$DWAC today failed to hold the breakout level from yesterday.

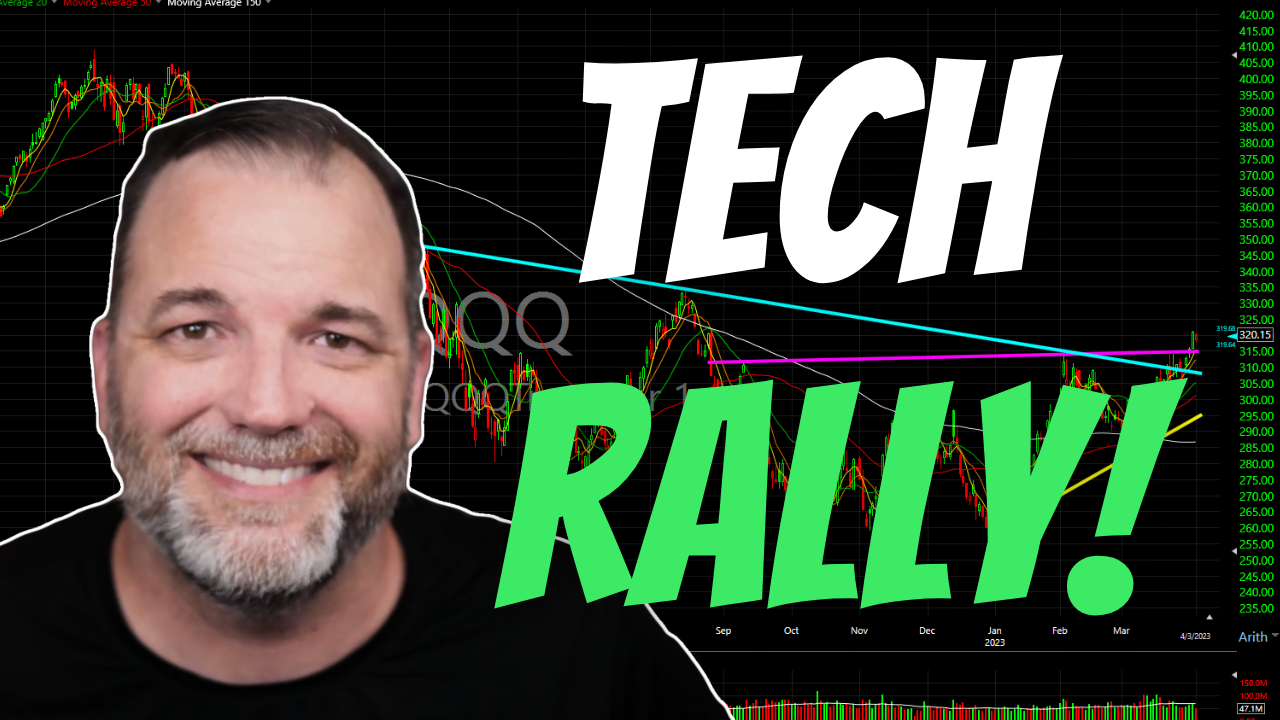

The tech rally in the Nasdaq 100 has been spectacular, but can it continue the momentum of the past few weeks and keep rally going? In this video, I am providing my Nasdaq 100 analysis using the QQQ ETF chart, as well as going over the big tech stocks and how they might be signifying

$ALB weekly has a broken long-term trend-line that is now acting as resistance. Potential leg lower here.

$NIO coming out of its basing pattern from the past month.

Episode Overview What to look out for when creating a trading system through TD Ameritrade's Thinkscript or any any trading system for that matter. Ryan talks about the most important aspect of any trading system and steps that one can create to maximize the profitability and minimizing the massive drawdowns often associated with trading systems.

Ryan talks about how he approaches his dividend portfolio and the stocks that he looks to add to it on a regular basis. Be sure to check out my Swing-Trading offering through Patreon that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks,

Episode Overview Ryan talks about how he approaches his dividend portfolio and the stocks that he looks to add to it on a regular basis. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] My First Real Vacation From TradingRyan shares his experience stepping away from the market for the first time in

Resistance to watch on $NKE ahead of their earnings this afternoon.

Episode Overview What popular cliches in trading are worth following? What about popular expressions like "Sell in May, Go Away" - is that worth paying attention to? What about Elliot Wave Theory? In this podcast episode, Ryan addresses the most popular beliefs that sway swing traders and whether they are legit. 🎧 Listen Now: Available

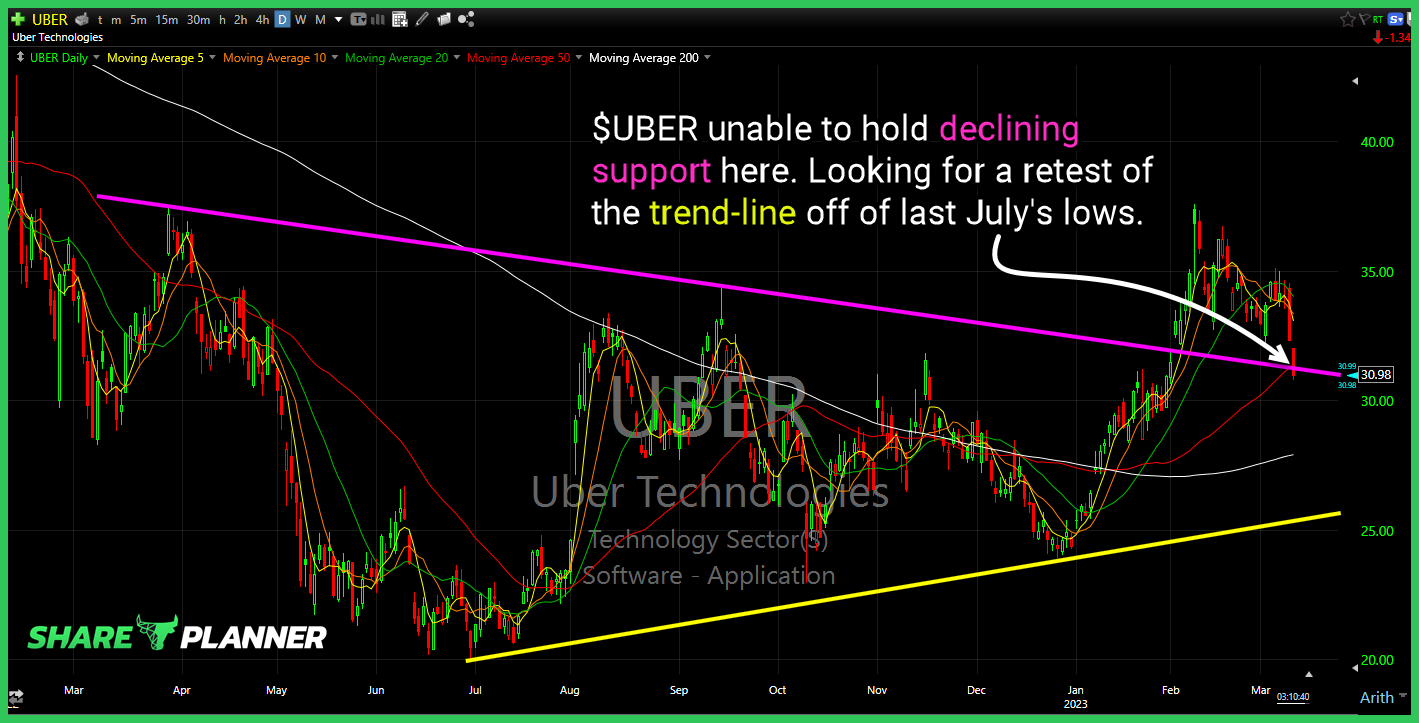

$UBER unable to hold declining support here. Looking for a retest of the trend-line off of last July’s lows.