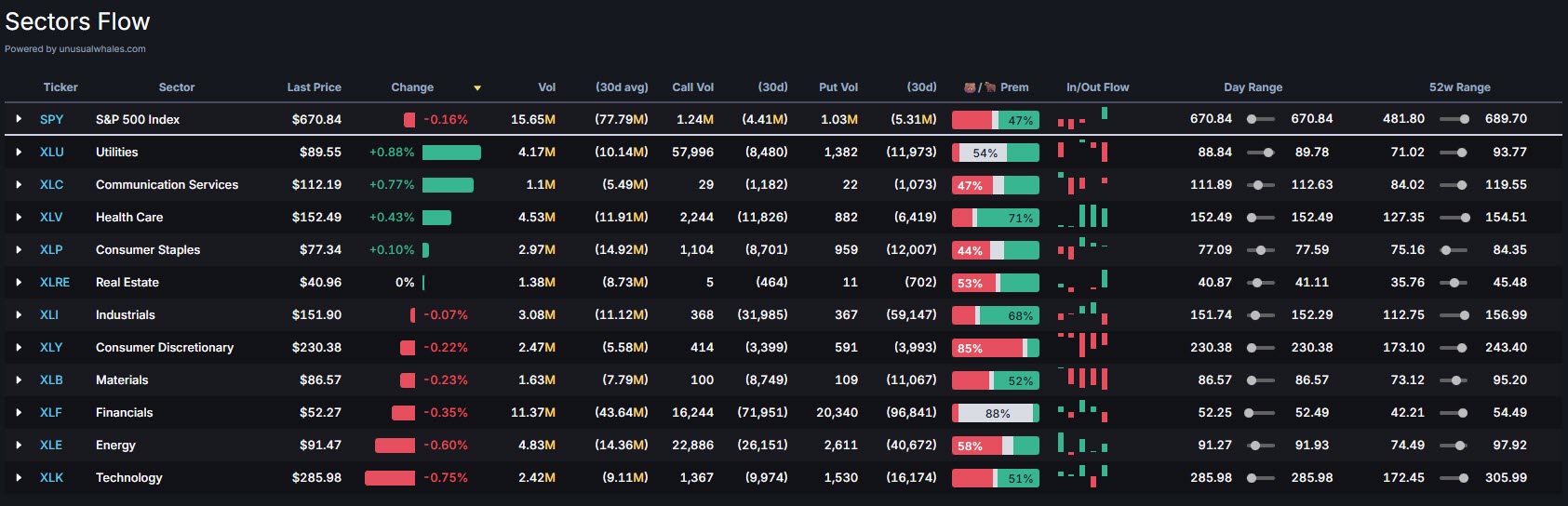

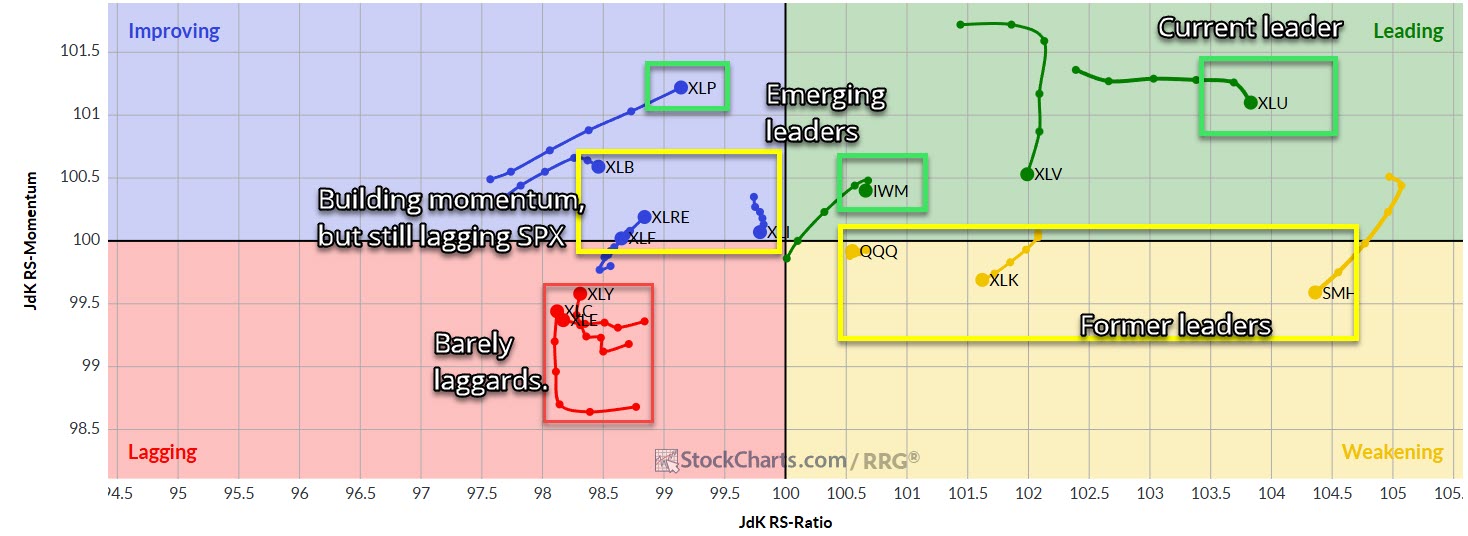

This morning - stocks are showing a slight rotation into defensive names here. Staples Sector (XLP) and Utilities Sector (XLU) showing life.

Utilities currently leading the way - never a good sign though.

The Utilities ETF (XLU) is currently in breakout mode, can this defensive play sustain the breakout though?

Episode Overview Ryan goes over one listener's swing trading journey, analyzes the trading strategy being employed, and answers questions on everything from short squeezes and short floats to insider and institutional buying and sector rotations. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by explaining why he

Episode Overview This episode focuses on Ryan's sector analysis and what he's looking for when determining which sectors to trade from. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by setting the tone on managing complexity in trading, particularly around sector analysis. [1:13] Listener Question: Otis from

$ZTS with a nice run from $180, may be starting to run into some resistance that goes back to early '22. $HXL nearing some short-term rising resistance & overbought. Price is closing in on a bear flag confirmation. $XLU $CVNA breakout of declining resistance off of June highs, but watch for potential resistance at the

Strong post earnings run for Alibaba Group (BABA), but struggling to push through resistance. Needs to break through to jump start the next leg higher. Major support for Utilities ETF (XLU) still holding but a push below $64 support could spell trouble for the utilities sector. Big move out of Yeti (YETI) today

Episode Overview Step-step directions on how I use the Top Down Trading Strategy in my swing trading. This trading strategy guides my decisions and how I analyze stocks and choose which stocks to trade. In this strategy I connect the overall stock market direction with sector strength and industrial technical analysis to help find the

Episode Overview What's the differences, advantages and disadvantages of swing trading vs day trading vs position trading, and what does it mean to be either of them? Also in this episode, Ryan explores one trader's questions about trading index funds only and provides the bigger questions that this person should be asking himself. 🎧 Listen