My Swing Trading Approach

I added a couple of positions yesterday, as conditions improved, booked profits in Netflix (NFLX) for a small +1% profit early on. I will play it cautious here, especially considering the larger than usual gap down the market is facing.

Indicators

- Volatility Index (VIX) – Popped another 5%, but still sporting the long upper shadows on the chart. Inverse head and shoulders pattern near a confirmation point.

- T2108 (% of stocks trading above their 40-day moving average): Lost 6% yesterday as it dropped down to 51%. Not a lot of strength in this indicator, and shows that stocks under the surface are struggling.

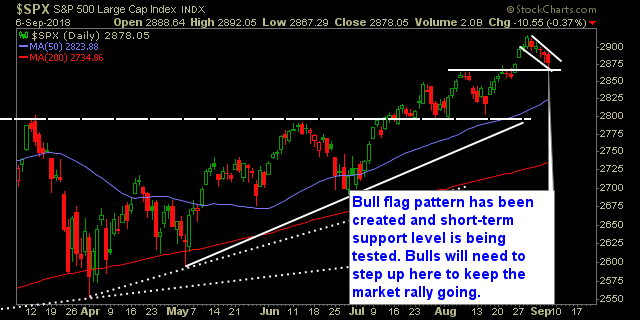

- Moving averages (SPX): SPX tested and held the 20-day moving average, but looks to test that area once again today.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Utilities continue to soar higher, back in breakout mode. Telecom finally with a respectable day, bouncing off of its 50-day moving average, yet again. Industrials remains one of the bright sports for the market this week. Financials still appears to be unpredictable and uncommitted to a direction. Healthcare still working that bull flag pattern. Technology testing the rising trend-line off of the June lows.

My Market Sentiment

The bulls have a great looking flag pattern to work with here, and is currently testing support in the short-term at 2864. Needs to hold, or a move down to the 50-day MA becomes more likely, and possibly the 2801 price level again.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 3 Long Positions

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.