My Swing Trading Approach

I closed out my position in Netflix (NFLX) yesterday at $358.78 for a +3.6% profit, while also decreasing dramatically the overall long exposure, and increasing my short exposure. I will watch the early morning action to determine which side of the trade I want to add more to. If it can’t be determined, I’ll do nothing.

Indicators

- Volatility Index (VIX) – Big time pop in the VIX yesterday without showing any sell-off before the end of the day, as has been the case of late, which increases the probability for further upside in the days that follow.

- T2108 (% of stocks trading above their 40-day moving average): A 4.5% decline yesterday that wiped out most of last week’s gains. Look for a push from the current reading of 49% down to the 44-45% range.

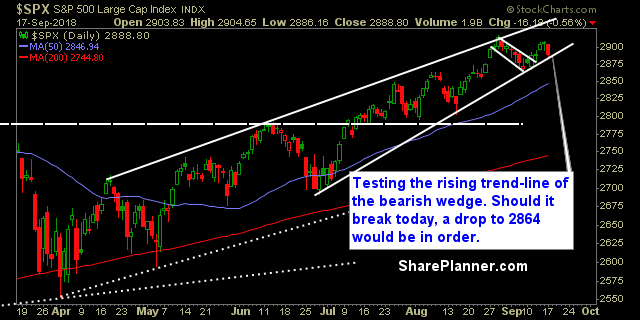

- Moving averages (SPX): Barely held the 10-day moving average, while testing the 20-day MA and holding so far. Both will be back in play again today. A break would likely result in a retest of the month’s lows.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities paving the way for a burst higher and out of consolidation from the past two weeks. Materials were strong yesterday but overall the sector remains weak with continued lower-highs on the daily chart. Energy remains in a sideways trading pattern. Industrials perhaps the strongest sector of the month so far. Technology and Discretionary have put in very concerning candles yesterday to potentially establish a lower-high here.

My Market Sentiment

The bulls appear to be be losing some of its grip following yesterday’s sell-off, and broad based profit taking in the tech sector. Most of your momentum stocks saw large losses as well.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 1 Long Position, 1 Short Position

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.