The market is trying to crash again like what we saw back in Q4 of last year, how are you going to be swing-trading it and most importantly preserving profits along the way. I go over the possibilities of a market crash, my swing-trading update, and the technical analysis of the most important stocks currently

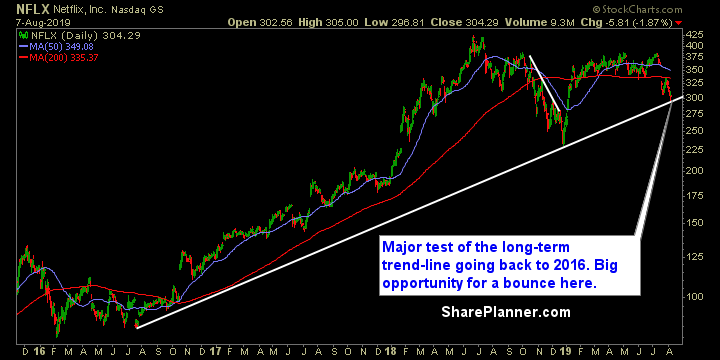

Thursday’s Swing-Trades: $NFLX $DVA $FAST Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Netflix (NFLX)

My Swing Trading Strategy I was stopped out of my Disney (DIS) trade yesterday, primarily due to the heavy influence from the Netflix (NFLX) earnings miss. However, I added two additional trades following the stop-out, and will consider adding a third position if the early morning strength can hold. Indicators Volatility Index (VIX) –

We are all familiar with traditional stock market cycles, but what about the market cycle within a bull market rally and what does that look like? More importantly what clues does the market provide within a bull market that can help us better understand when the rally is going to be coming to an end?

My Swing Trading Strategy I closed out four positions yesterday: Best Buy (BBY) for a 4.6% profit, Take Two (TTWO) for a 2.1% profit, Netflix (NFLX) for a 1.8% profit, and Lyft (LYFT) fora 1.7% profit. I also added one additional trade to the portfolio as well. Indicators Volatility Index (VIX) – VIX saw

My Swing Trading Strategy I sold Netflix (NFLX) for a +1.5% profit yesterday. I didn’t add any new positions today, and am willing to get short should the market show a willingness to sell off further this morning. Indicators Volatility Index (VIX) – Sold off for the seventh time in the last ten trading sessions.

My Swing Trading Strategy I booked gains in Netflix (NFLX) yesterday at 361.21 for a +3.3% profit. I still have a few other long positions, but plan to tighten my stops on each of them to lock in gains amid today’s pre-market weakness. Indicators Volatility Index (VIX) – Dropped for the fifth time in the

My Swing Trading Strategy One new trade was added on Friday, but I stayed put the rest of the day. I sold my position in Netflix (NFLX) for a +1.1% profit. Today the market is opening lower, so it will be important that any weakness can be contained and kept from seeping lower. Indicators