US Global Jets (JETS) nearing a potential bounce off of long-term support here from '20. UPDATE: McCormick (MKC) Following a break of the head and shoulders neckline, watch the rising trend-line getting retested from '08, and whether it can finally find some support here. Global X Uranium (URA) increasing potential for a

Coty (COTY) Head and shoulders formed and testing the neckline for a confirmation. Heavy sell-off from peak right shoulder, better to see some consolidation or bear flag, before breaking down, or it is possible to result in a head-fake. NextEra Energy Partners (NEP) has all-time lows in sight, and now sporting almost a 14% dividend

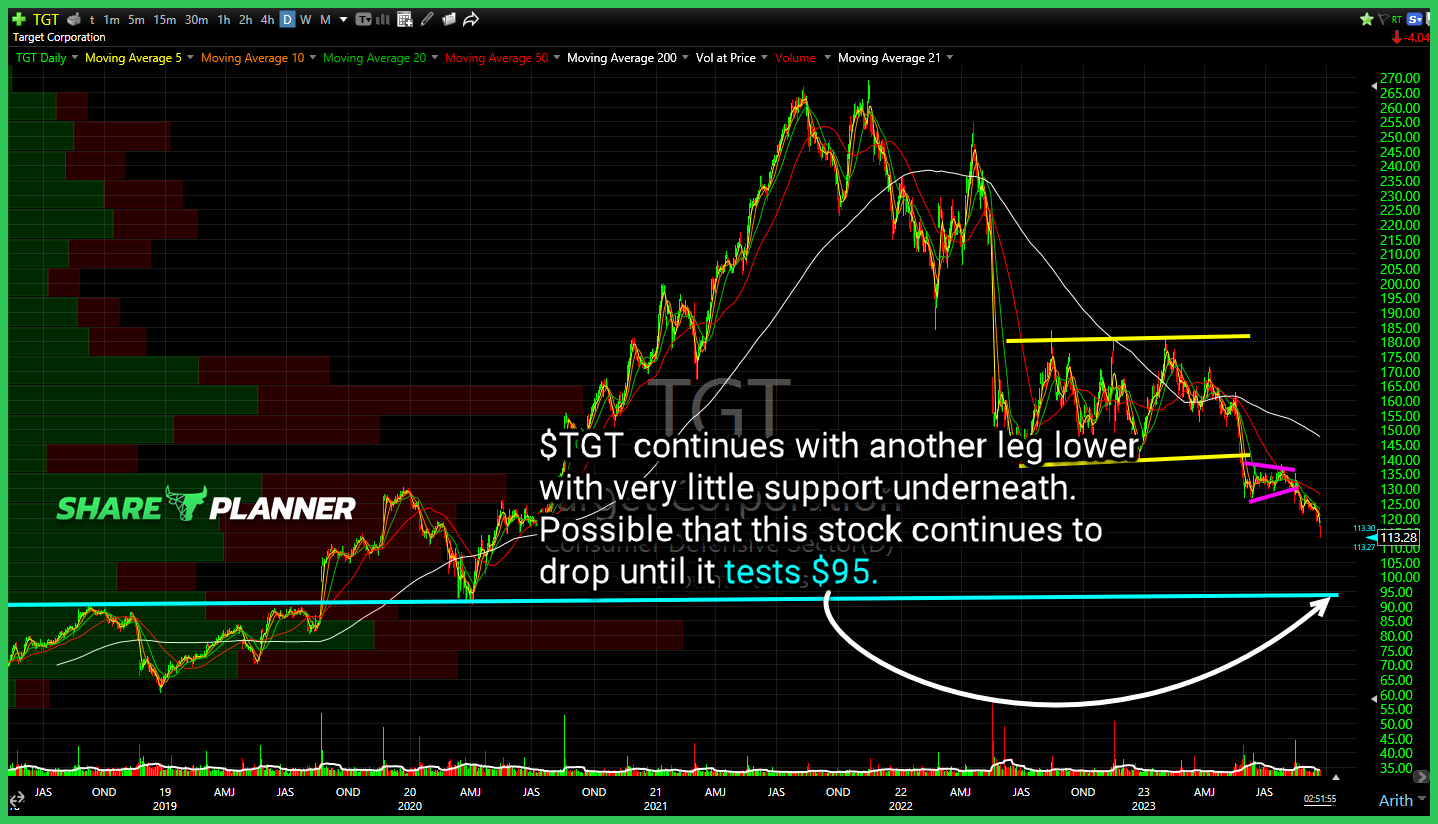

$TNX 10 year yield suggests we may very well hit 5% before the end of the year - very scary scenario for the entire economy, and a resistance level that goes back to 2001. Looking more and more like $TGT will ultimately, get to $94 for a test of long-term support. I won't looking to

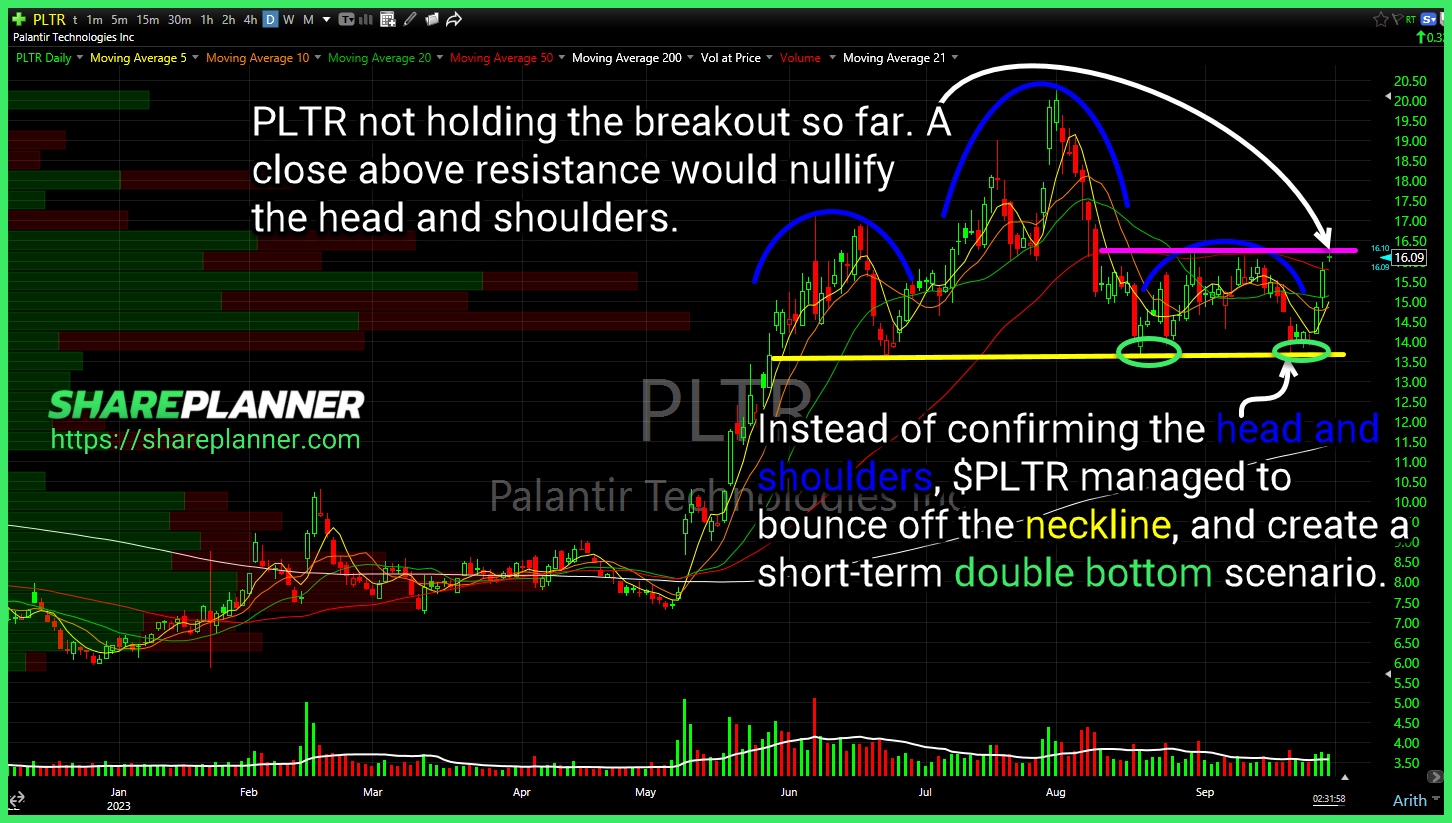

Instead of confirming the head and shoulders, $PLTR managed to bounce off the neckline, and create a short-term double bottom scenario. $F has a promising setup if it can break through short-term consolidation, but it is also dealing with heavy rejection at the 200-day moving average. $CCL needs to hold key support here at $13.70,

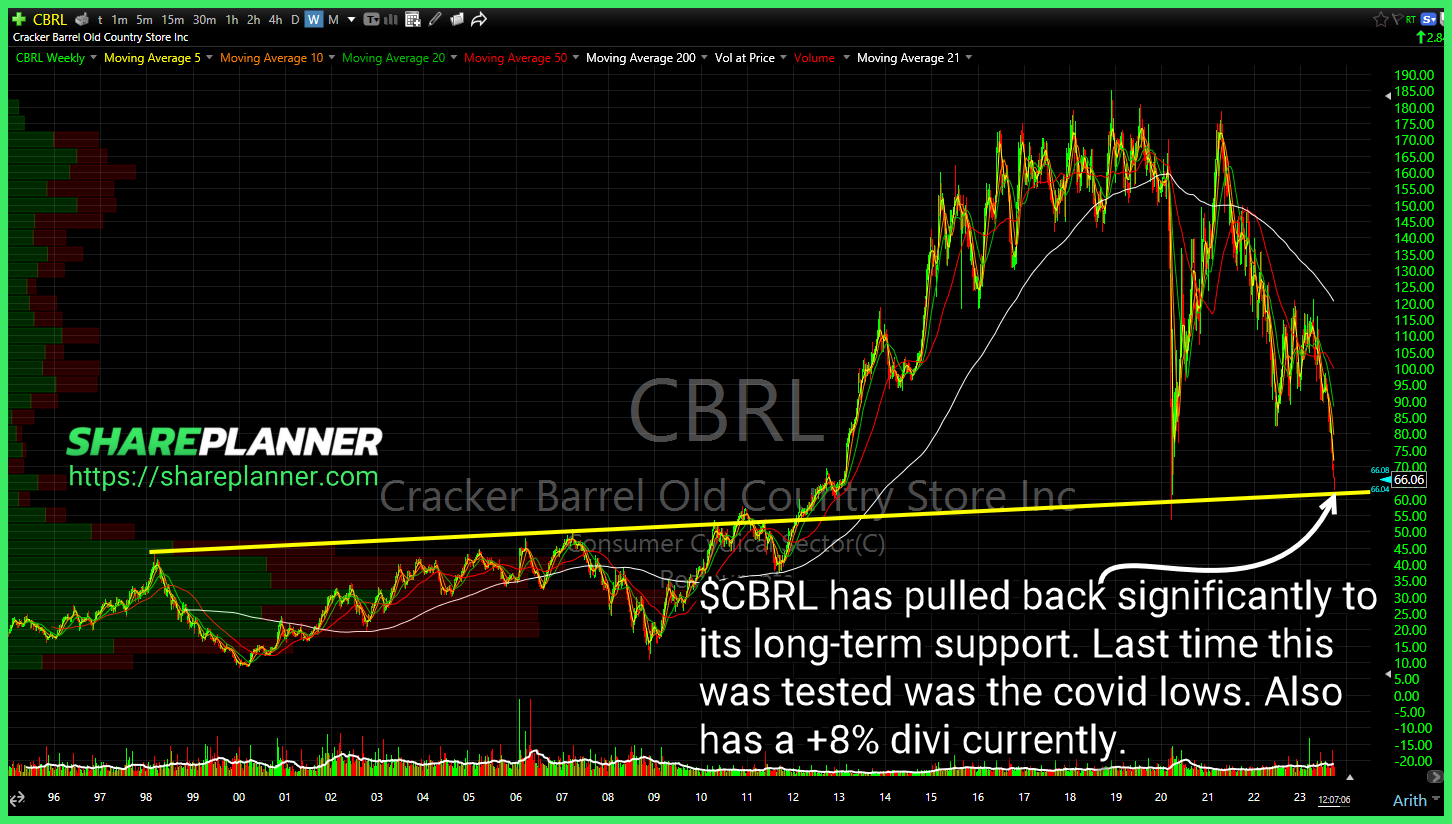

Cracker Barrel Old Country Store (CBRL) has pulled back significantly to its long-term support. Last time this was tested was the covid lows. Also has a +8% divi currently. GameStop (GME) couldn't hold the break above the declining trend-line. UnitedHealth (UNH) Retest of the declining trend-line and subsequent bounce from there. May encounter some resistance

Impressive stock market bounce, but if those rates don't come down, the rally will fizzle as well, and so far the rates haven't budged on the CBOE 10-Year Treasury Yield Index (TNX) NextEra Energy (NEE) nearing the closest thing to support at $59. Losing $70 was a big deal, but very oversold on daily, weekly

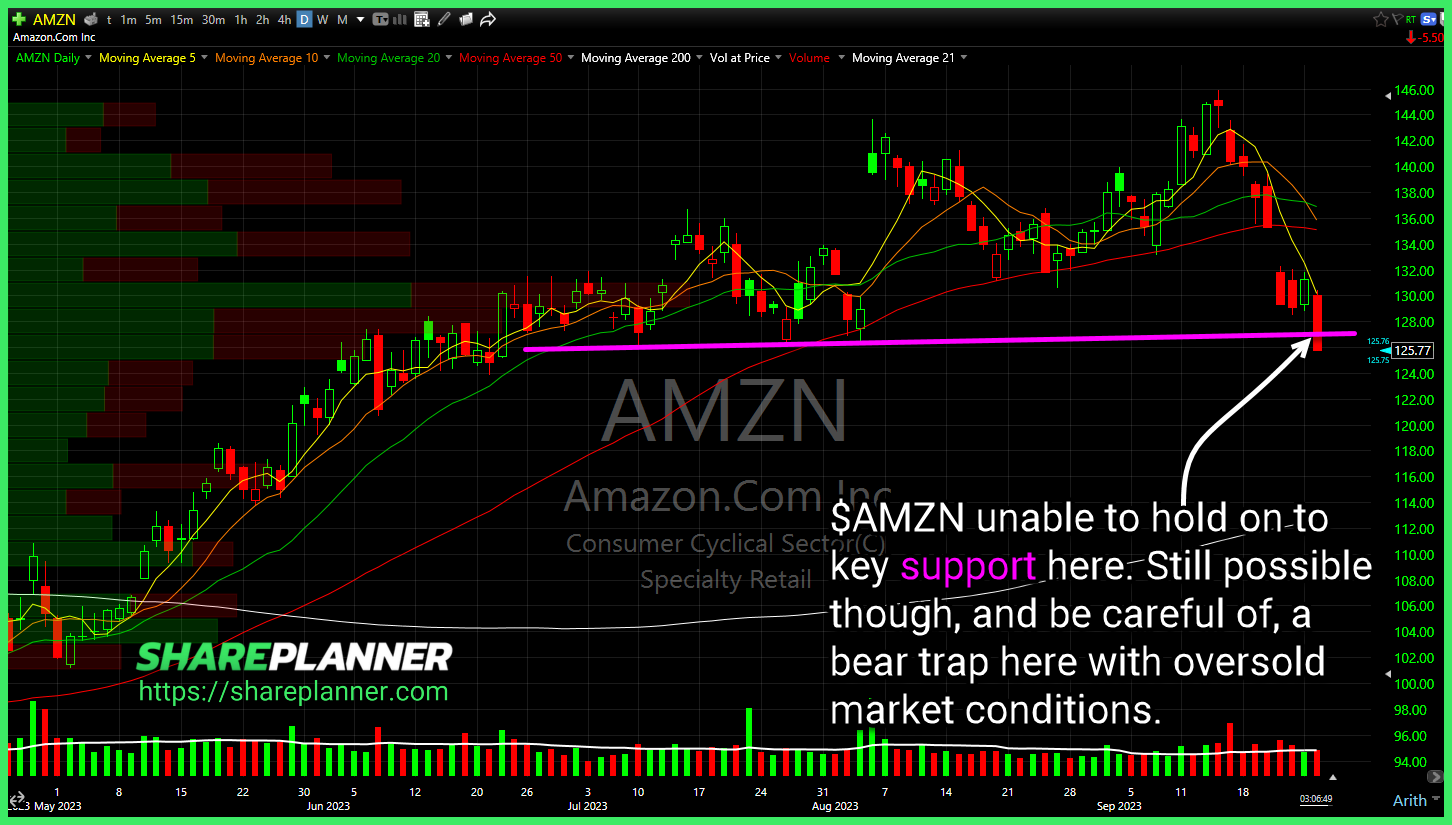

Amazon (AMZN) unable to hold on to key support here. Still possible though, and be careful of, a bear trap here with oversold market conditions. Ideal conditions for Uranium ETF (URA) entry would be on a pullback to the rising trend-line once a bounce materializes. Buying here at overextended levels, creates a high risk scenario

$TGT continues with another leg lower with very little support underneath. Possible that this stock continues to drop until it tests $95. $SOFI confirming that head and shoulders, with little support underneath. Next level is $6.50 followed by $5.25. $RCMT testing key resistance. A push above would create a breakout scenario.