Traders often struggle to separate their feelings about a company from the reality of its stock price. It is easy to look at SoFi Technologies (SOFI) and see a disruptive fintech story. You might love the app or use the services and assume that means the stock should go up. But as swing traders, we

SoFi Technologies (SOFI) sporting a bear flag over the past few days with the potential for another move lower here.

SOFI experienced a significant sell‑off today, leaving traders asking whether this is just a pullback in a broader uptrend — or the start of something deeper? In today’s technical breakdown, I analyze the daily chart to give you clarity on: Where key support levels reside and where buyers may step in Trend structure (higher lows

Episode Overview Have you ever wondered what it takes to know when you are on the cusp of a long-term bull market? Ryan, in this podcast episode, talks about the signs that he looks for as well as his go-to indicator for spotting long-term trends in the stock market. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube

Episode Overview Headline risk is part of trading no matter how well you manage the risk. There's always the possibility of getting a downgrade or press release that wrecks havoc on your swing trade. But what can you do to better prepare your portfolio against such headwinds? 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights

Episode Overview Often times when reality collides with our expectations as it pertains to swing trading, it can create a lot of frustrations that lead to very bad and horrible trading decisions. In this podcast episode, Ryan talks about how we have to be willing to change our bias and our outlook as

Should you trade large-cap or small-cap stocks in the stock market? I'll explore the unique characteristics, advantages, and risks associated with each category and how the stock market treats each. What You'll Learn: - Key differences between large-cap and small-cap stocks - Liquidity, volatility, and growth potential of each category - Market cycles and how

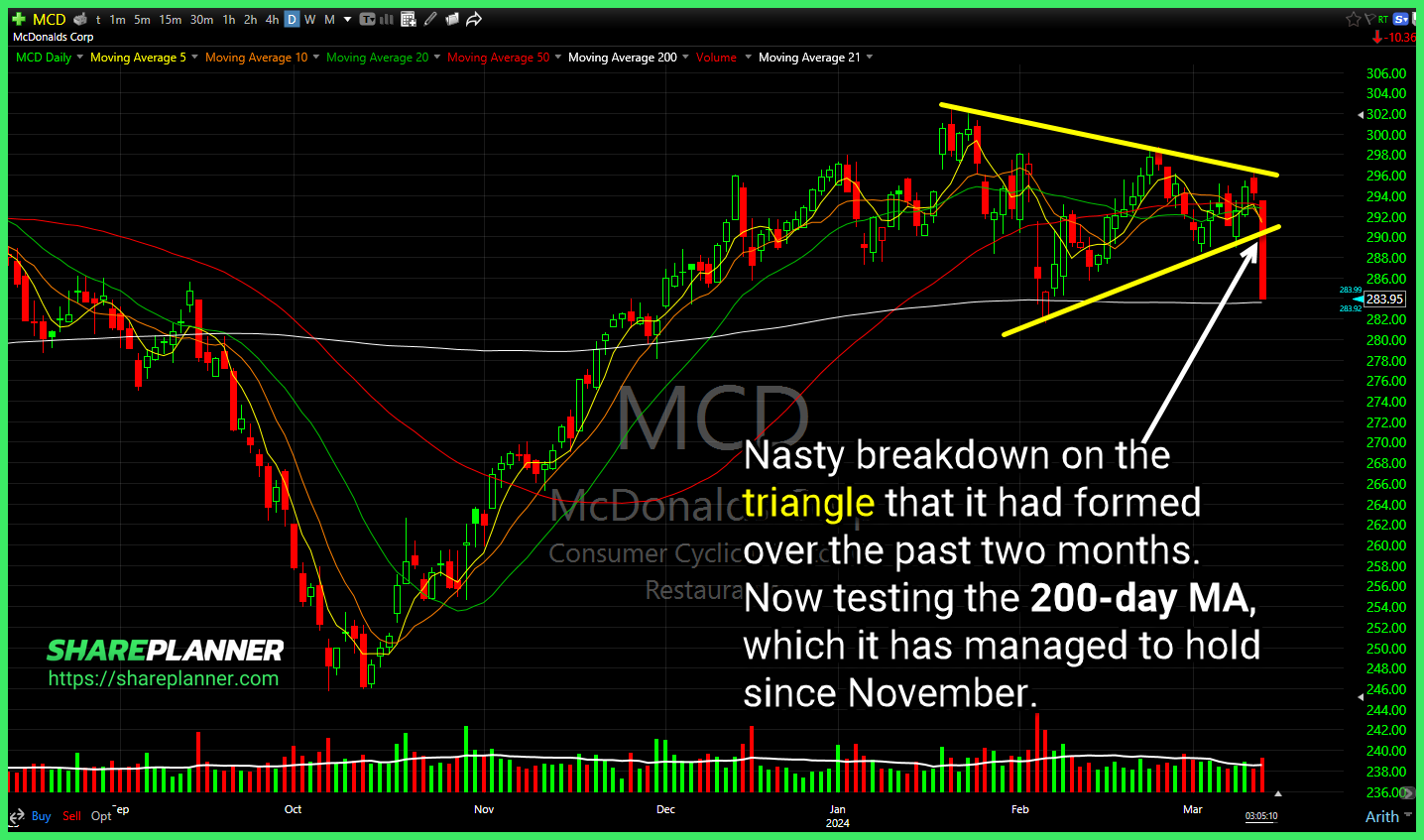

Nasty breakdown on McDonalds (MCD) with the triangle that it had formed over the past two months. Now testing the 200-day MA, which it has managed to hold since November. SoFi Technologies (SOFI) wedge break following a breach of the rising trend-line looks at a potential move back down to its lower channel band.

Episode Overview Ryan discusses whether one should avoid trading the same stocks multiple times in a short period of time. Also discusses the impact of the wash sale rule as it pertains to swing trading. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan introduces the episode with a question many traders

$DENN is nearing a break of consolidation. However heavy resistance looms in the $11's. . $SNAP remains in a promising bull flag but with earnings 2/6 you may not have enough time to see it play out. Definitely one stock I would never hold through earnings as well. Watch upper channel band for resistance on