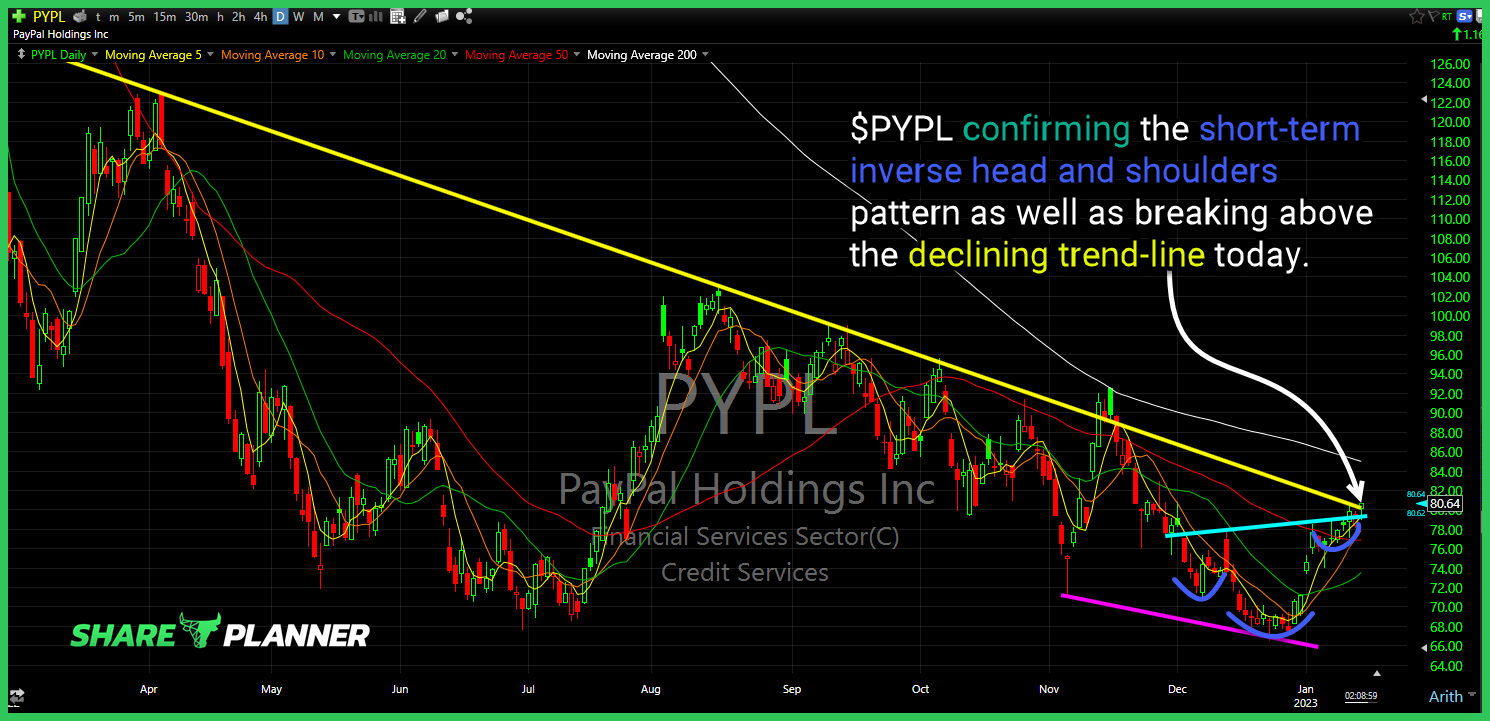

$PYPL confirming the short-term inverse head and shoulders pattern as well as breaking above the declining trend-line today.

Which sector provides the best opportunity for traders in 2023? In this video, I provide my technical analysis and opinion on each sector in the stock market and which ones are likely to do the best, while which ones are most likely to lag the over all market.

Episode Overview What platforms are the best for managing a watch list? In this episode of Swing Trading the Stock Market, Ryan details the essentials for having a good watch list and how he sets up and uses his own personal watch lists. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] Introduction

$VIX Extreme move to new 52 week lows with a break of major support.

SPY has rallied over 5% in the past week! A lot of traders are hoping this is finally the moment it can break through declining resistance and just start a bull market for the stock market. I'm providing my technical analysis on SPY and what you can expect as it does battle with major resistance.

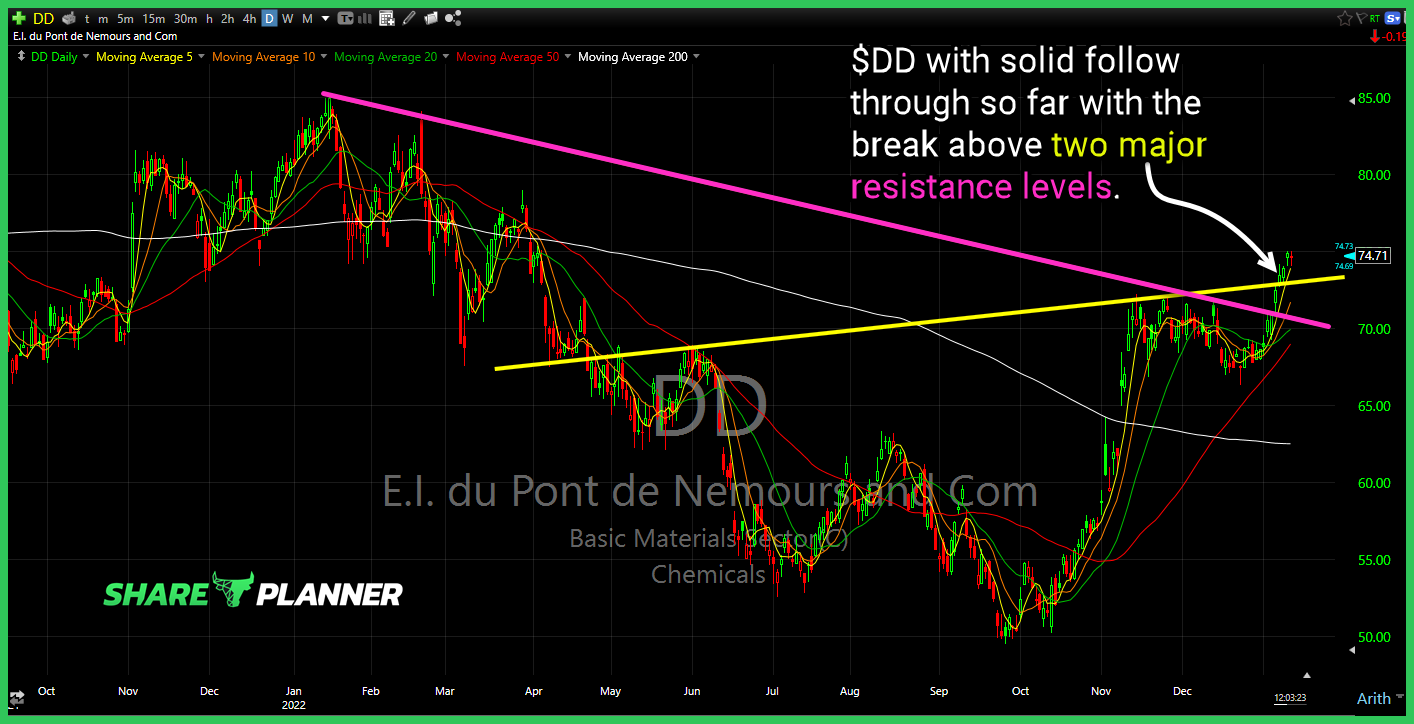

$DD with solid follow through so far with the break above two major resistance levels.

$AMC running hot into heavy layers of resistance. Just like previous runs, its a sucker’s rally that will cost traders a lot of their capital…again.

Episode Overview Ryan takes on a question from a listener in Australia about the gambling aspects of trading in the stock market (or crypto, forex, or any other trading vehicle for that manner) and whether it may in fact be a moral hazard to engage in. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights &

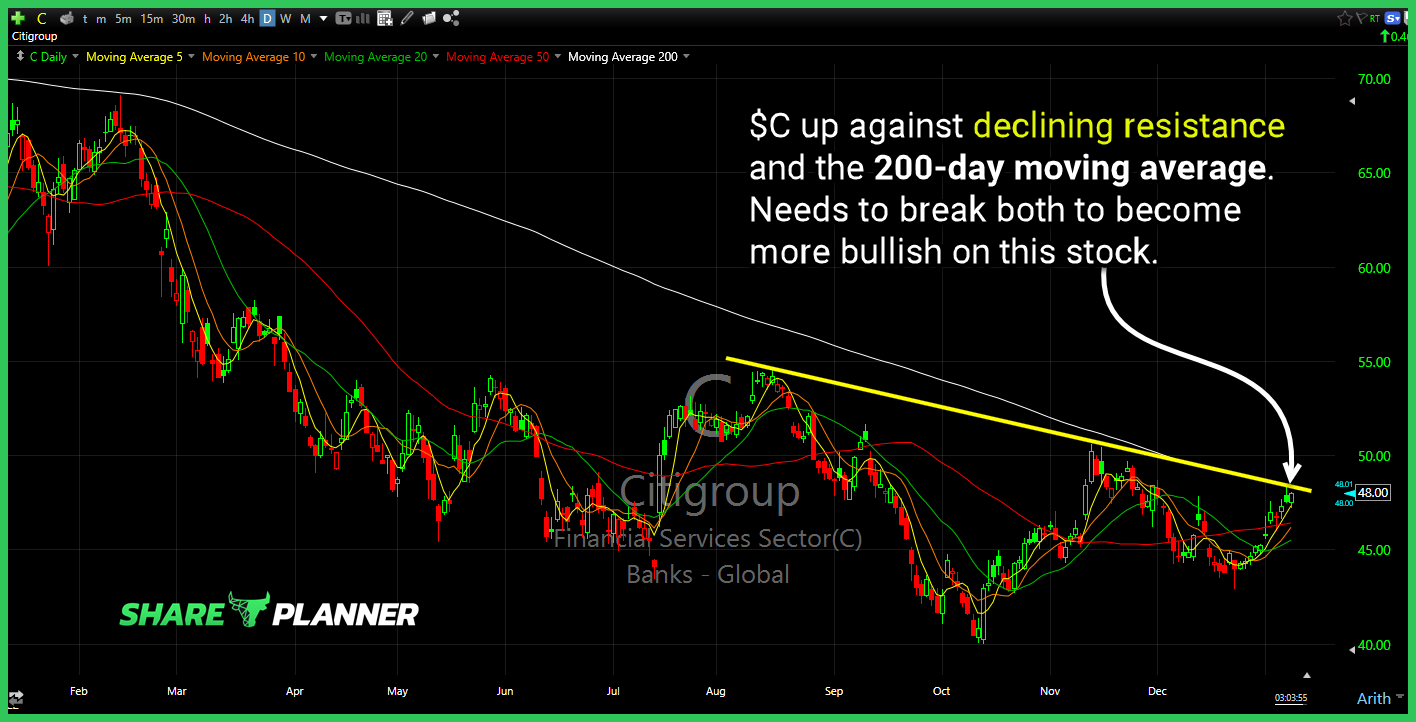

$C up against declining resistance and the 200-day moving average. Needs to break both to become more bullish on this stock. Also has earnings scheduled for the 13th.

The stock market saw a breakout with SPY after being stuck in a trading range for 13 straight days. But the follow through was less than impressive leaving traders wondering whether the rally of late was nothing more than a short lived bounce. In this video, you will get SPY technical analysis on a daily