Coinbase Global (COIN) finally starting to break out of the declining channel from mid-July. Very little resistance overhead from here to continue to the climb. Imagine getting stopped out on a random 7% drop mid-day for no reason at all on Oracle (ORCL). No news that I can find anywhere. Starbucks (SBUX) breaking

Nvidia (NVDA) earnings could change this with their earnings tomorrow, but so far, the Semiconductors ETF (SMH) dead cat bounce running out of steam at short-term resistance formed by the double top. TMST attempting to confirm the bear flag today, but support underneath could stabilize the stock. I didn't notice this Baidu (BIDU) support level

$TNX pushing above October '22 highs and breaking through some heavy resistance. $AMC rejection at resistance was the clue to get out. Now it is breaking major support going back to '22. Retested it on Friday and failed. For those that think $AMC is rigged, then why are you even trading it? Simple logic -

$IBB bouncing off of the rising trend-line from October '22. You'll still want to be mindful of overhead resistance. $CVS for a second straight day testing key support that if broken goes back down to 2019 & 2020 prices. $VIX running into heavy resistance at the 200-day moving average. $TNX 10 year yields showing rejection

Bitcoin $BTC.X crashing & breaking the rising trend-line off of the January lows. $LNG Rising parallel channel, with a hard bounce off the lower channel band. Looking for a move back to the upper channel band from here. Pullback to the rising trend-line in place seems to be the most logical area to target a

Major support breaking today on Tesla (TSLA). Now the next level of support comes in at the rising trend-line around 207-210 area. SPDR Gold Trust (GLD) inverse cup and handle pattern nearing confirmation. CBOE 10-year Treasury Yield Index (TNX) October highs on tap. Rates continue to rise significantly. Lululemon Athletica (LULU) price action still struggling

$F rising trend-line off of the July '22 lows could see a test and bounce. Patience is key here. $SPCE breaking below key support to new all-time lows. $TGT with a continuation triangle break to the downside. $DBI not quite there yet, and definitely having some struggles today, but worth watching in the days that

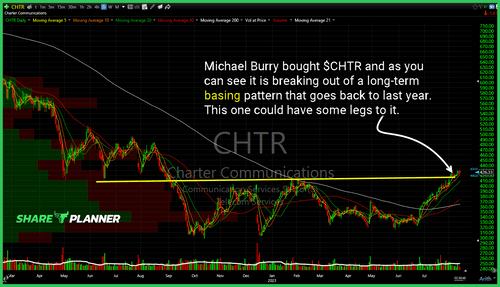

Michael Burry bought $CHTR and as you can see it is breaking out of a long-term basing pattern that goes back to last year. This one could have some legs to it. $VIX still can't break above resistance. Volatility shorts continue crushing the index with every bounce. Strong bounce so far today for $SMH, but

I'm watching to see if Advanced Micro Devices (AMD) pulls back to the rising trend-line from the Nanuary lows. If that Holds it could create a nice bounce opportunity. Netflix (NFLX) attempting to finish off this head and shoulders topping pattern. Watch for SoFi Technologies (SOFI) to retest year long support. If it

Strong post earnings run for Alibaba Group (BABA), but struggling to push through resistance. Needs to break through to jump start the next leg higher. Major support for Utilities ETF (XLU) still holding but a push below $64 support could spell trouble for the utilities sector. Big move out of Yeti (YETI) today