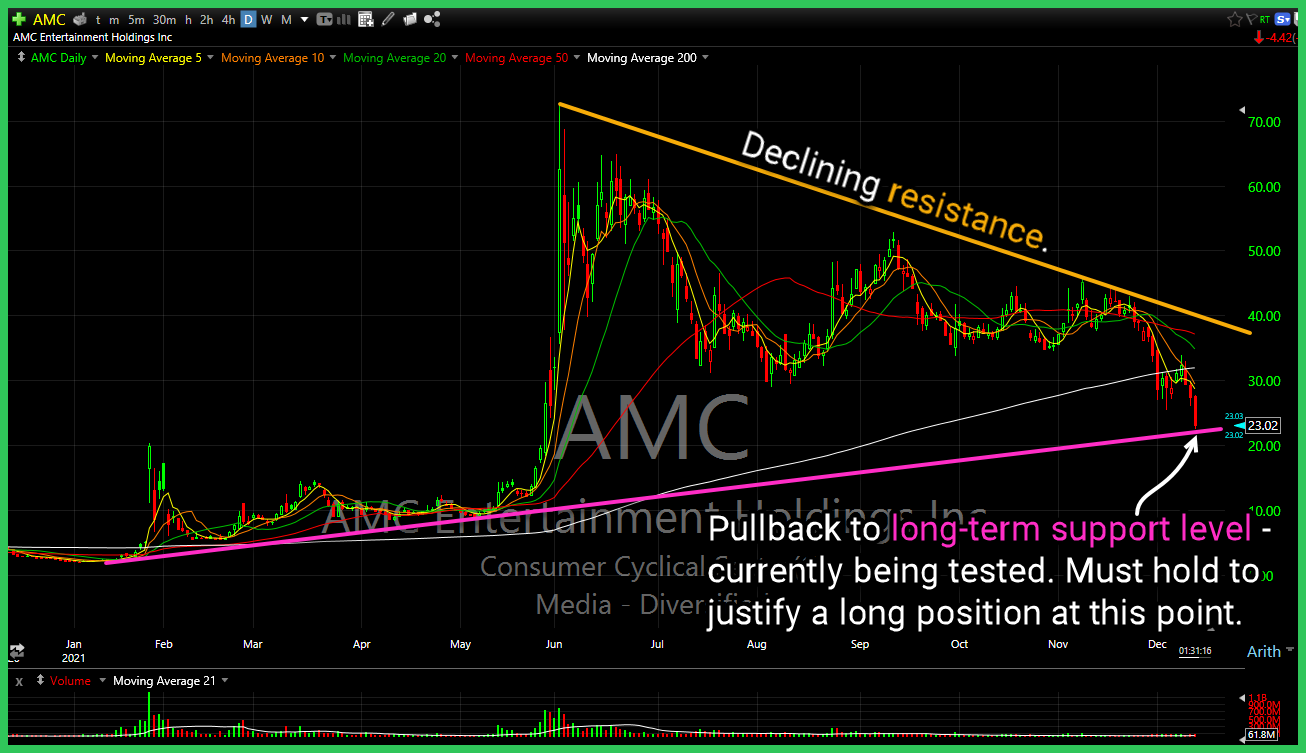

AMC Entertainment (AMC) pulling back to its long-term trend-line. Bulls are in a do-or-die moment here for the stock, as a move below $10 becomes much more likely, if the trend-line fails to hold. Discretionary ETF (XLY) with a double top trying to confirm. Target (TGT) Textbook double top forming, but shorting it here, could