My Swing Trading Strategy

The market decided to throw a temper-tantrum on Friday, with above average volume, and sell-off that wiped out one of my long positions. Should the market want to shake off the sell-off, I am more than open to adding a new long position, however, I am also poised to short this market, shoudl the head and shoulders pattern on the 30 min chart play out.

Indicators

- Volatility Index (VIX) – A 6.8% rise on Friday took the indicator above the declining downtrend off of the May highs. This is problematic for the bears, as the index now sports a double bottom, and the potential to jump into the 16-18 range short-term.

- T2108 (% of stocks trading above their 40-day moving average): A 5% decline Friday, takes the indicator out of the range it had been trading in for more than two weeks. Currently sitting at 58%, which isn’t an ideal reading when the market is so close to all-time highs.

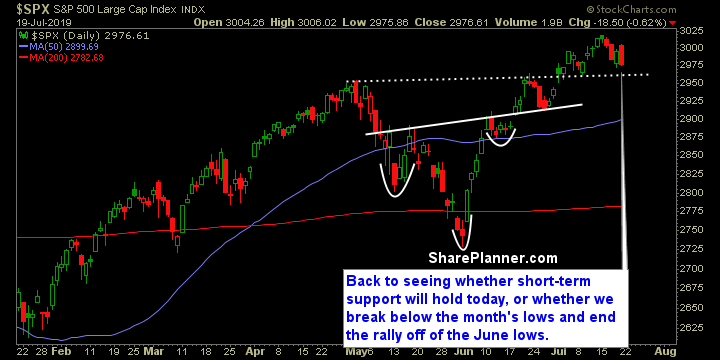

- Moving averages (SPX): Closed below the 5 and 10-day moving averages, and just above the 20-day MA now.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

I wouldn’t be surprised if Energy started to rally again this week, especially with rising tensions in Iran. I managed to be only one of three sectors to finish in positive territory on Friday. Surprisingly, the sectors to ses the strongest amount of selling on Friday was Utilities and Real Estate, which means that Friday’s selling didn’t find investors searching out safe sectors.

My Market Sentiment

Hard sell-off on Friday afternoon, but little technical damage at this point. Instead we are stuck with consolidation that has been seen for much of the month of July. Big question is whether the Fed will cut interest rates 25 or 50 basis points, and the uncertainty is creating the unease.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 2 Long position.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

The percentage amount for your stop-losses and where to put them at when trading the stock market can be very difficult to determine. In this podcast episode, Ryan talks about times when it works using tight stop-losses versus very wide stop-losses and the tricks that you can use to narrow the stop-loss even further.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.