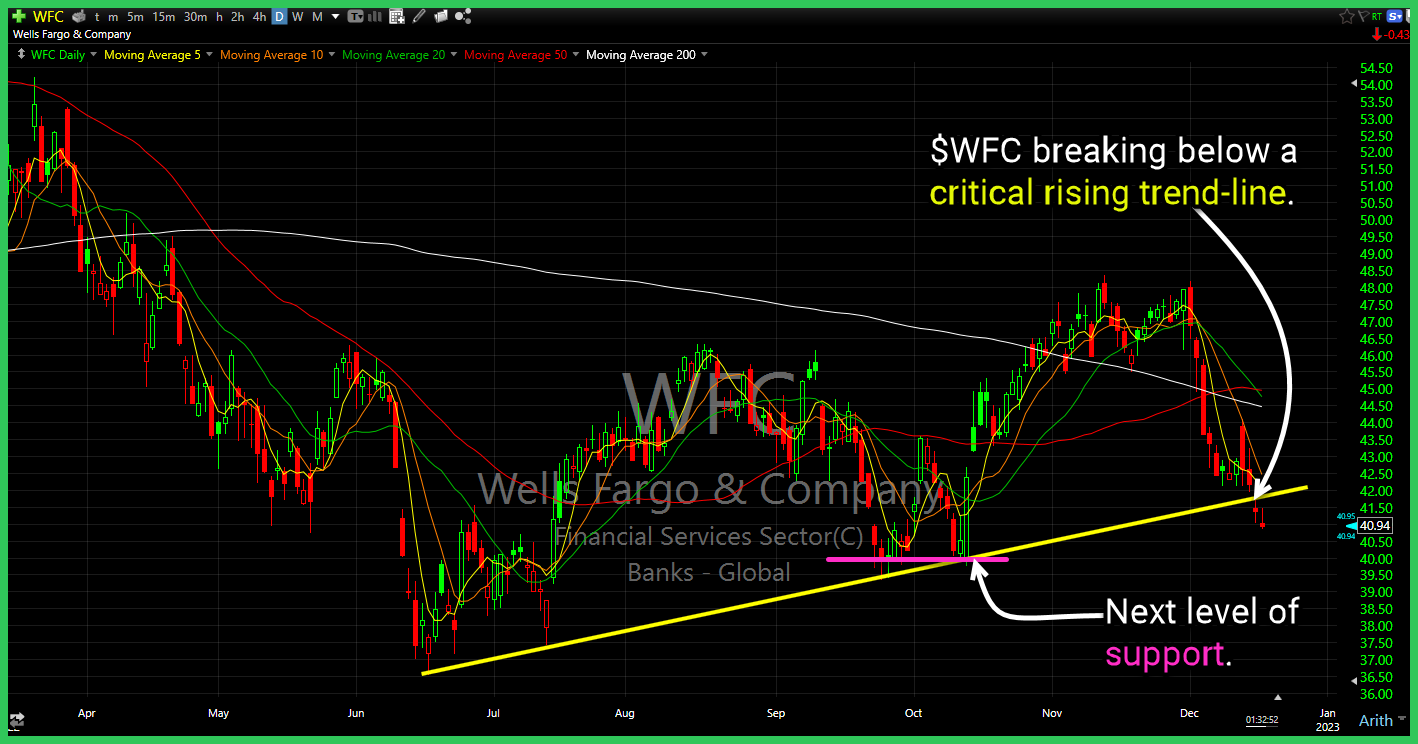

$WFC breaking below a critical rising trend-line.

The FOMC Statement was released and Jay Powell had his presser thereafter. Stocks sold off as a result, and leaves traders wondering if we have really reached a stock market bottom. I provide my technical analysis for the stock market following the FOMC Statement and where the market looks to go from here.

Episode Overview What does one have to do to trust their trading strategy, and when one is having trouble executing it, what is that a sign of and how can a trader correct this behavior in their swing trading and investing. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan introduces the

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.

$PINS finally breaking through some major resistance.

$AMGN wedge pattern breaking to the downside.

Episode Overview What does Ryan Mallory have to say about what a realistic return expectation for swing trading the stock market is every month? Also, Ryan shares his thoughts on treating one's trading capital like inventory and the need to turn it over as much as the market allows. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube

Episode Overview In this episode, Ryan reflects on his trading and particularly that of inverse ETFs and whether he plans to continue trading them in light of some research he has done on his own trading, and despite them being a huge part of the success he has enjoyed as a trader this year. 🎧

$VIX breaking declining resistance…finally.

Stocks have been overextended for over a months. Following Jay Powell's speech at the Brookings Institute, it looked as if the stock market would continue to rally but it ran into heavy technical resistance and stocks since has been trending lower. Is this the time to get short or long? In this video, I provide