Tesla (TSLA) broke declining trend-line, but also holding the rising trend-line off of recent lows. Room to run as high as $206. Break back below declining trend-line would spell trouble. Upper channel band on Palantir Technologies (PLTR) in play. Why I never swing trade earnings: Snap (SNAP)

$DENN is nearing a break of consolidation. However heavy resistance looms in the $11's. . $SNAP remains in a promising bull flag but with earnings 2/6 you may not have enough time to see it play out. Definitely one stock I would never hold through earnings as well. Watch upper channel band for resistance on

Fiverr International (FVRR) declining trend-line getting retested on the pullback. Worth waiting first to see if it will bounce or not before trying to get long on it. Otherwise it may end up pulling back to the original breakout level. Snap (SNAP) finally pushing through long-term resistance. High risk for a head fake due to

$RIVN downward channel bands remain in place. Potential for a base breakout within the channel though. Careful chasing $SNAP here at the upper end of this channel band. So far seeing some push back at resistance. Better to wait for consolidation and then a break through it. Extremely overbought here. $NVDA key support level breaking

Episode Overview The ARM IPO came out this week, hailed as the next Nvidia, and retail traders bought it with vengeance. But are buying stock IPOs a wise move for traders? Should you buy ARM IPO or the future Instacart IPO? In this podcast episode, I'll talk about whether this is the right move to

$ROKU bull flag right around the breakout level. I prefer waiting until after earnings, before making a move this stock due to the heightened risk. $DWAC pumps have historically been short lived and I expect nothing different here. $DKNG bull flag worth watching. May see a breakout here $QQQ can stabilize and bounce. Bullish wedge

Strong move out of $SNAP today, but needs to clear year-long resistance in order to breakout and fill the gap to $15. Not a lot of support underneath on $CVNA, so I would be taking this sell-off serious, and looking for a potential landing spot in the low-to-mid-$18's. $BTC.X clearing major resistance on strong volume.

Salesforce (CRM) sneaking into the gap for the attempted fill. Heavy resistance starting to mount for Apple (AAPL). CBOE 10 year Treasury Yield Index (TNX) attempting to hold support at its breakout level. Advanced Micro Devices (AMD) breaking out above short-term declining resistance. Snap (SNAP) heading towards a major layer of resistance around $12.50. Loving

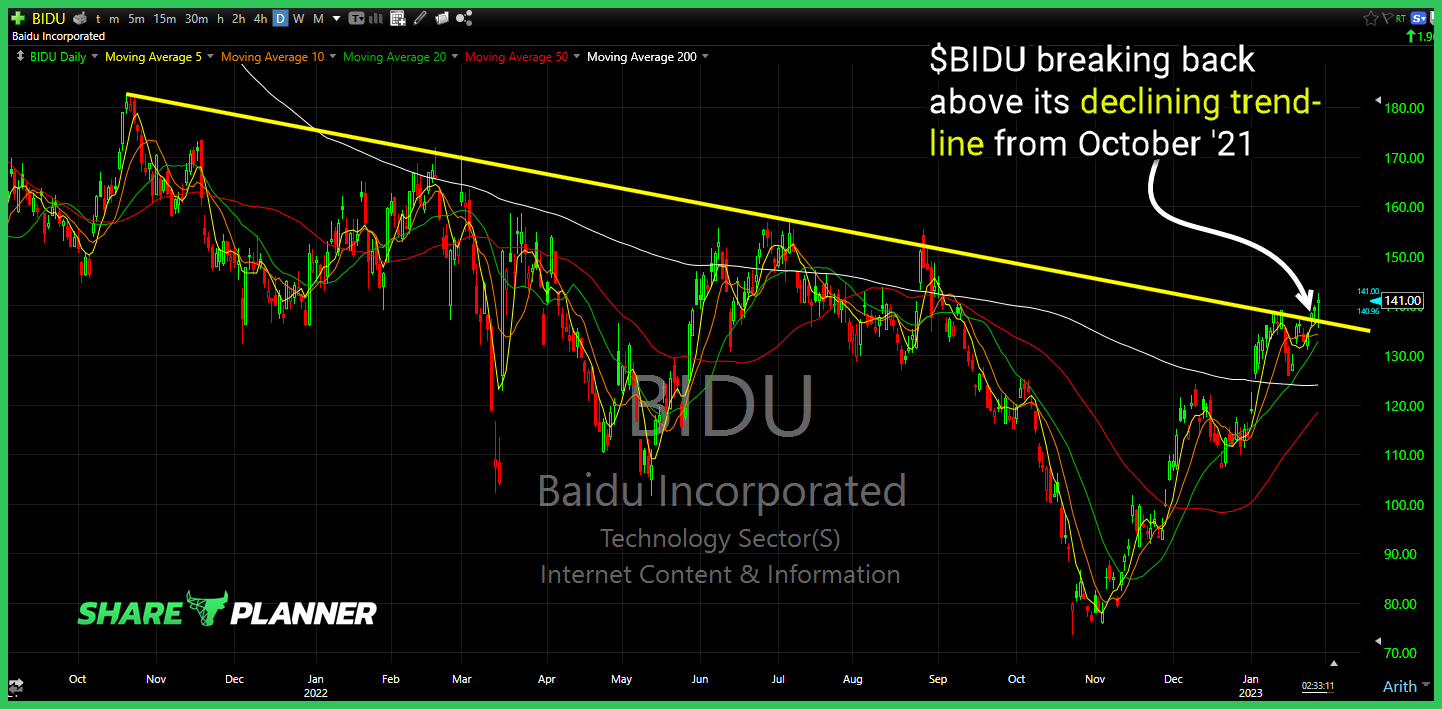

Baidu (BIDU) breaking back above its declining trend-line from October '21 Snap (SNAP) declining resistance starting to break despite being overbought all month long. Carvana (CVNA) finally breaking out of a base it has been forming since November. US Dollar holding its long-term trend-line and setting up for a bounce going into FOMC.

AMZN with an ugly break of long-term support. SOFI price action unable to sustain the move above resistance. Watch for it to close the gap. The SNAP pop isn't worth trusting as long as it remains below declining resistance just overhead. LLY rising trend-line off of September lows could be tested here really soon.