The stock market ripped higher following the FOMC Statement issued by Jerome Powell. The stock market soared, and from a technical analysis standpoint, the outlook looks good for stocks going forward. In this video, I provide my analysis on the SPY, QQQ and IWM ETF, as well as my outlook on the VIX index.

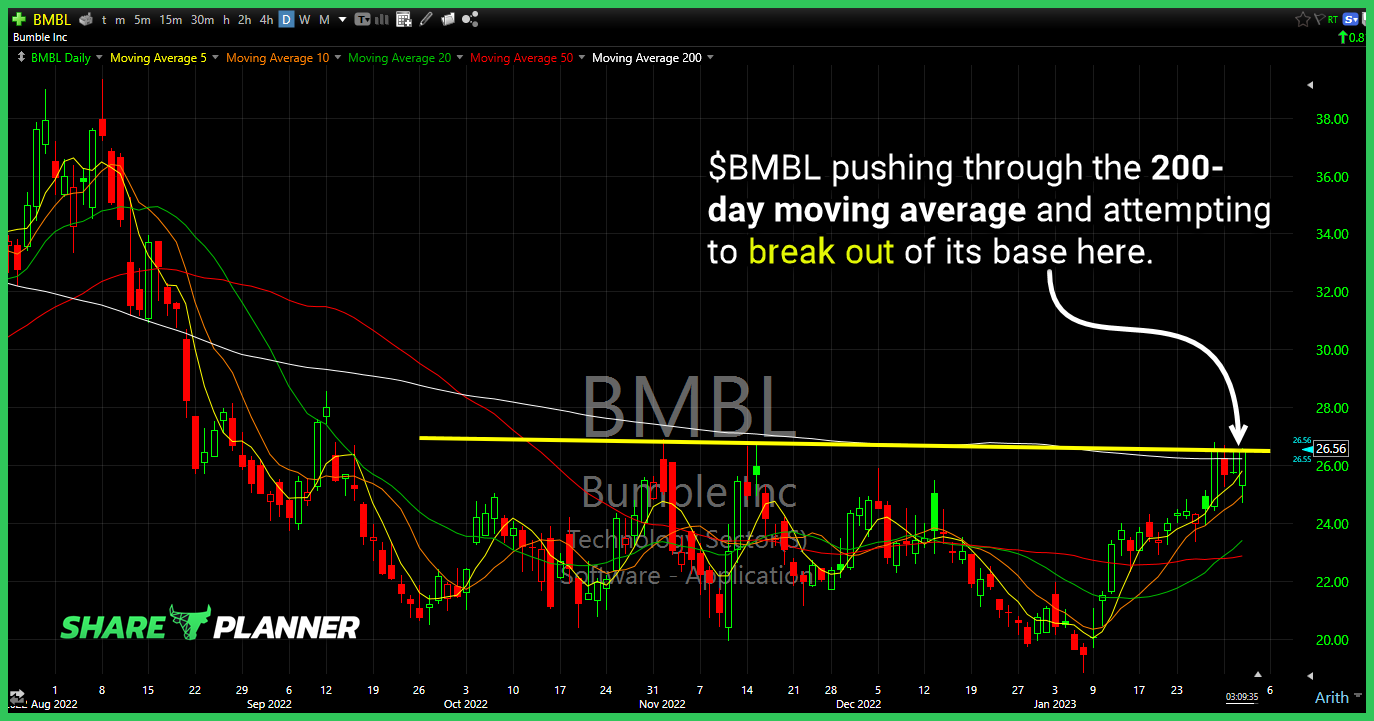

$BMBL pushing through the 200-day moving average and attempting to break out of its base here.

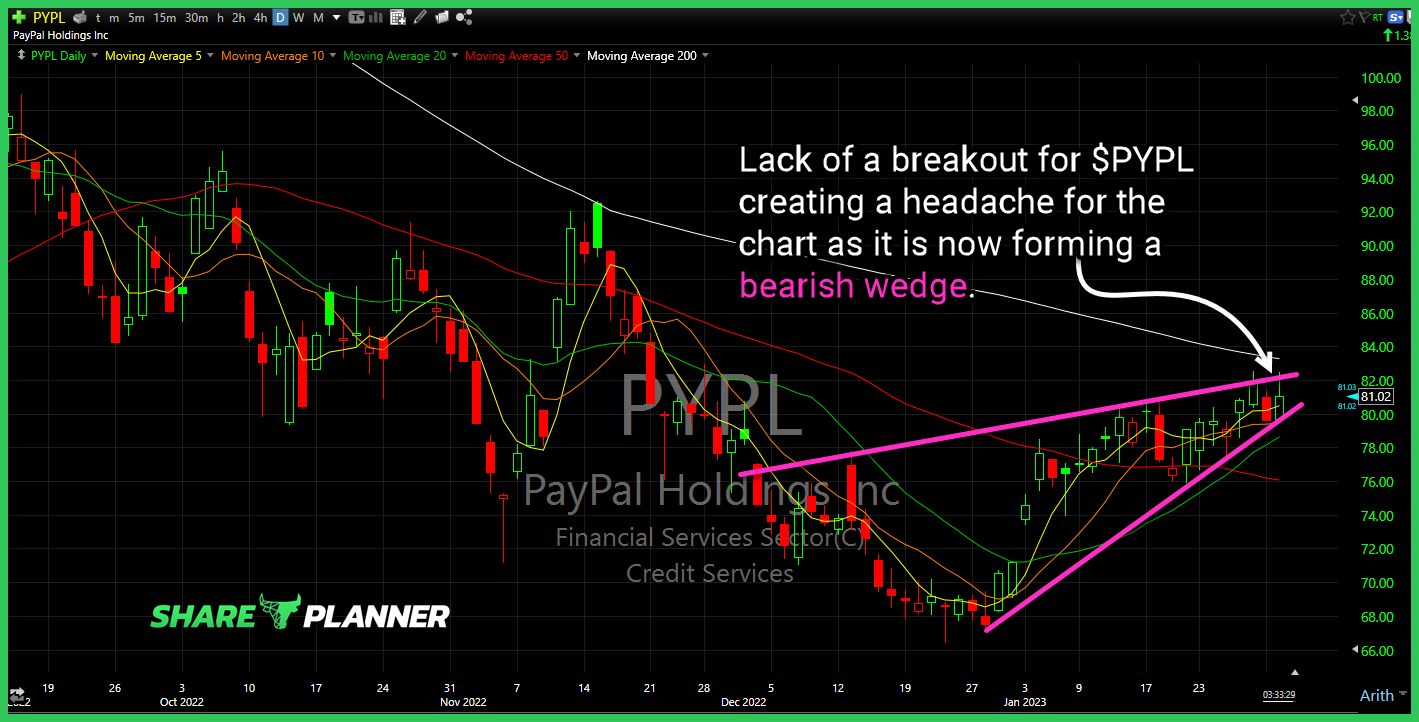

Lack of a breakout for $PYPL creating a headache for the chart as it is now forming a bearish wedge.

The stock market faces a major week of volatility and price swings with the FOMC Statement. This in addition to earnings coming from Meta, Apple, Google and Amazon that will be sure to rock the stock market for better or worse. I'll be going over the selling seen on Monday and whether it is indicative

Episode Overview Trading alone can have its whole set of challenges and ramifications from a mental standpoint and how it affects us in our trading decisions. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by addressing an email from a listener named Boomer, who is struggling to

$SPY 5 min intraday pullback only a 23.6% retracement from Thursday lows to Monday highs. Needs $395-7 to make it a meaningful one.

Episode Overview How does one deal with the frustrations that are typically unrelenting as a trader? Ryan details some of his own frustrations that he has experienced so far this year in 2023 as a trader, and what he is doing to overcome them. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07]

Resistance on $VIX continues to kick price back down. The 8th straight successful attempt this year alone and 11th overall.

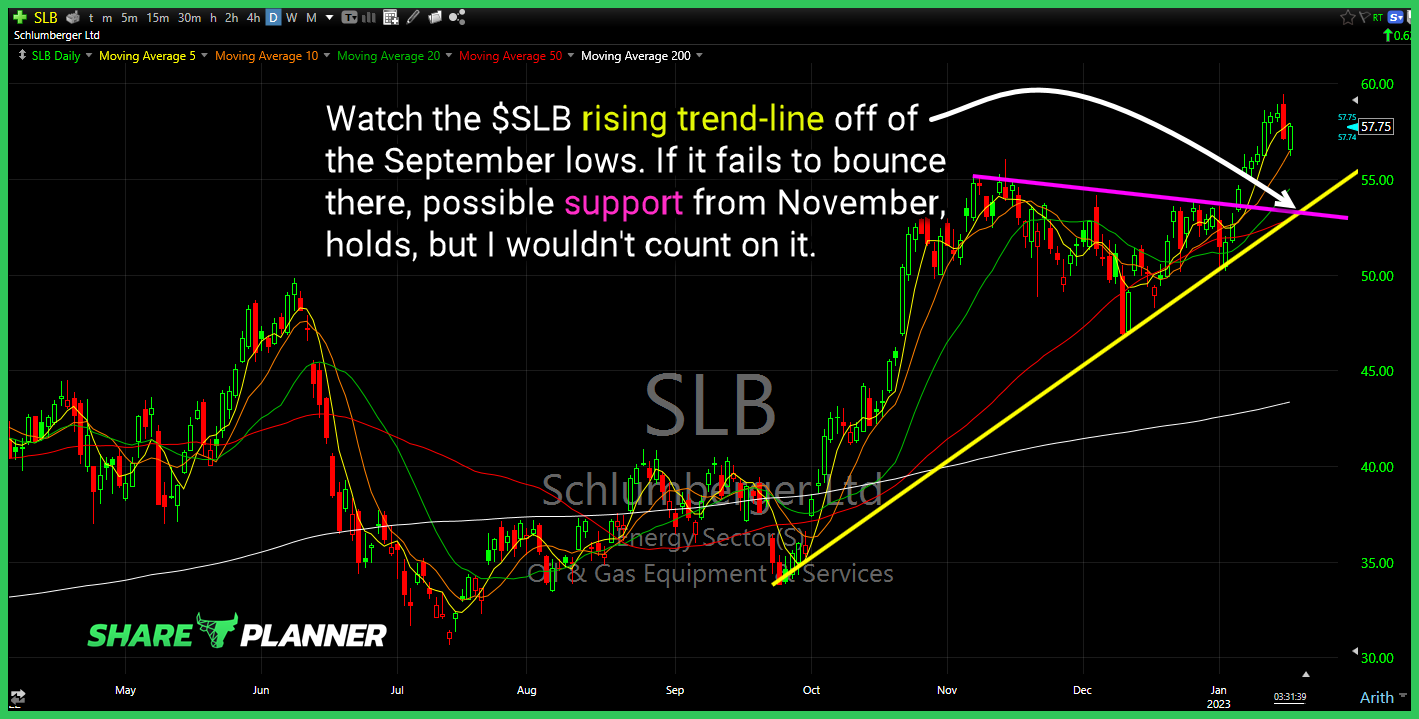

Watch the $SLB rising trend-line off of the September lows. If it fails to bounce there, possible support from November, holds, but I wouldn’t count on it.