If $YALA continues this run higher, you'll want to be mindful of the longer-term resistance overhead, and not too far away. Nice bull flag in $CMPR weekly forming, and also testing the 200-day MA. Be aware though, if it starts to run of the declining resistance that goes back to 2018 $MTG continuation triangle formed,

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains elevated. The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity,

Cannabis and US Cannabis ETF (MSOS) specifically rolling over. I expect a retest of the $6's. Arm (ARM) continues to trend lower following its IPO which is what is to be expected with pretty much any IPO. Best to wait at least 6 months before buying for the long-term. Microsoft (MSFT) pulling back

KLA Corp (KLAC) hitting oversold levels and testing a key short-term support level that could offer up a bounce opportunity. Rising support underneath, could also provide another. Semiconductors ETF (SMH) short term and long-term support so far holding up today and price is attempting to bounce off of it. Patterson-UT Energy (PTEN) Watching

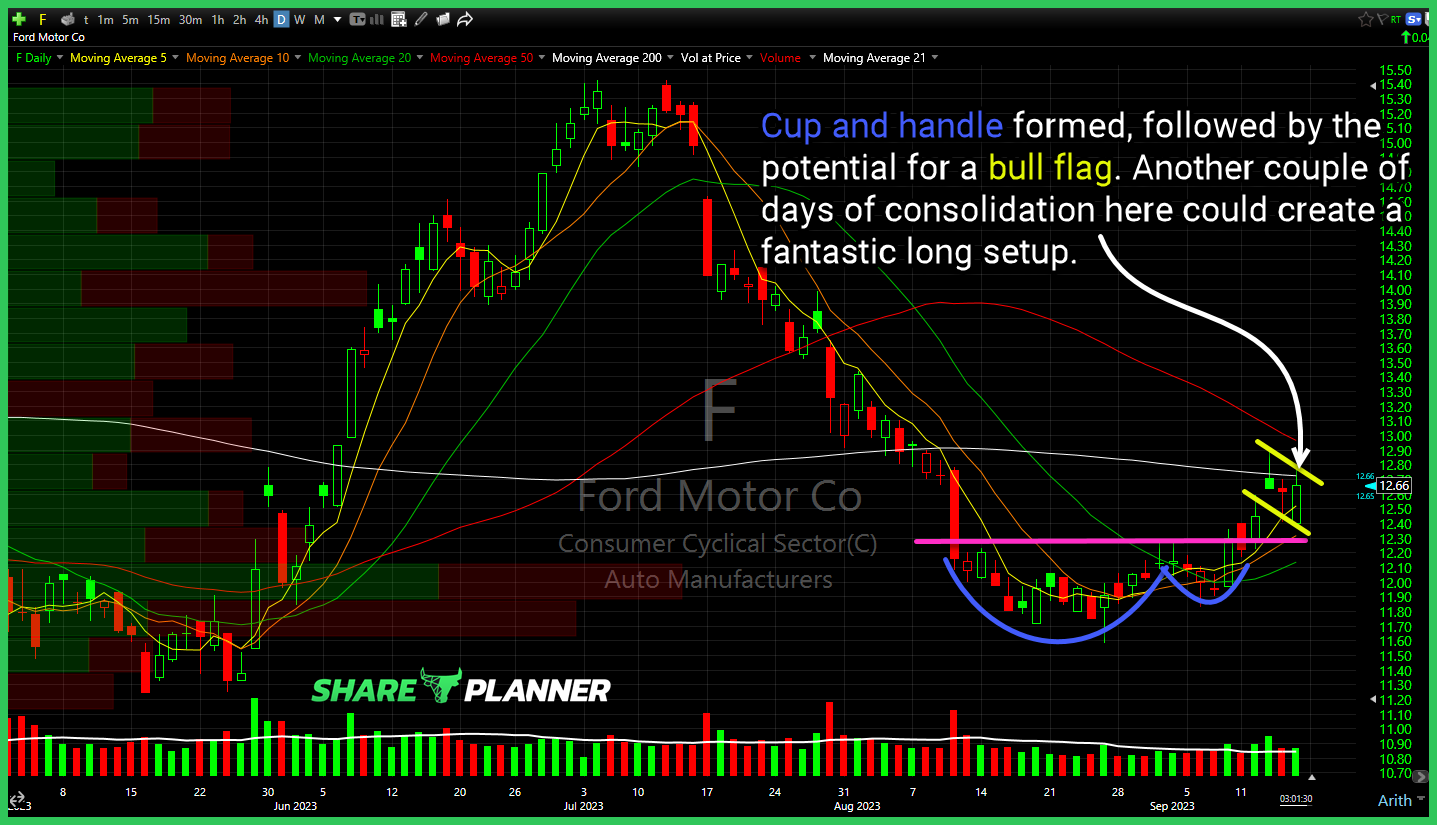

Ford Motor (F) Cup and handle formed, followed by the potential for a bull flag. Another couple of days of consolidation here could create a fantastic long setup. CBOE Market Volatility Index (VIX) hard bounce off price level support, now testing declining resistance. Advanced Micro Devices (AMD) breaking below its rising trend-line that goes back

Big break this week for Amazon (AMZN) weekly chart. Needs to hold this level into the close tomorrow. Netflix (NFLX) support levels to watch. Very little reason for me to want to play this bounce so far. No basing taking place, and support has yet to hold. Carvana (CVNA) inverse head and shoulders going back

Watch $SLB as it pulls back. If energy continues the weakness today and in the days ahead, a bounce opportunity off of support could emerge. As $ROST pulls back watch for whether it can hold this rising trend-line and ultimately bounce higher. $SOFI working on a cup and handle pattern here. Broke out yesterday, but

$URA rallies continues, best entry is to wait for a pullback to the rising trend-line, managing it as a current trade, I would be using the 10-day MA and a break below for taking profits. Could play the $V triangle breakout but some stiff overhead resistance nearby limiting the R/R for the setup. $ORCL starting

Double top confirmation with the recall news on $RTX. Possible support at $75. $TSLA broke out of the triangle pattern with a massive gap higher, but be mindful of the heavy resistance lurking overhead, that doesn't make this trade an ideal reward/risk following the massive run higher today. Long-term resistance getting tested on $FNGR following

Watch this consolidation in $TSLA just below the 50-day moving average. A break above the triangle and moving average could jump start the next move higher. T2108 Update Break this key support level and $GME starts to look more like the next $AMC $GPOR with a developing bull flag pattern, but yet to breakout. A