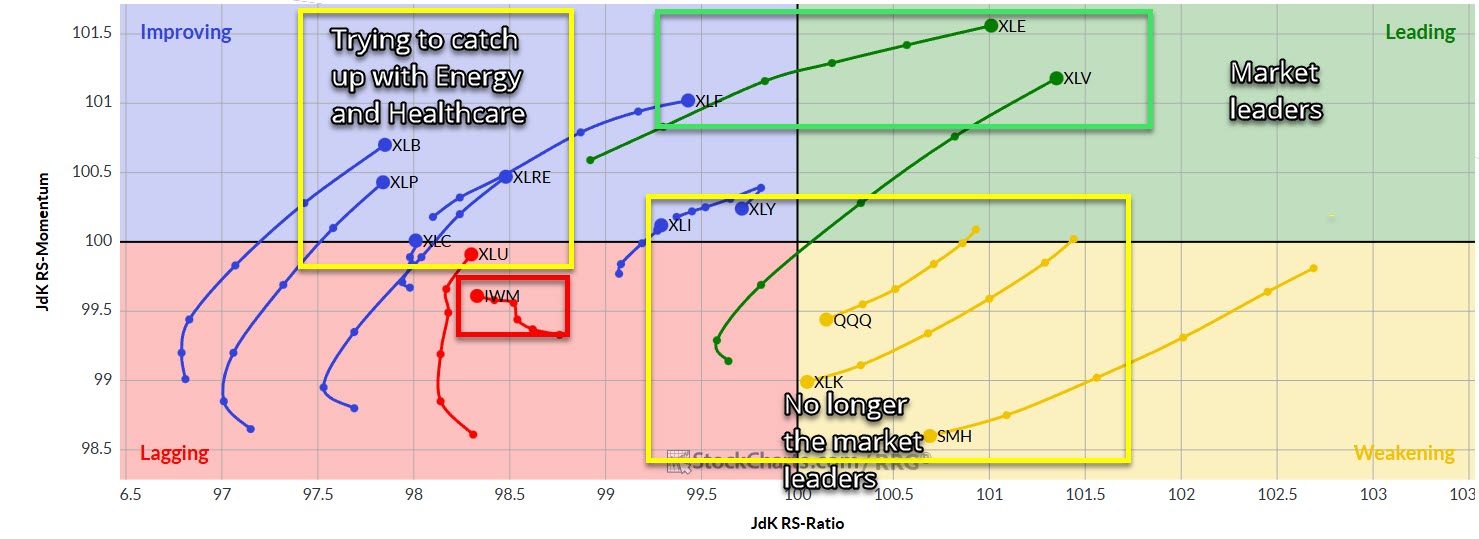

Healthcare Sector (XLV) and Energy Sector (XLE) leading the way right now, while Semiconductors (SMH) and Technology Sector (XLK) are the new laggards.

Semis and tech losing the leadership mantle and handing it over to Energy and Healthcare.

Selling the semis and tech in general.

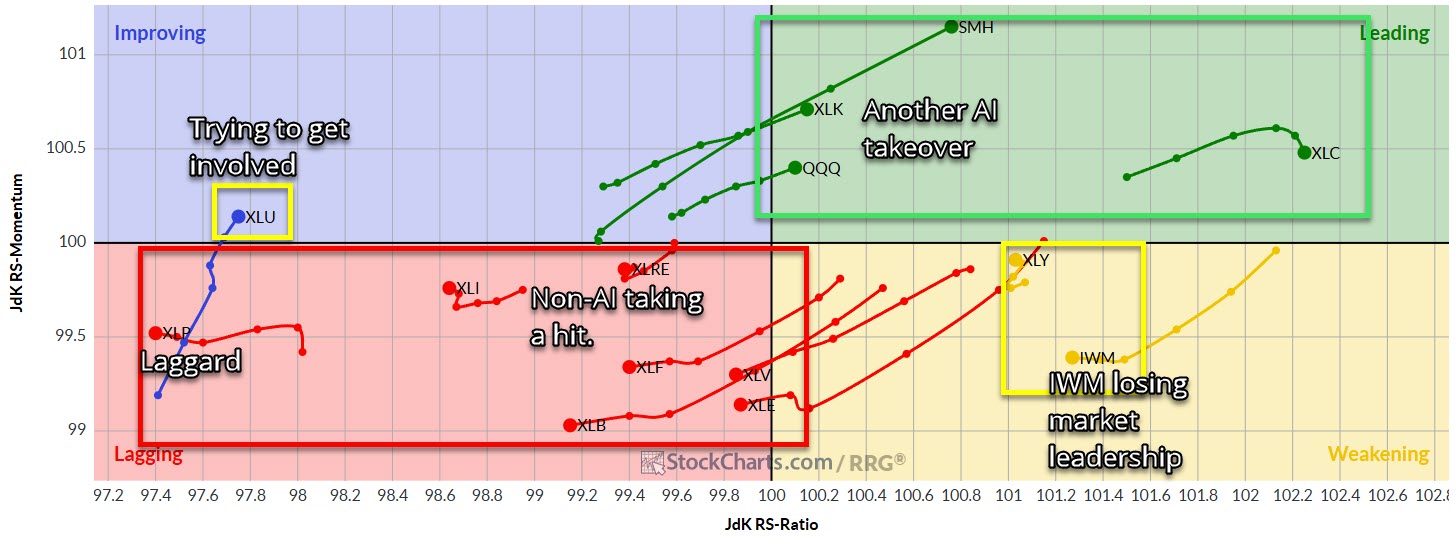

Usual sectors taking over again, with Semiconductors (SMH) taking the lead.

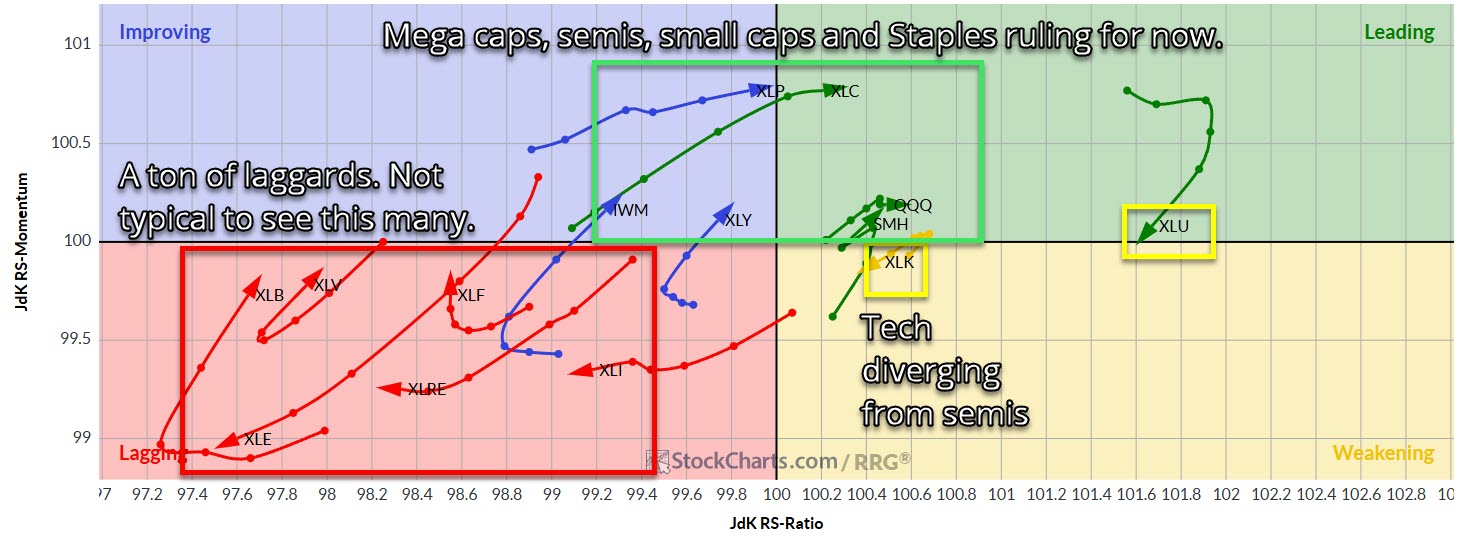

Semiconductors are showing weakness and Tech is following.

Technology is even diverging from Semis which is an interesting development.

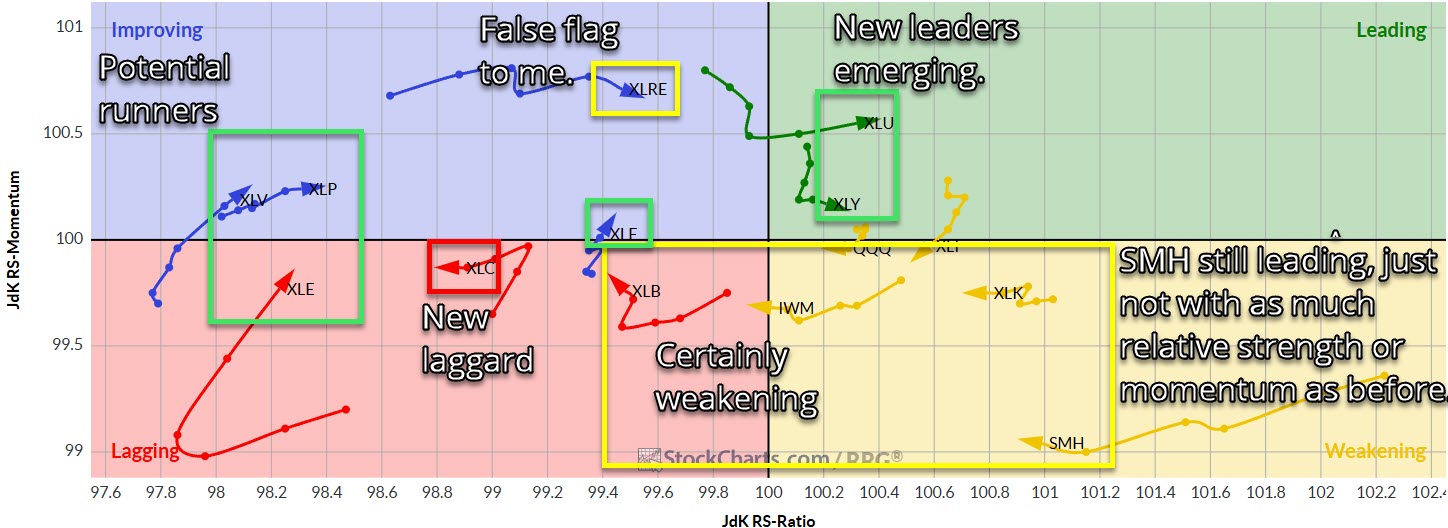

Semis are losing some steam, but still appear to be the market leaders here.

It's all semis at this point that is pulling this market higher.

Semis and Energy are holding firm to this market. Healthcare and real estate trying to make a play here, but I'm not sure it lasts.