Episode Overview Ryan takes on a question from a listener in Australia about the gambling aspects of trading in the stock market (or crypto, forex, or any other trading vehicle for that manner) and whether it may in fact be a moral hazard to engage in. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights &

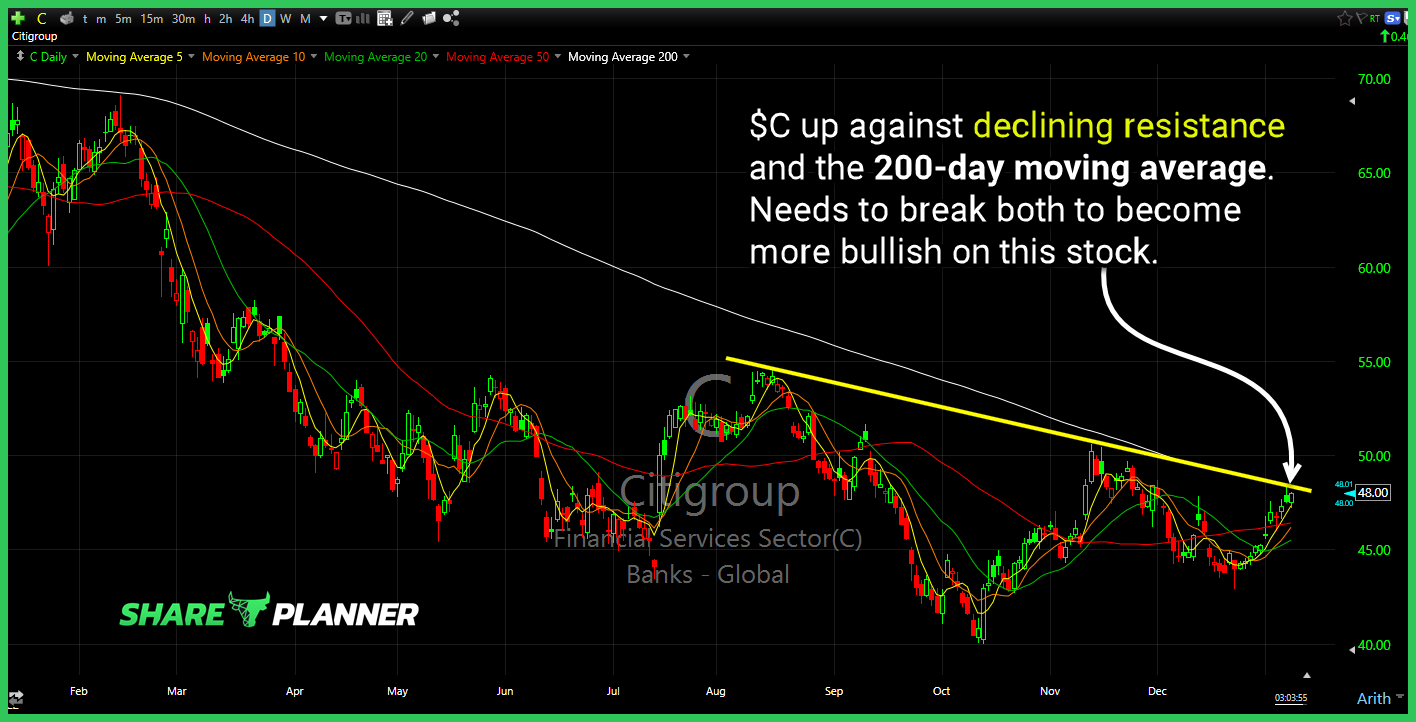

$C up against declining resistance and the 200-day moving average. Needs to break both to become more bullish on this stock. Also has earnings scheduled for the 13th.

The stock market saw a breakout with SPY after being stuck in a trading range for 13 straight days. But the follow through was less than impressive leaving traders wondering whether the rally of late was nothing more than a short lived bounce. In this video, you will get SPY technical analysis on a daily

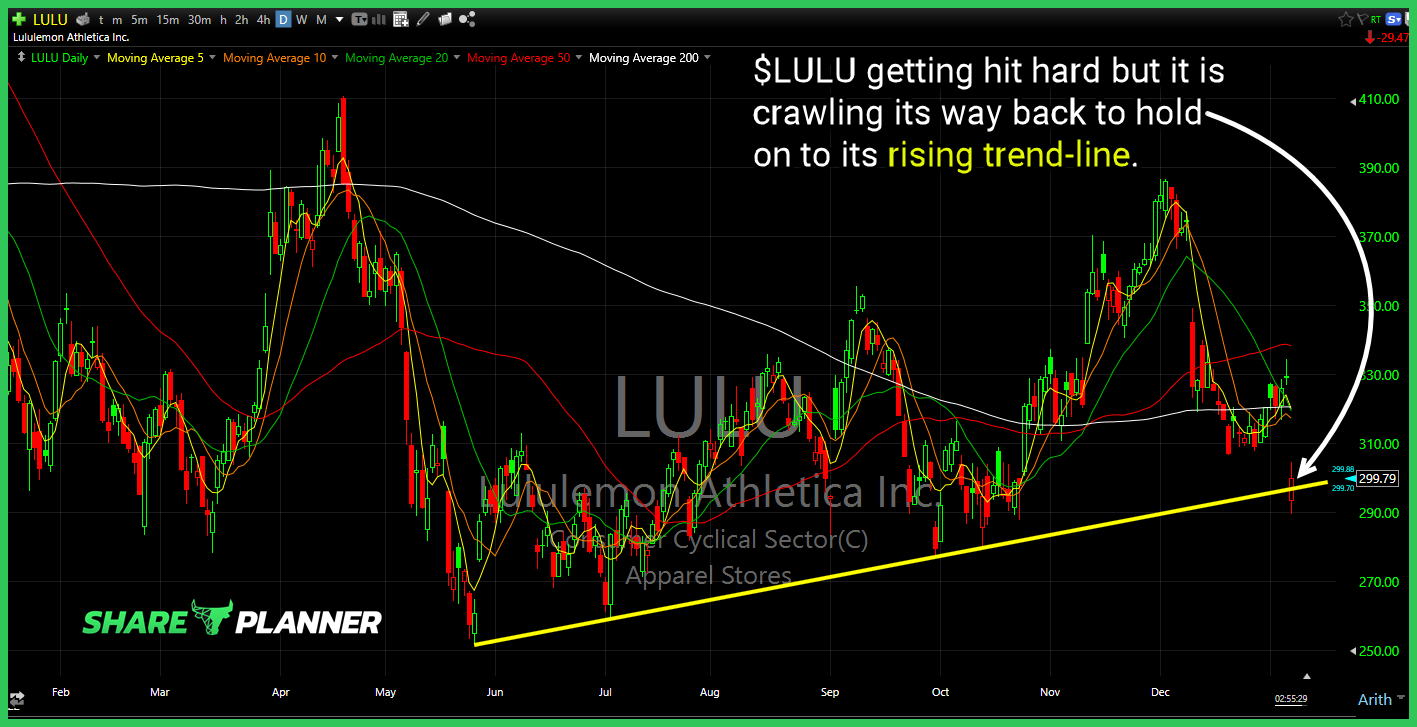

$LULU getting hit hard but it is crawling its way back to hold on to its rising trend-line.

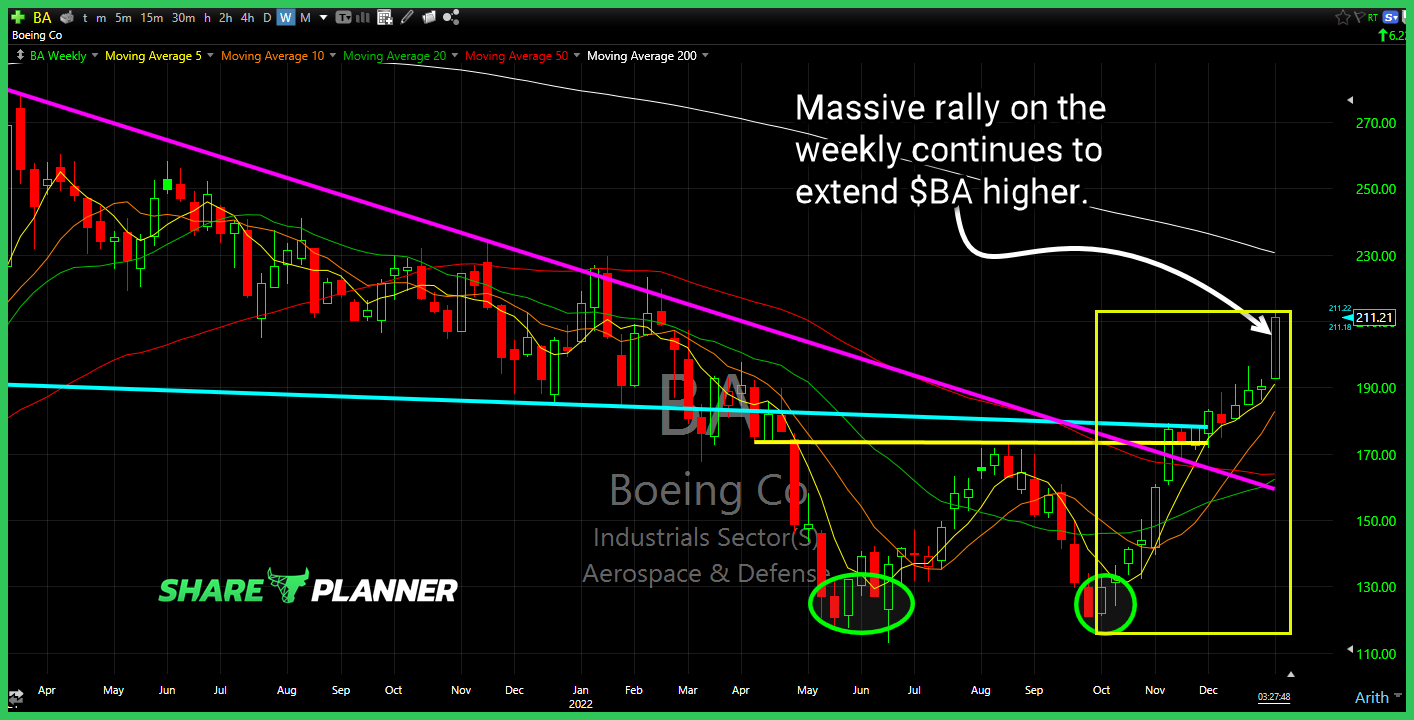

Massive rally on the weekly continues to extend $BA higher.

Episode Overview What's the differences, advantages and disadvantages of swing trading vs day trading vs position trading, and what does it mean to be either of them? Also in this episode, Ryan explores one trader's questions about trading index funds only and provides the bigger questions that this person should be asking himself. 🎧 Listen

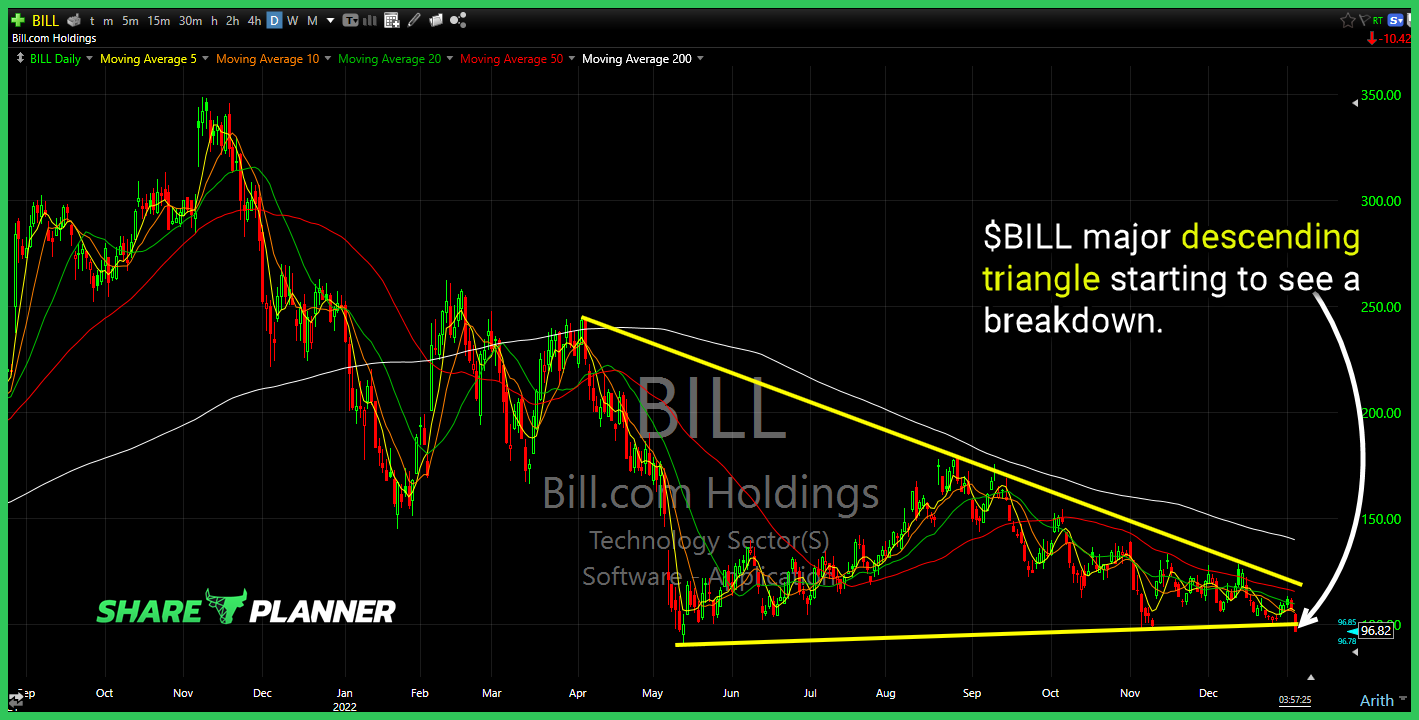

$BILL major descending triangle starting to see a breakdown.

With 2023 underway, when can we expect a stock market bottom? I have found that some clues may lie with the long-term charts of QQQ using technical analysis. Though certainly not a sure thing, past history suggest that the Nasdaq 100 (QQQ) could find its bottom at this key price level.

$NCR cup and handle pattern nearing a breakout.

$GLD struggling with upper channel band resistance. Potential for a pullback to the rising trend-line underneath.