My Swing Trading Approach I booked my profits in NFLX at $354 for a +3.2% profit yesterday. I added one additional long position, but that is all I am working with in this market. I am not looking to get aggressively long, and may even flip to the short side, if the bulls lose

My Swing Trading Approach I didn’t add any new positions to the portfolio yesterday, but did book profits in Netflix (NFLX) for a +2.2% profit. The market though continues to sell off in the afternoon rendering any morning strength meaningless, which is making it difficult for adding new positions to the portfolio. Until that

Friday’s Swing-Trades: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Netflix (NFLX)

My Swing Trading Approach I closed out my position in Netflix (NFLX) yesterday at $358.78 for a +3.6% profit, while also decreasing dramatically the overall long exposure, and increasing my short exposure. I will watch the early morning action to determine which side of the trade I want to add more to. If it

My Swing Trading Approach I added a couple of positions yesterday, as conditions improved, booked profits in Netflix (NFLX) for a small +1% profit early on. I will play it cautious here, especially considering the larger than usual gap down the market is facing. Indicators

Thursday’s Swing-Trades: Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long Netflix (NFLX)

Oh I know, we are right below those new all-time highs on SPX – how could this market be faltering? Take out Apple (AAPL), Netflix (NFLX), Alphabet Google (GOOGL) and Amazon (AMZN) and where do you think this market stands? Much lower.

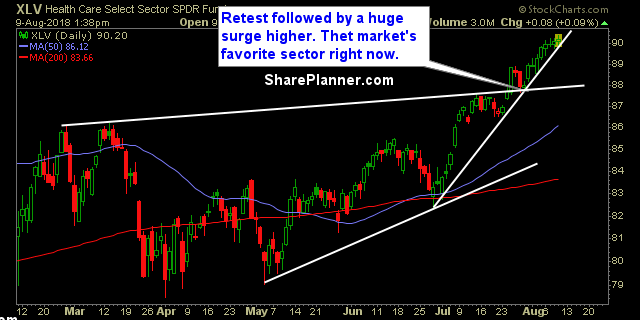

Most of the sectors are showing sideways trading patterns. The market isn't entirely untradeable but it is getting pretty darn close to it. I'm finding the breakout plays to be more difficult than most, and instead focusing on the stocks that are forming a base and coming out of that base, following a sell-off. Most

My latest update of the FAANG stocks, including Apple (AAPL), Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Google (GOOGL). I also cover Square (SQ), Weight Watchers (WTW) as well as Wayfair (W).

People – support and resistance – that’s what matters most in this market. The bulls have plenty of support underneath them, particularly with the 2801 level, and they have very little resistance above them. The one spot being, at this point, the all-time highs established in January.