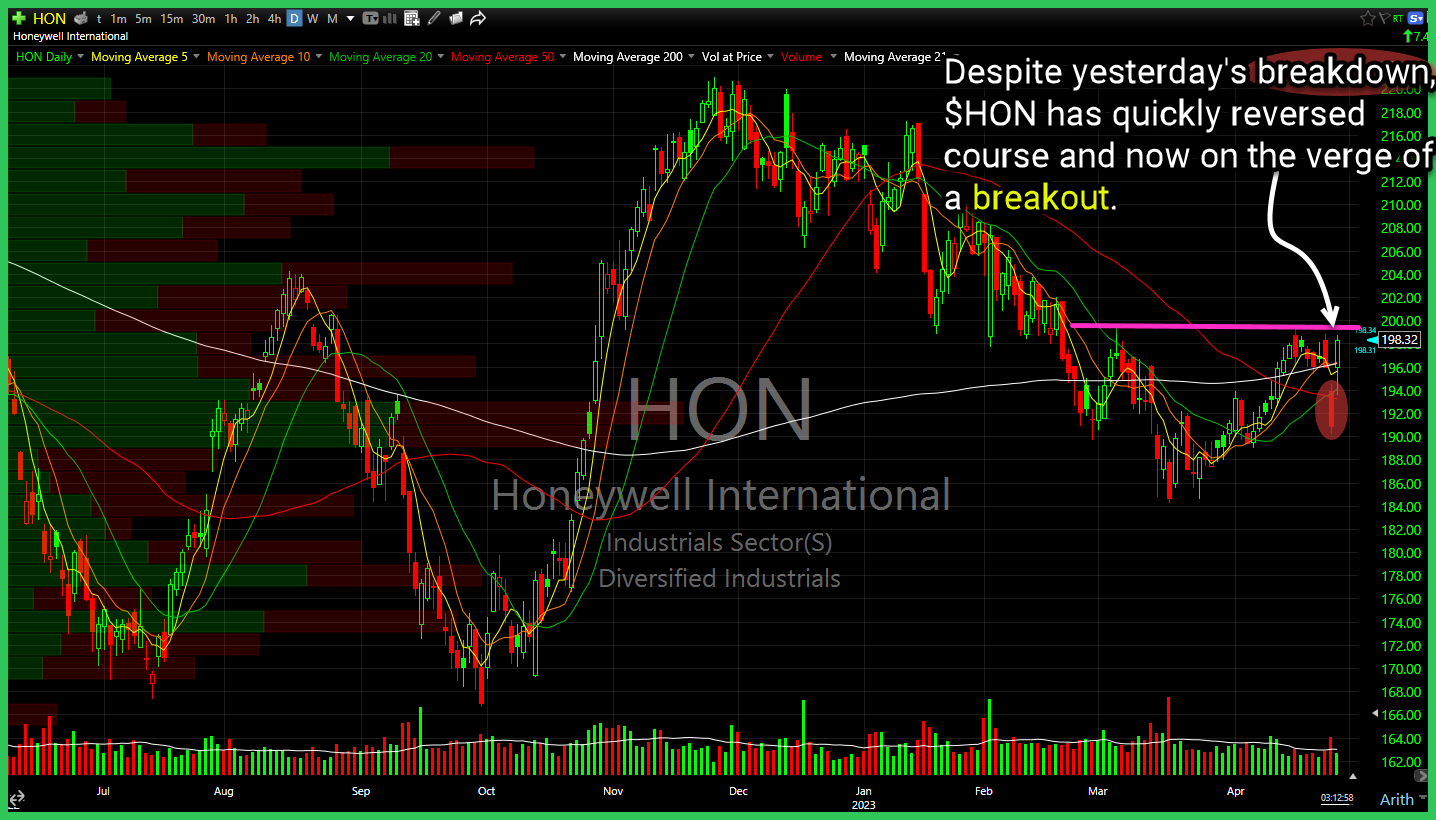

Despite yesterday's breakdown, Honeywell (HON) has quickly reversed course and now on the verge of a breakout. Quite the clown market we are in. Caterpillar (CAT) intraday breakdown of support has now seen a sharp intraday rebound. Watch declining resistance above. Communications Sector (XLC) ripping higher on Meta Platforms (META) earnings, but closing

Episode Overview Ryan provides his insights into reading and interpreting volume on the charts and how that correlates with breakouts and making quality trade decisions. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] Introduction and Listener QuestionRyan introduces a message from Hank, a new trader who started during the COVID lows, seeking

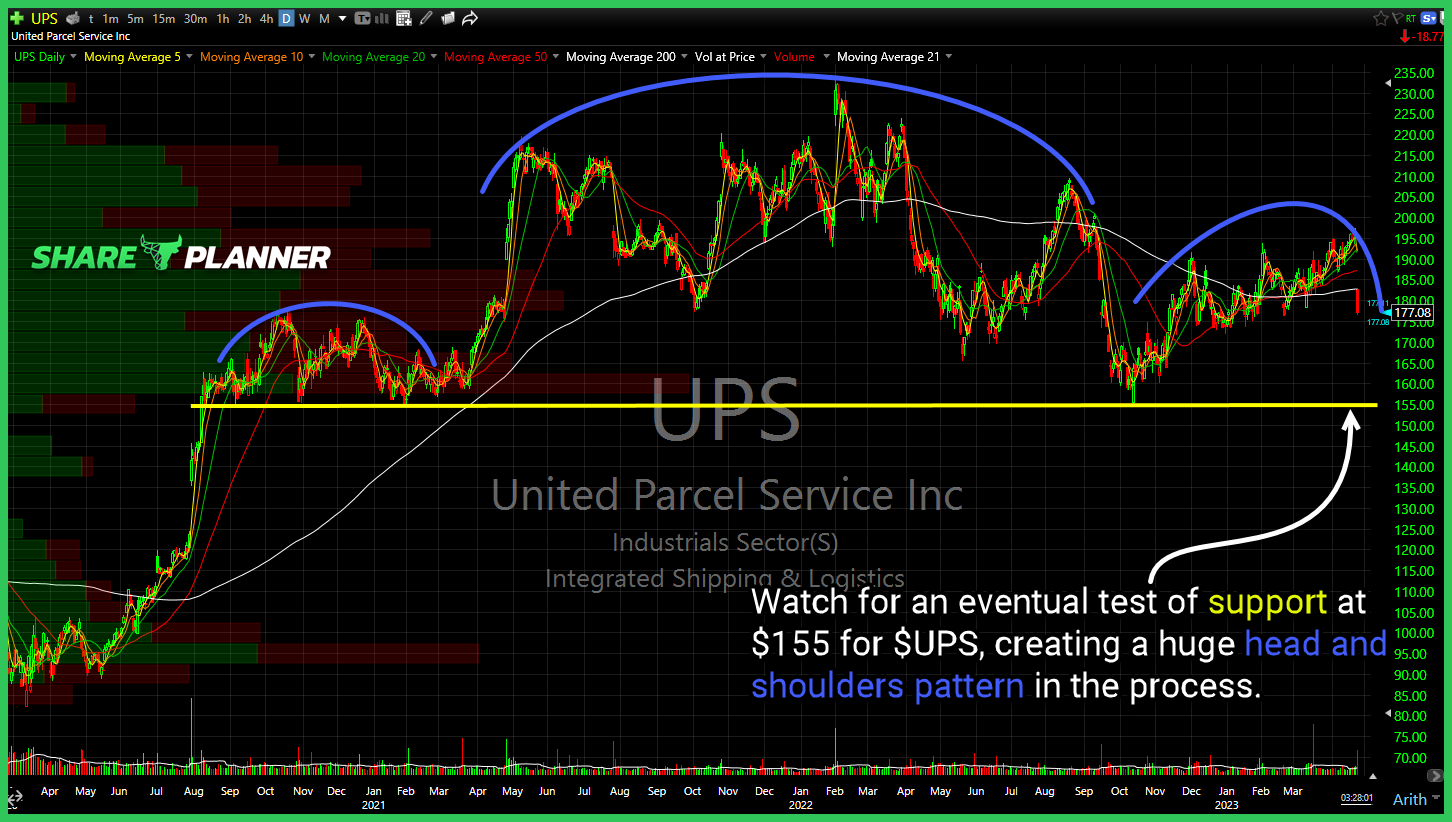

Watch for an eventual test of support at $155 for $UPS, creating a huge head and shoulders pattern in the process.

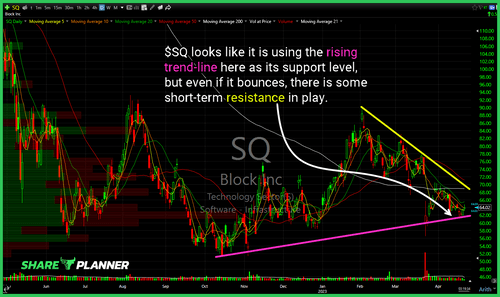

$SQ looks like it is using the rising trend-line here as its support level, but even if it bounces, there is some short-term resistance in play.

Episode Overview Which one loses: Opportunity Cost or Stop-loss? Is it okay to move on from a trade despite the fact the stop-loss hasn't been triggered? What if there is a better trading opportunity that exists and should a trader go ahead and pursue it rather than remaining in the current swing trade because it

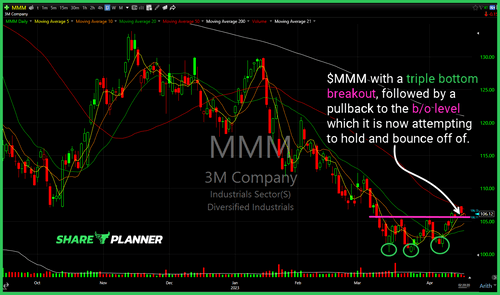

$MMM with a triple bottom breakout, followed by a pullback to the b/o level which it is now attempting to hold and bounce off of.

Episode Overview Ryan picks up where he left off on last episode talking about inverse ETFs and why in most cases it is better to simply use 1:1 leverage than 2:1 or 3:1. Also, more about stop-loss placement and where he raises the stop to, after a swing trade becomes profitable. 🎧 Listen Now: Available

$UNH rejection at the broken trend-line, waiting for a pullback to key support.

Episode Overview Ryan Mallory digs into the topic of adding to his positions after he got into the trade. Furthermore he talks about using leverage in the portfolio for stocks with low volatility. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] Revisiting Barry’s Trading JourneyRyan introduces a follow-up email from Barry in

Another breakout for $GOOGL looking really strong here against this tape today.