This move in Technology ETF (XLK) over the past month blew right through its rising channel and never looked back. MercadoLibre (MELI) short-term rising channel in play - looking for a bounce back towards 1400, if it holds. Cameco (CCJ) pushing through huge resistance as it breaks out of a long-term triangle. Not a huge

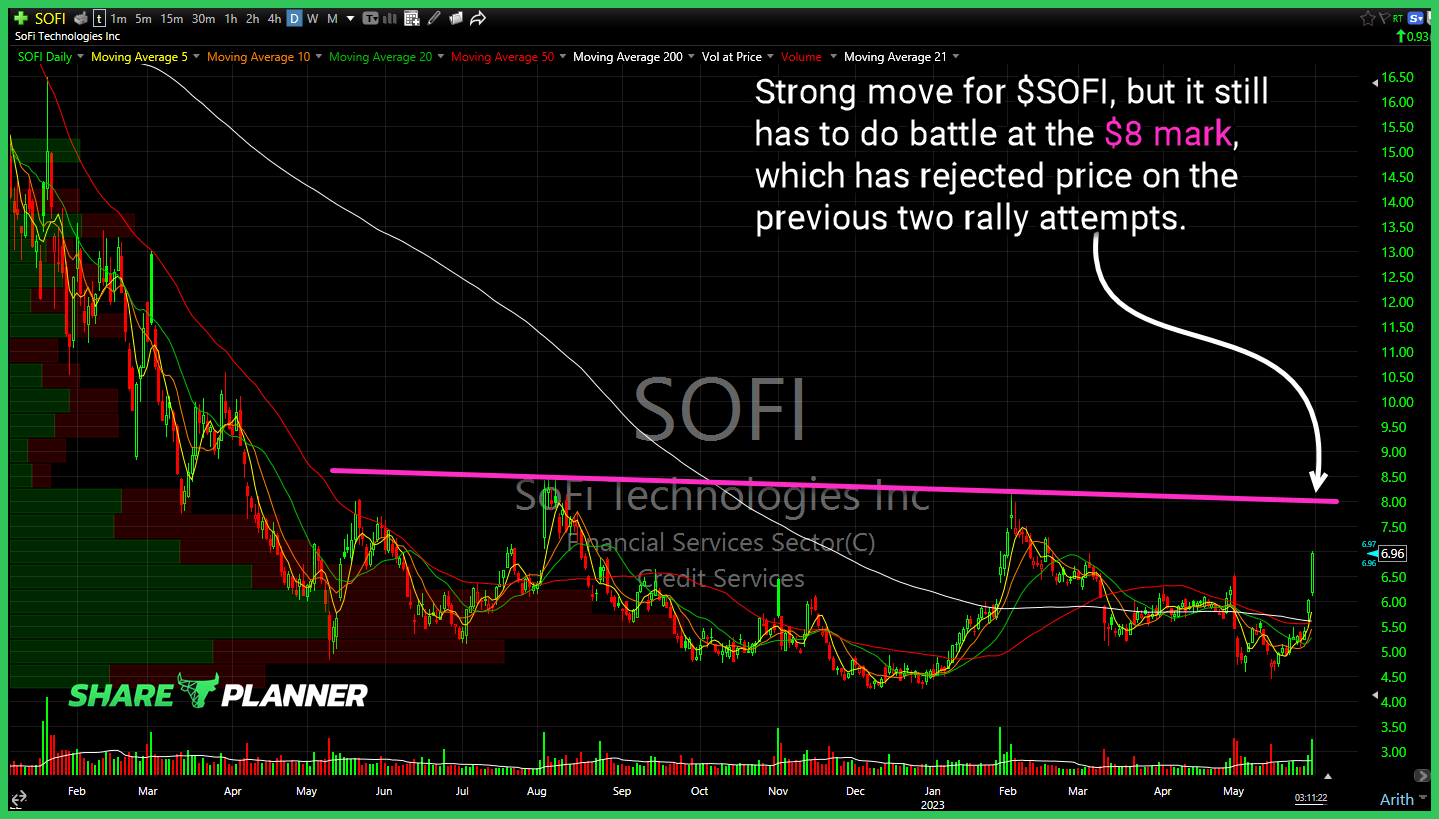

Strong move for $SOFI, but it still has to do battle at the $8 mark, which has rejected price on the previous two rally attempts. $NVDA gap closed, but the effort to bounce it after that failed. Watch for an attempt at filling the second gap. $UNH price action still a struggle, but if it

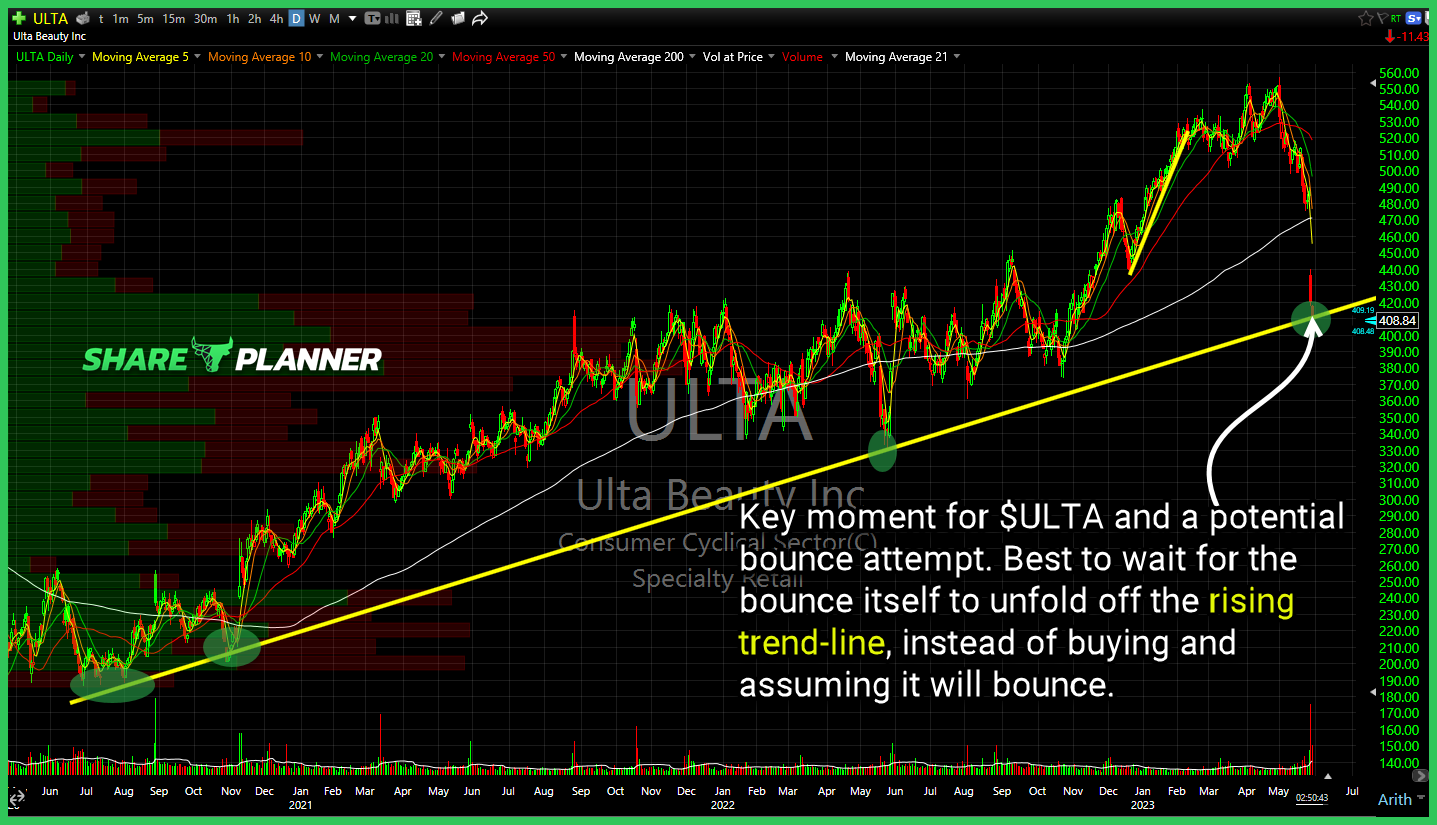

Key moment for Ulta Beauty (ULTA) and a potential bounce attempt. Best to wait for the bounce itself to unfold off the rising trend-line, instead of buying and assuming it will bounce. ChargePoint (CHPT) testing declining trend-line and attempting to push through here. Broadcom (AVGO) candle looks like a blow-off top has emerged,

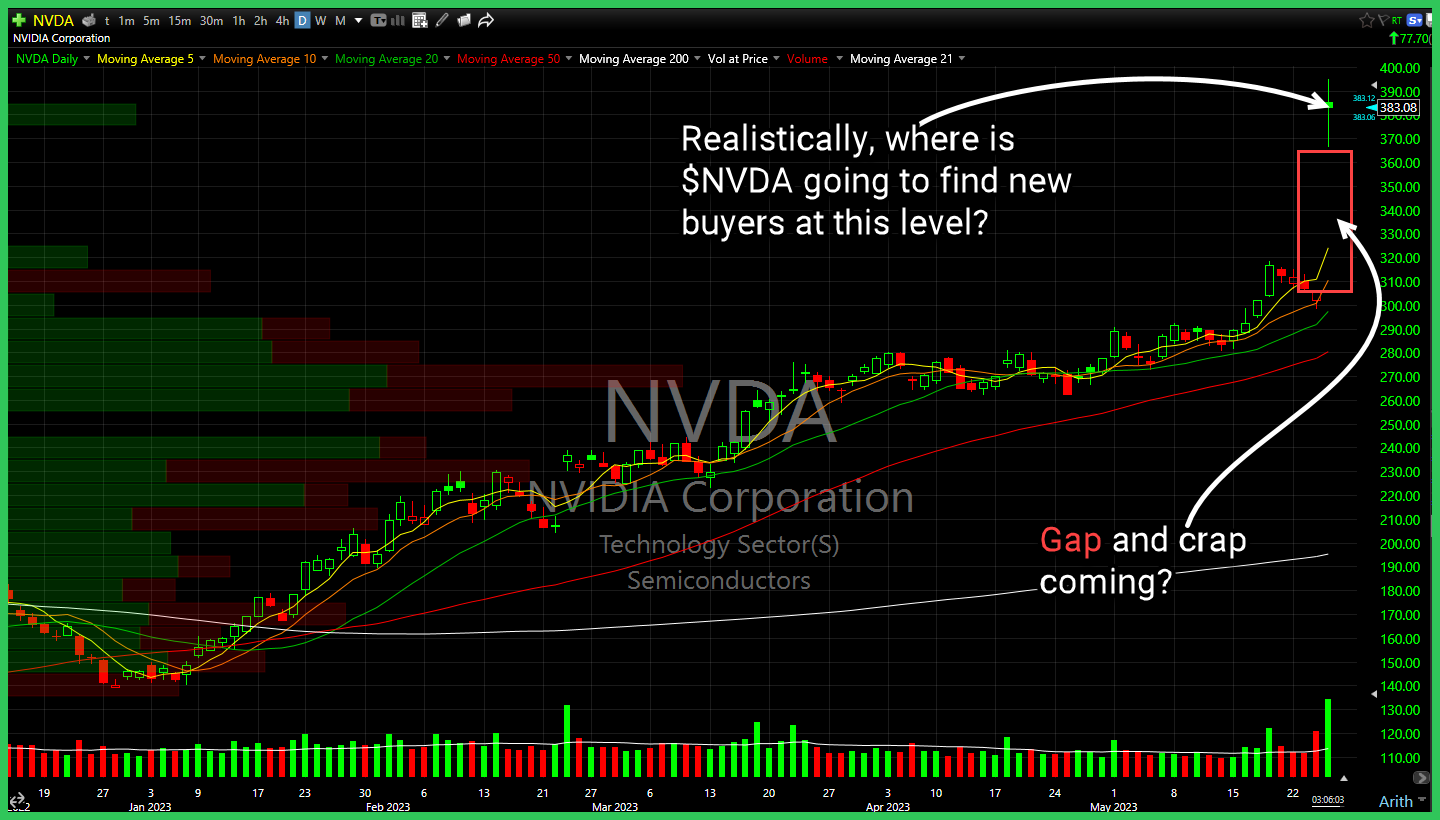

Realistically, where is Nvidia (NVDA) going to find new buyers at this level? Descending triangle pattern breaking to the downside on Alibaba Group (BABA) Significant breakdown taking place on Target (TGT) as it pushes below the lower channel band. Intel (INTC) breaking down through the triangle, and looking at a possible retest of

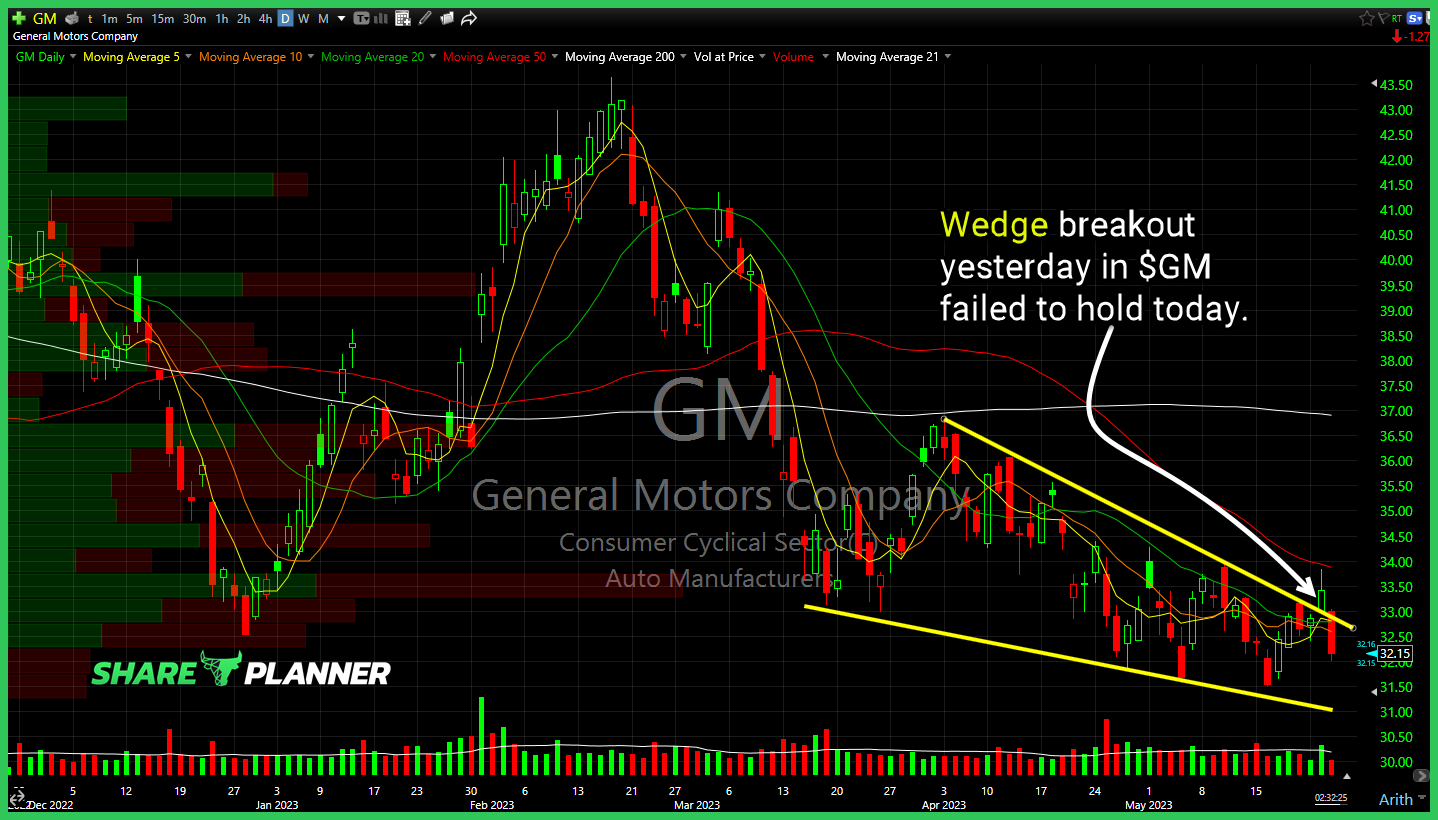

Wedge breakout yesterday in $GM failed to hold today. A lot of these happening in stocks right now. Especially in the non FAANG plays $BBWI with not the most convincing breakout so far, but it is still managing to hold the support level. $SHOP bull flag pattern worth watching still $TGLS breaking short-term support and

$WYNN rolling over and breaking a key support level here. Watch declining resistance for potential push back on $MRNA $PLUG running hard into an area of resistance that make complicate the bounce off its lows. $PINS running into the underside of broken trend-line support. A break back above would put it in the gap. Strong

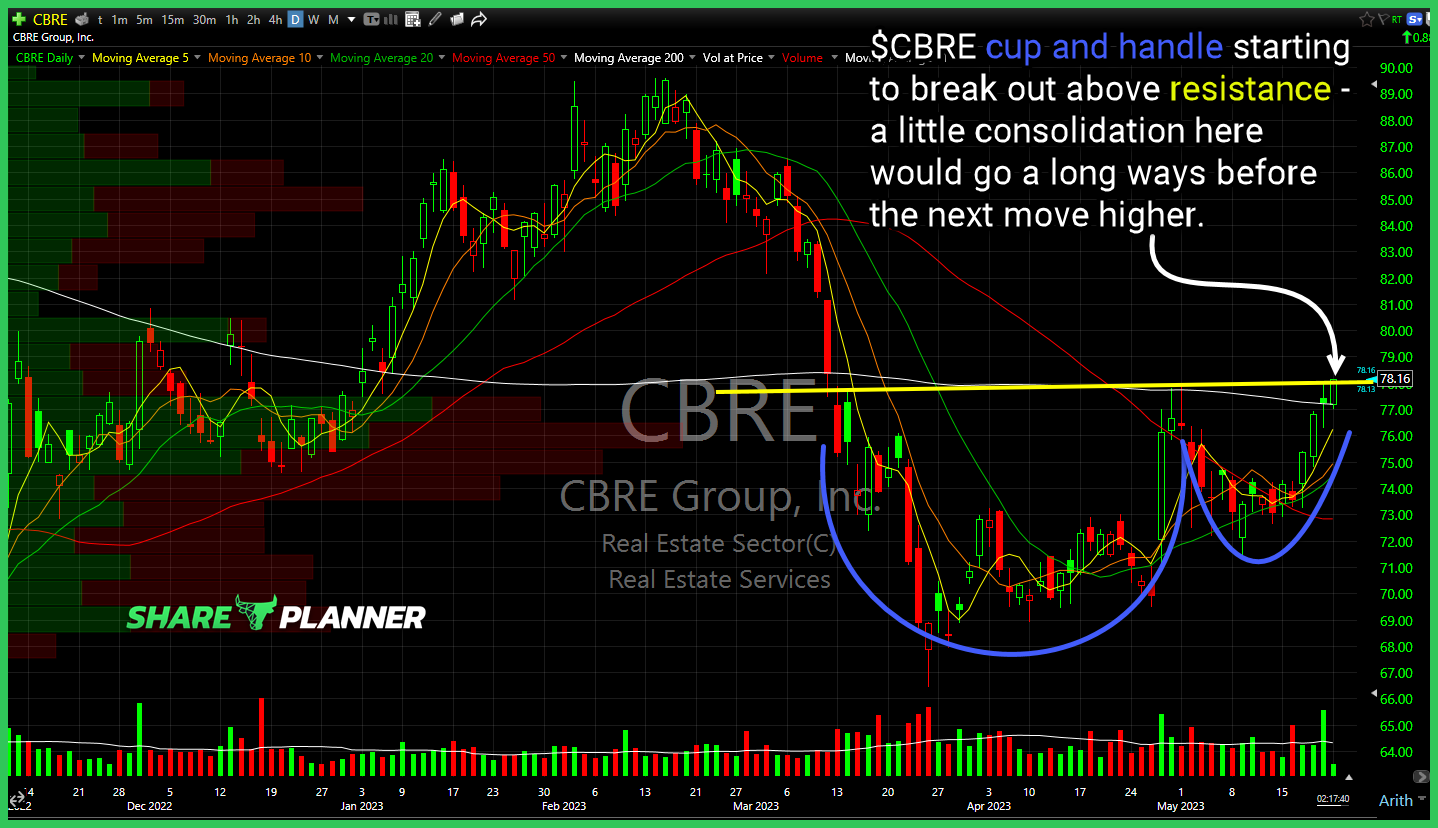

$CBRE cup and handle starting to break out above resistance - a little consolidation here would go a long ways before the next move higher. $GME 200-day moving average has been a headache the previous two attempts to break above, marking temporary highs. Will need to break and close above it to change the narrative.

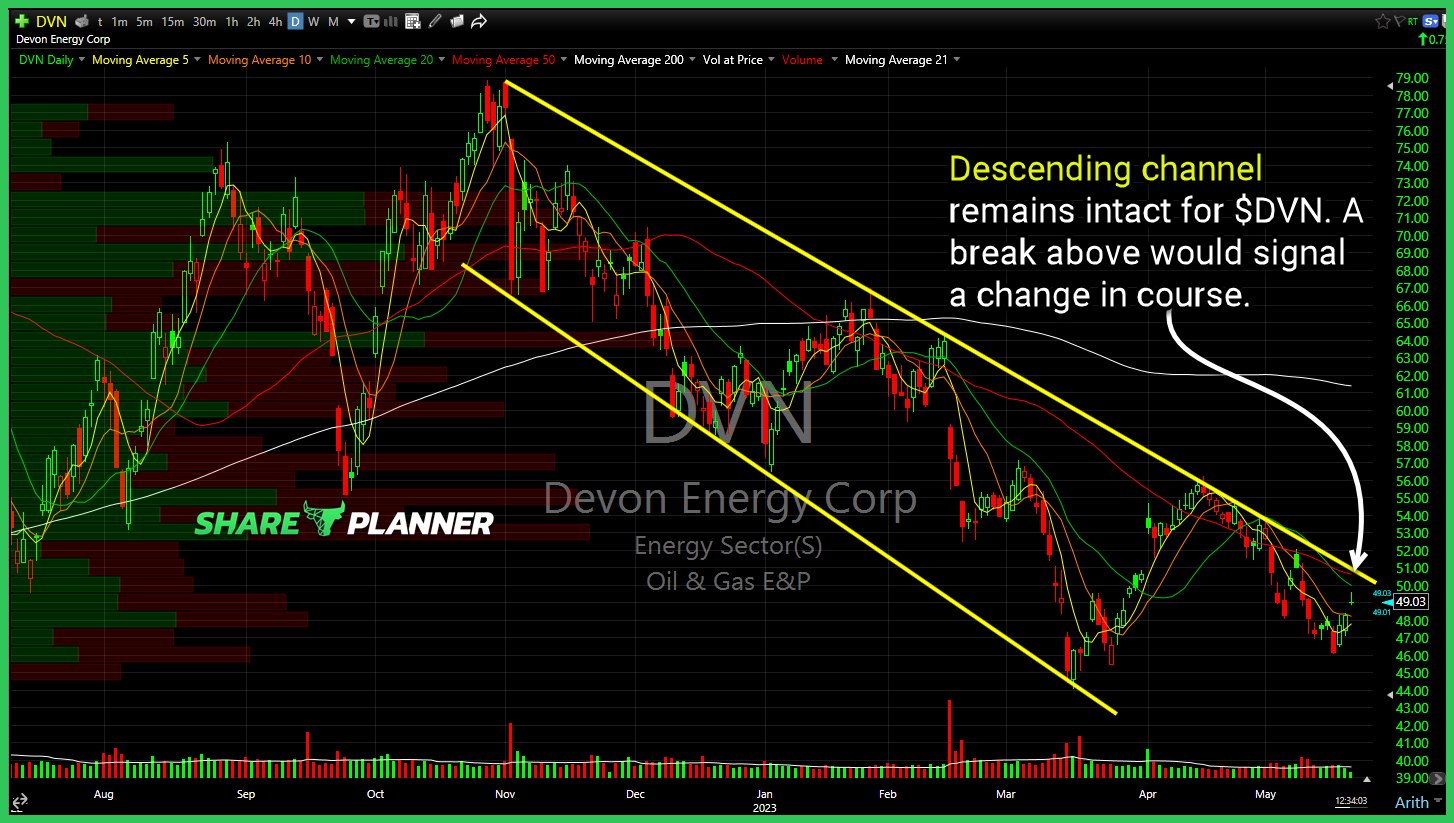

Descending channel remains intact for $DVN. A break above would signal a change in course. $SHLS with a nice push through declining resistance, but needs to breakout of consolidation to get bullish on it. $CRS attempting a bounce here off of short-term rising support. Should the bounce hold be mindful of resistance in the mid-$50's

Nvidia (NVDA) posting a 99 stochastics reading on a monthly chart is next level crazy. Costco (COST) still confined to a triangle pattern, but nearing a retest of support underneath. Netflix (NFLX) facing stiff push back against long-term resistance. Don't get me wrong - incredible rally today, but be mindful of the challenge above.

$NKE attempting here to avoid confirming a double top pattern by trying to bounce off of price level support.