Episode Overview In this podcast episode, Ryan Mallory gives insight to how liquidity levels in stock trading impacts the volatility of an individual stock. From a swing trading stand point, Ryan explains what this means for traders how are searching for bigger rewards and the impact it has to the risk/reward ratio for stock traders.

Episode Overview Have you ever wondered what it takes to know when you are on the cusp of a long-term bull market? Ryan, in this podcast episode, talks about the signs that he looks for as well as his go-to indicator for spotting long-term trends in the stock market. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube

Episode Overview Headline risk is part of trading no matter how well you manage the risk. There's always the possibility of getting a downgrade or press release that wrecks havoc on your swing trade. But what can you do to better prepare your portfolio against such headwinds? 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights

The holiday season presents unique opportunities for swing traders who understand the market's behavior during these low volume periods. Thanksgiving and the Christmas/New Year period in particular exhibit some of the most reliable trading patterns of the year, offering swing traders distinct advantages when properly understood. Thanksgiving Week Trading Patterns Thanksgiving week has historically provided

Episode Overview One swing trader finds it quite difficult to profit when in bear markets and not sure what to do if the current market rally we are in eventually turns bearish on everyone. Is it better to sit on cash and wait it out, or to actually short the stocks? Ryan has an answer

Episode Overview Ryan does a deep dive into swing trading scans and watchlists, the importance and differences of the two and his best practices as it pertains to each. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan opens the episode by explaining his approach to teaching swing trading in a complex

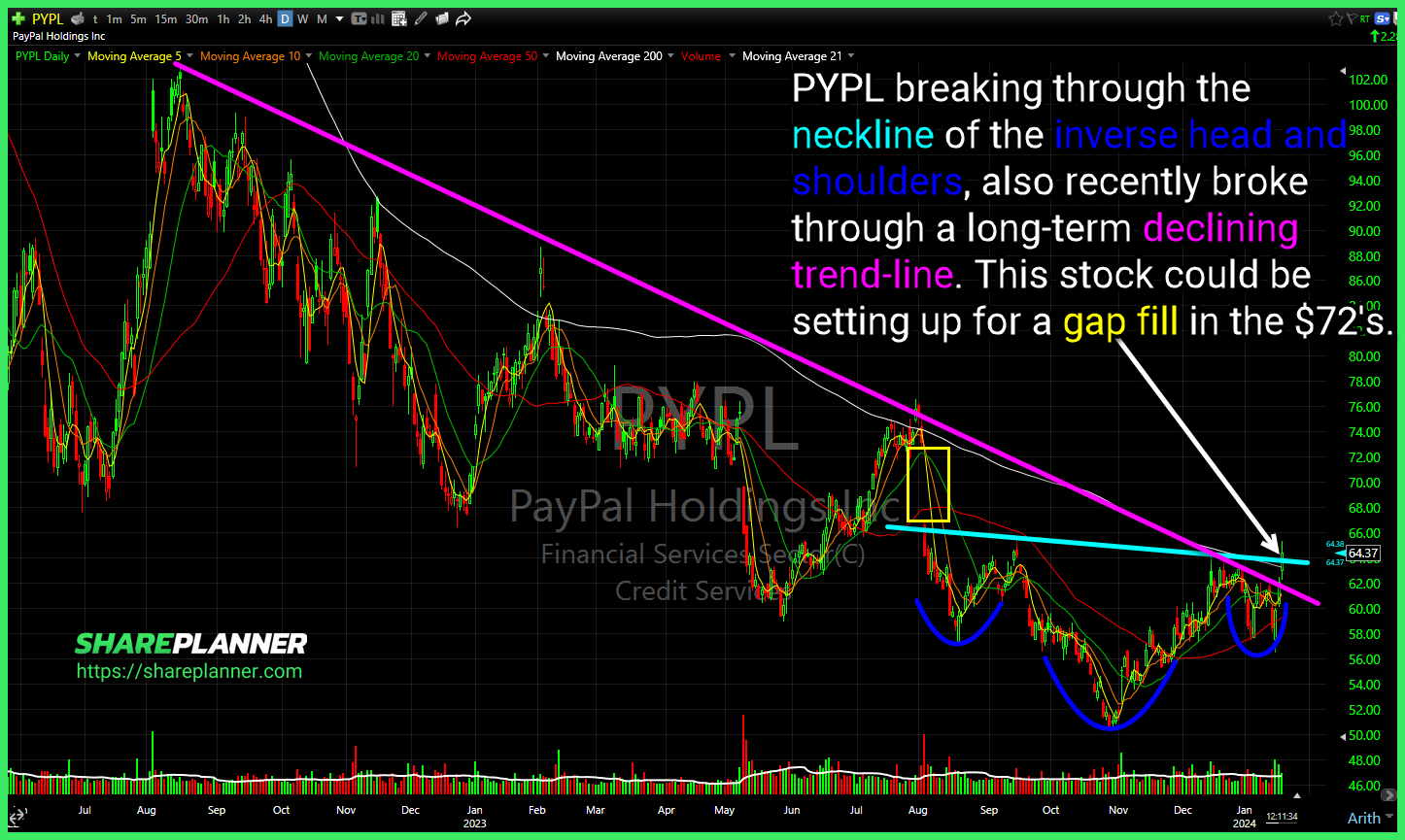

PayPal (PYPL) breaking through the neckline of the inverse head and shoulders, also recently broke through a long-term declining trend-line. This stock could be setting up for a gap fill in the $72's. Closed out this bounce play in Wayfair (W) today for a +12% profit. Nice to get some positive news that helps the

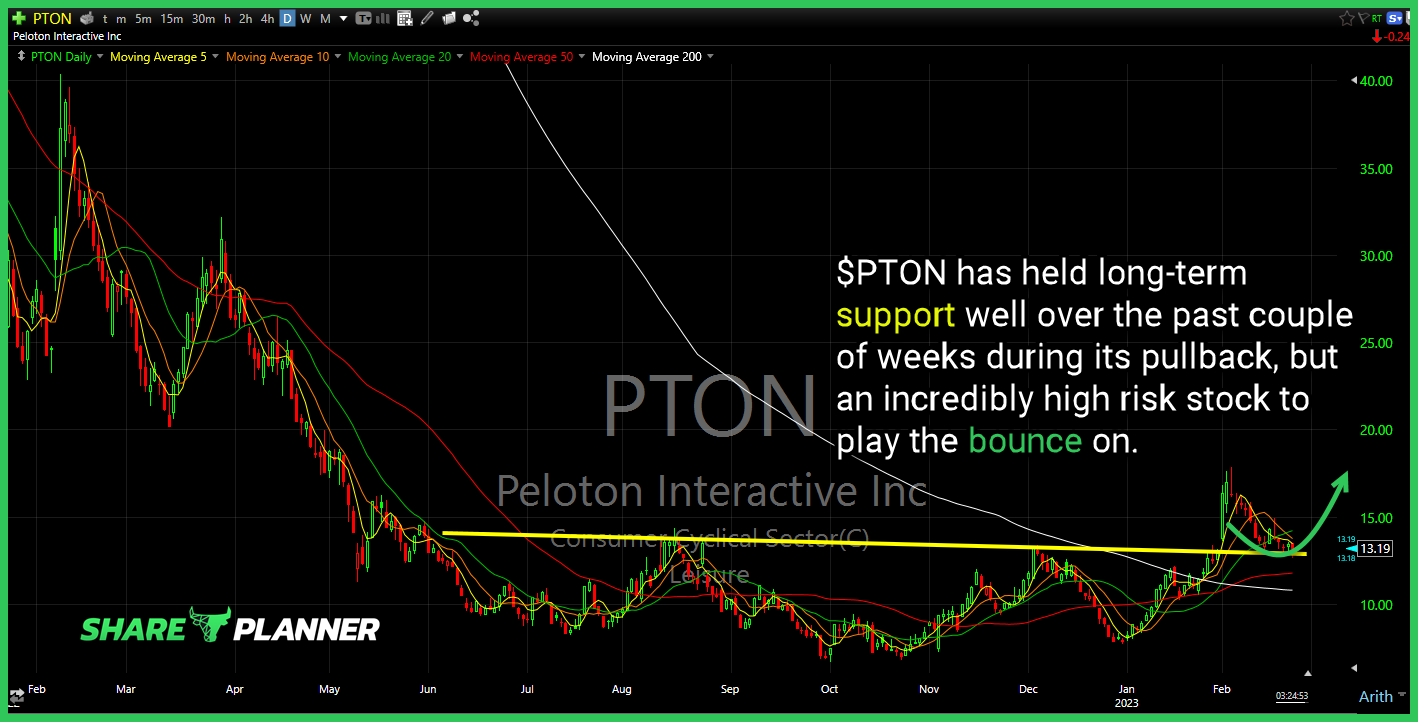

$PTON has held long-term support well over the past couple of weeks during its pullback, but an incredibly high risk stock to play the bounce on.

The latest installment of my Stock Market Bubble Update 2021. My focus will be, is the stock market overvalued or not and whether a stock market bubble pop is imminent. I also answer "should I buy Tesla stock right now" along with a number of the biggest stock market bubble stocks. Today's market bubble is

Rally Stocks Now and Forever More Honestly, I hate this market, as I am sure plenty of of others do too. It isn’t that I have something against bullish markets, but I do have something against markets that have been completely taken over by a federal government trying to win re-election and re-appointment, and investors