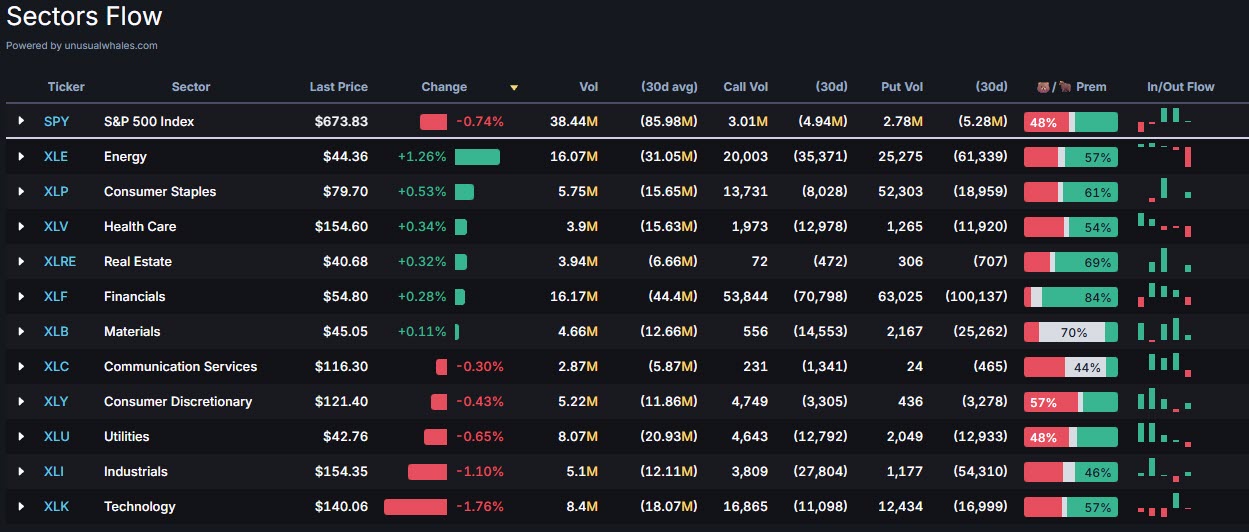

Energy Sector (XLE) leading the way, while the Technology Sector (XLK) is getting railroaded

Still Tech holding this market up. Semis trading higher, everything else, minus small caps, trading lower.

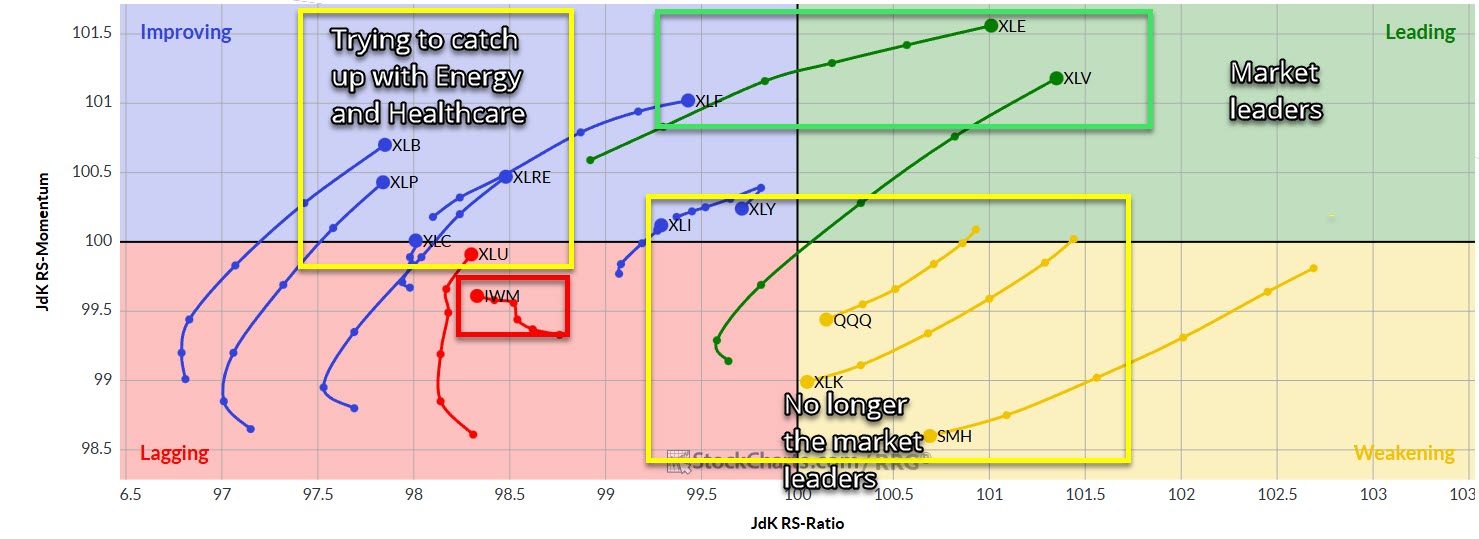

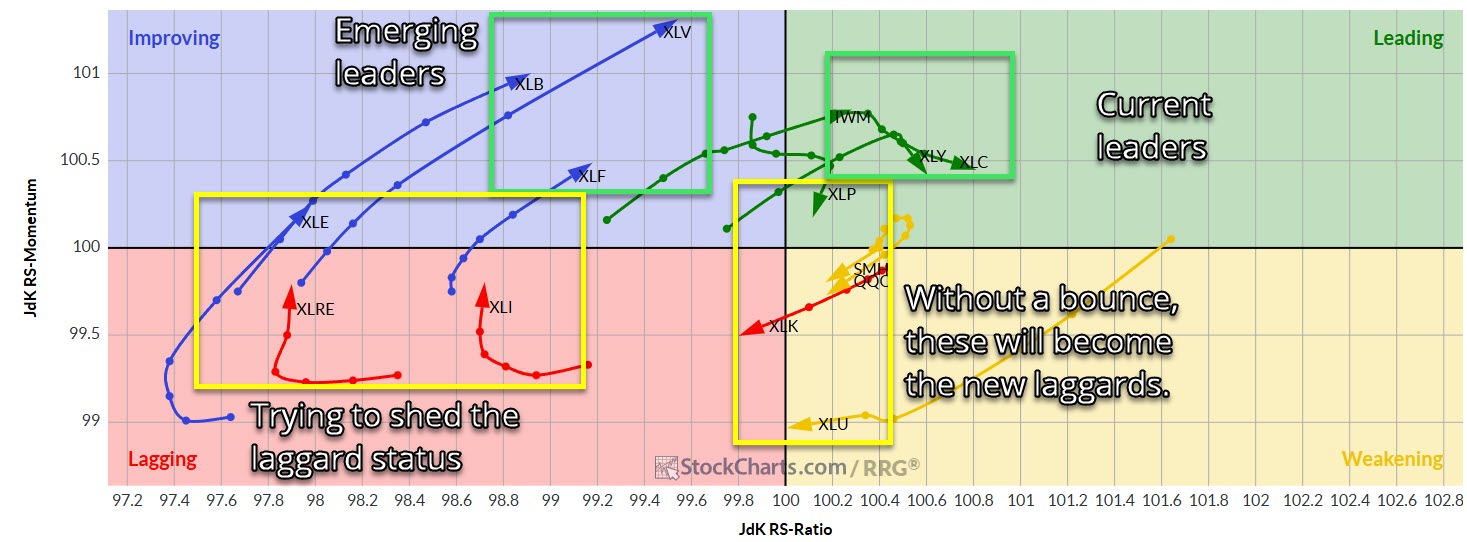

Healthcare Sector (XLV) and Energy Sector (XLE) leading the way right now, while Semiconductors (SMH) and Technology Sector (XLK) are the new laggards.

Semis and tech losing the leadership mantle and handing it over to Energy and Healthcare.

Technology Sector (XLK) still dragging this market higher, led by the one, and only, Nvidia (NVDA)

No surprise here, with the Technology Sector still handling its business.

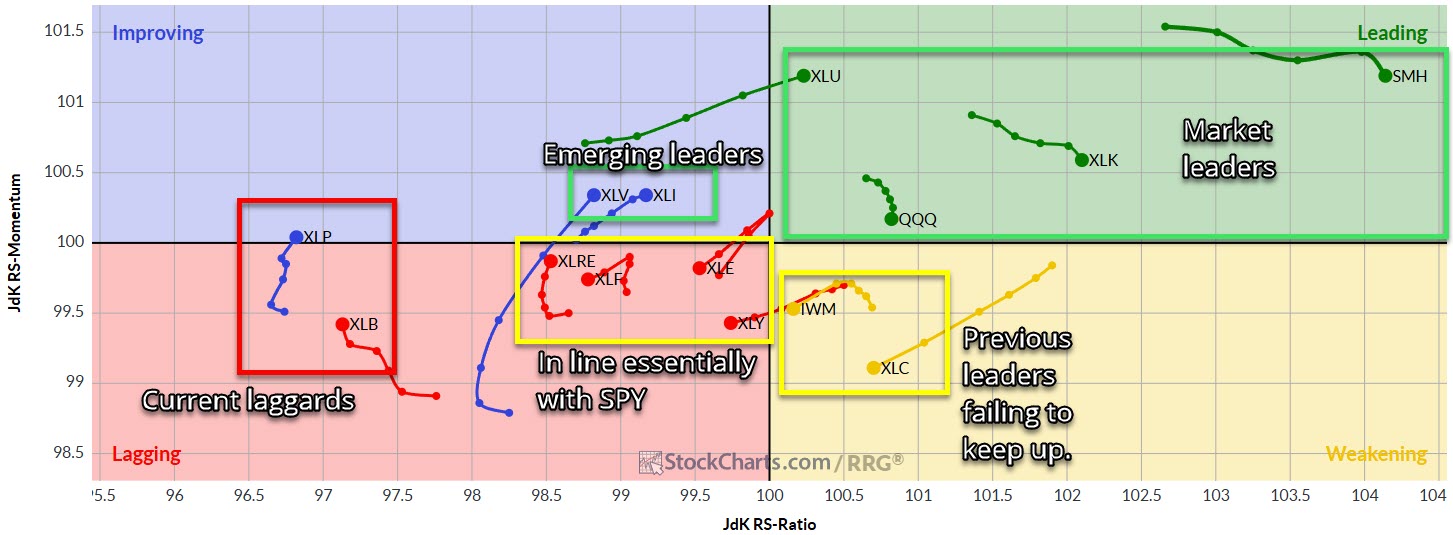

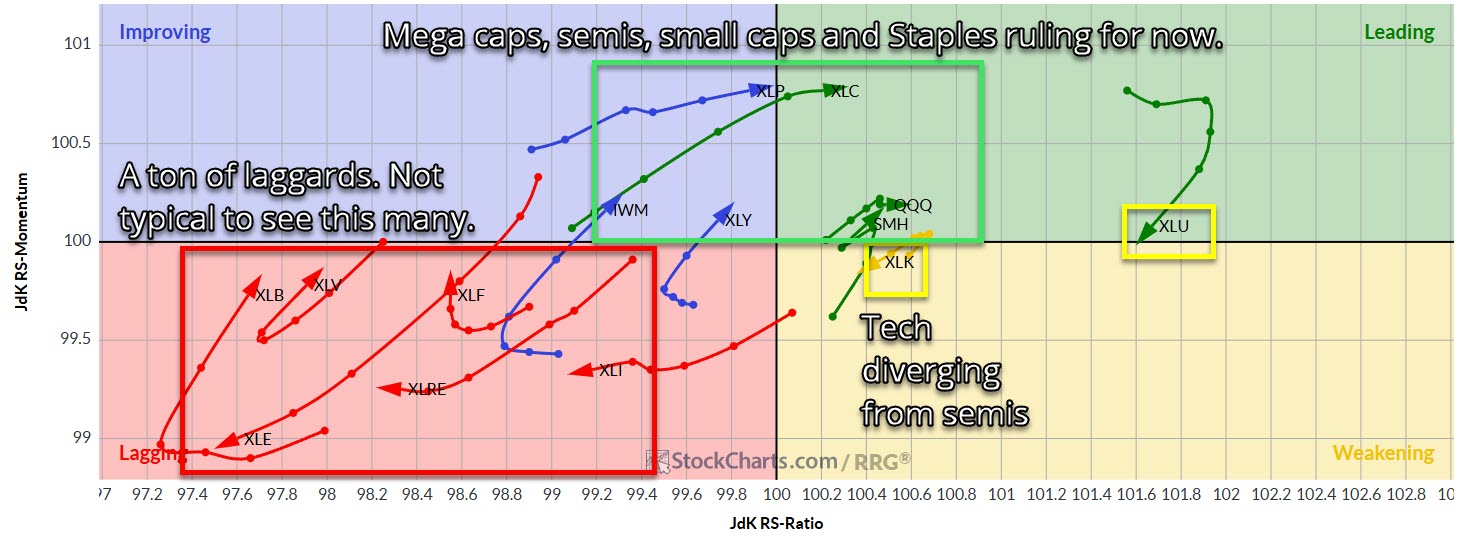

Technology sector is taking heavy losses this week, with Nvidia (NVDA) looking at a third straight week of losses. Meanwhile Russell 2000 (IWM) looking to rally for a fourth straight week.

Tech is starting to lag the market which could indicate this market has run out of the momentum it sustained off the April lows.

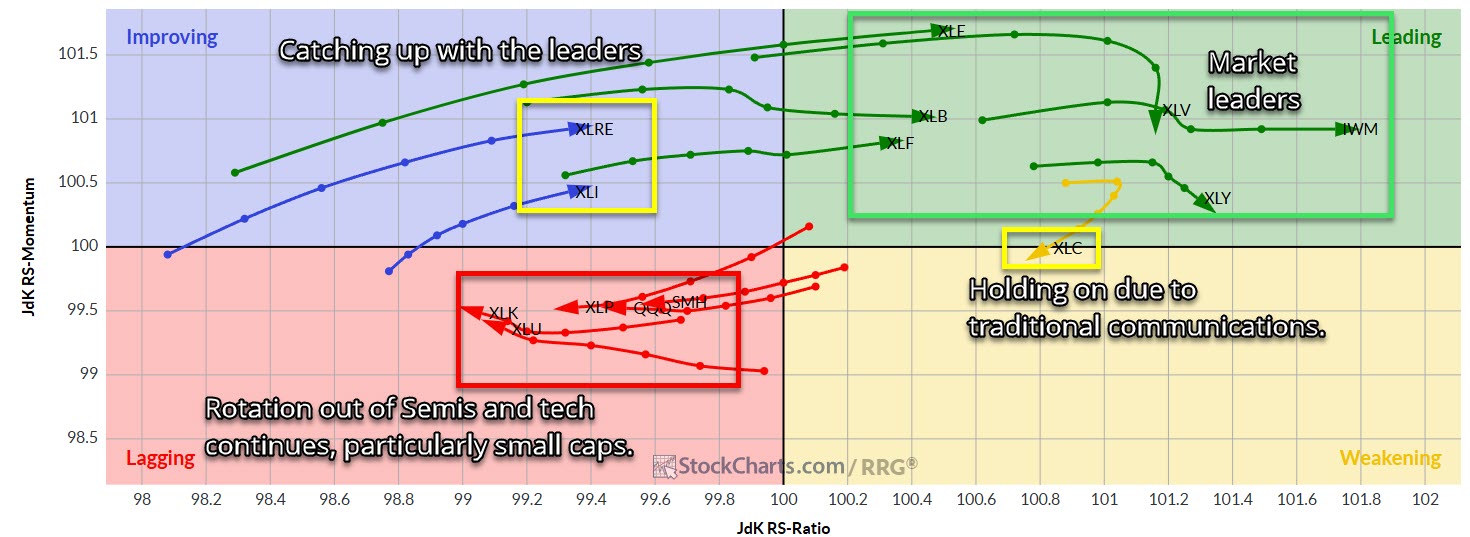

Semiconductors are showing weakness and Tech is following.

Technology is even diverging from Semis which is an interesting development.