The market has held strong following the Trump election and as of yet my trend reversal indicator remains bullish.

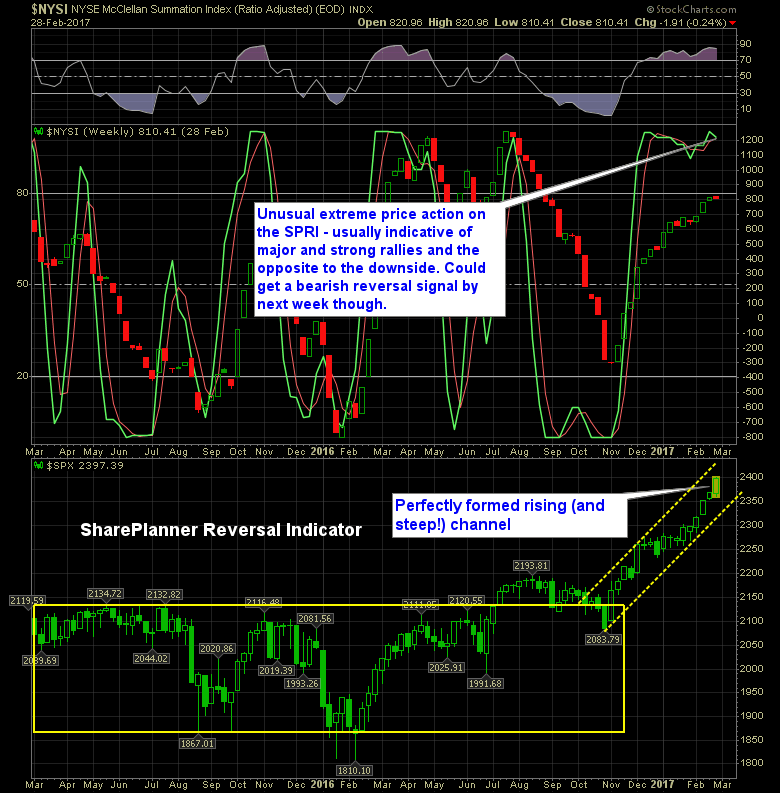

Obviously that can always change at any given time, so even in the most bullish of markets, you want to be managing your stops and curbing your risk exposure. Right now, the SharePlanner Trend Reversal Indicator is still strong, though at extremes, it has done that for ages now. There is nothing new about that.

But could it end soon?

Possibly, days like we are having of late feel good to our morale. Makes you think you can’t do anything wrong in this market. You have to be careful though because these markets all come to an end, and the majority of traders will ultimately give back everything they made. Avoid doubling down on trades, that is where a lot of people will get themselves in trouble when this market grinds to a halt. They’ll see every dip an opportunity worth buying. And who shouldn’t, every dip has been worth buying of late, but that doesn’t mean you lose your discipline in the process. Always manage risk, always manage profits, always avoid unnecessary pitfalls and amateur trading decisions.

Trend Reversal Indicator

Going into tomorrow, you are going to want to see whether this market can follow through on today’s breakout move. Yes, there have been plenty of breakouts a long the way, but this is the first one that has had a daily range of more than 1% in more than fifty trading sessions. So yes, today’s a bit more special than other rallies, but it won’t be if it can’t rally tomorrow. Below is my take on the SharePlanner’s Trend Reversal Indicator:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In this podcast episode, Ryan examines one swing trader's disaster of a trade in Robinhood (HOOD) and the problems that come with not managing the trade and managing the risk in every swing trade that one takes.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.