My Swing Trading Strategy I added one new trade yesterday, while getting stopped out of another. I’ll likely play it safe today ahead of tomorrow’s G-20 Summit between the U.S. and China and may also look to curb long exposure at some point today. Indicators Volatility Index (VIX) – The declining trend-line from the 5/9 highs

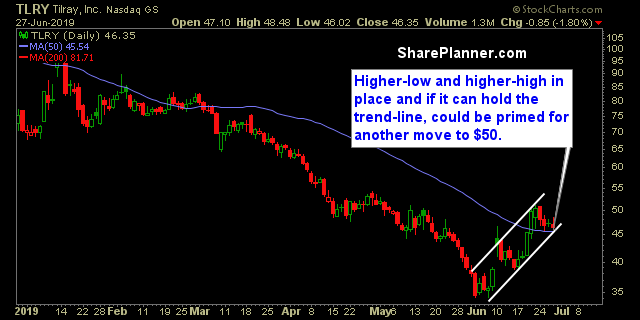

Thursday’s Swing-Trades: $TLRY $BBY $PEP Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Tilray (TLRY)

My Swing Trading Strategy One additional trade was added yesterday, and while the futures are pointing higher, this morning, the ideal time to add another trade to the portfolio may be after the morning gap has been filled, as opening price levels have not been able to hang on as of late. Indicators Volatility Index

Thursday’s Swing-Trades: $ROKU $AMAT $ALGN Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Roku (ROKU)

Thursday’s Swing-Trades: $ROKU $AMAT $ALGN Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Roku (ROKU)

My Swing Trading Strategy I added one additional long position on the dip yesterday which is off to a good start so far. I’m a little concerned by the extent of yesterday’s pullback and the fact that volume came in to support the selling late yesterday. I’ll hold off on adding any new positions in

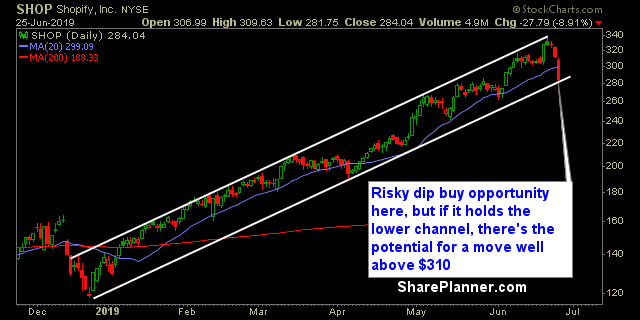

Wednesday’s Swing-Trades: $SHOP $LULU $MNK Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Shopify (SHOP)

Maybe I’m taking it a little to far, but this market is insanely boring so far this week. I’m not surprised by it being this quiet and this dull, I mean every summer is like this, unless you have a financial crisis, or some European meltdown like was seen in the summer months of 2011.

My Swing Trading Strategy Currently holding on to two positions in the portfolio, and with the lowest volume seen in over a year in the market yesterday, I refrained from adding any new positions. I’ll look to add additional long exposure today, should the market show the desire to push higher. Indicators Volatility Index (VIX) –

Tuesday’s Swing-Trades: $LYFT $DBX $LPLA Take a look at three trading ideas to prep you for the next trading session. Get all of my trades that I make real-time by jumping in the SharePlanner Trading Block and start making some profits for yourself! Long: Lyft (LYFT)