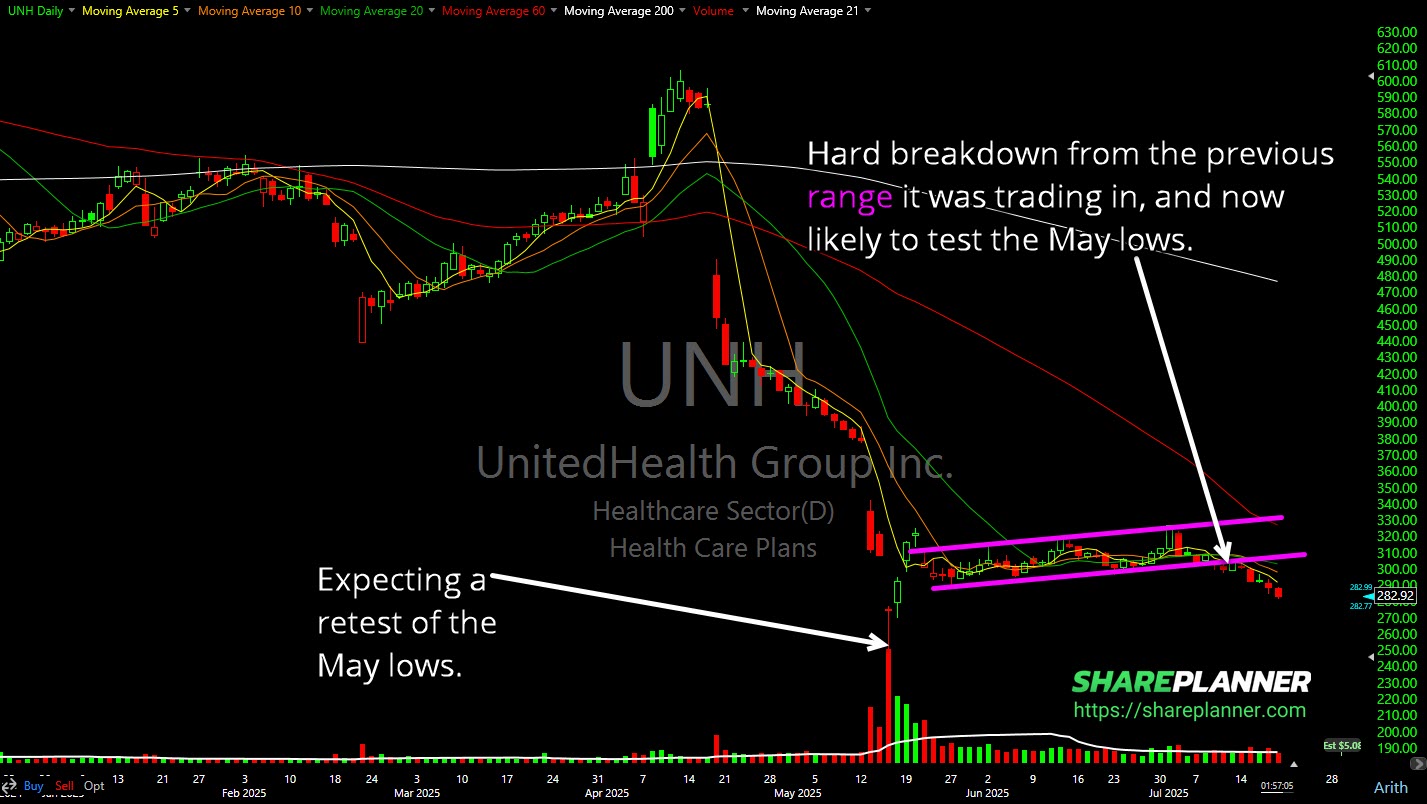

UnitedHealth Group (UNH) experienced a significant sell‑off recently, causing technical levels that helped define the uptrend to break. While such moves can be frightening, they also reveal key support levels that make great reference points for traders looking to enter, protect, or manage risk. In today’s video, we focus on: The UNH chart’s current structure

I said UnitedHealth (UNH) wasn't bouncing in June, and got roasted on X for it, but who's laughing now?

UnitedHealth (UNH) still can't find itself a bottom.

Episode Overview In today's episode, I tackle a listener email covering a variety of swing trading topics, including the benefits of cash accounts, T+1 settlements, options trading using straddles, and even straddling the indices with leveraged ETFs. I'll also discuss whether new traders should be trading options and the ramifications that come with skipping over

UnitedHealth (UNH) Keeps Dipping UnitedHealth Group (UNH) continues to see its stock crash, now over 56% down from its all-time highs following the resignation of CEO Andrew Witty and the suspension of its 2025 financial outlook. Now the DOJ is opening a federal investigation on the stock causing it to plummet further. In this video,

UnitedHealth (UNH) down 50% from all-time highs! UnitedHealth Group (UNH) is crashing. The stock dropped over 17% today following the resignation of CEO Andrew Witty and the suspension of its 2025 financial outlook due to rising medical costs, particularly in its Medicare Advantage segment. In this video, I analyze the the UNH stock, discuss the

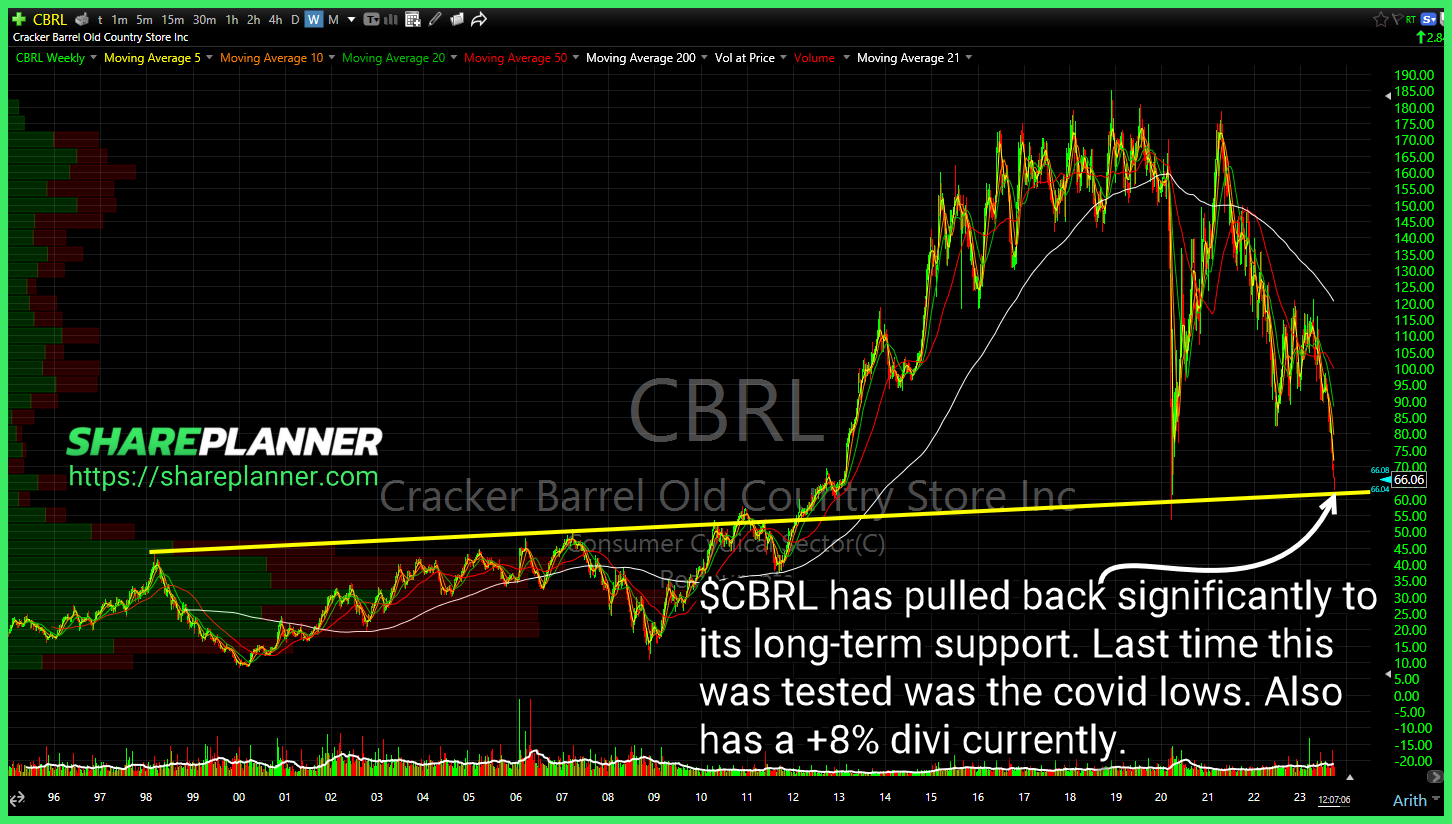

Cracker Barrel Old Country Store (CBRL) has pulled back significantly to its long-term support. Last time this was tested was the covid lows. Also has a +8% divi currently. GameStop (GME) couldn't hold the break above the declining trend-line. UnitedHealth (UNH) Retest of the declining trend-line and subsequent bounce from there. May encounter some resistance

$AKAM gapped above the inverse head and shoulders neckline, but I think it's better to wait for a pullback to the neckline before considering a new long position at this point. $UNG held the breakout level into the close. Worth watching going forward. Serious puking underway on $SPY ahead of tomorrow's CPI Report. $UNH in

NIO (NIO) breaking through both layers of resistance today on strong volume. Either UnitedHealth (UNH) bounces at $455 as it has done for the past 1.5 years, or it confirms the triple top and breaks down. Either way the $455 level is what I'm watching on UNH. Lyft (LYFT) is breaking out

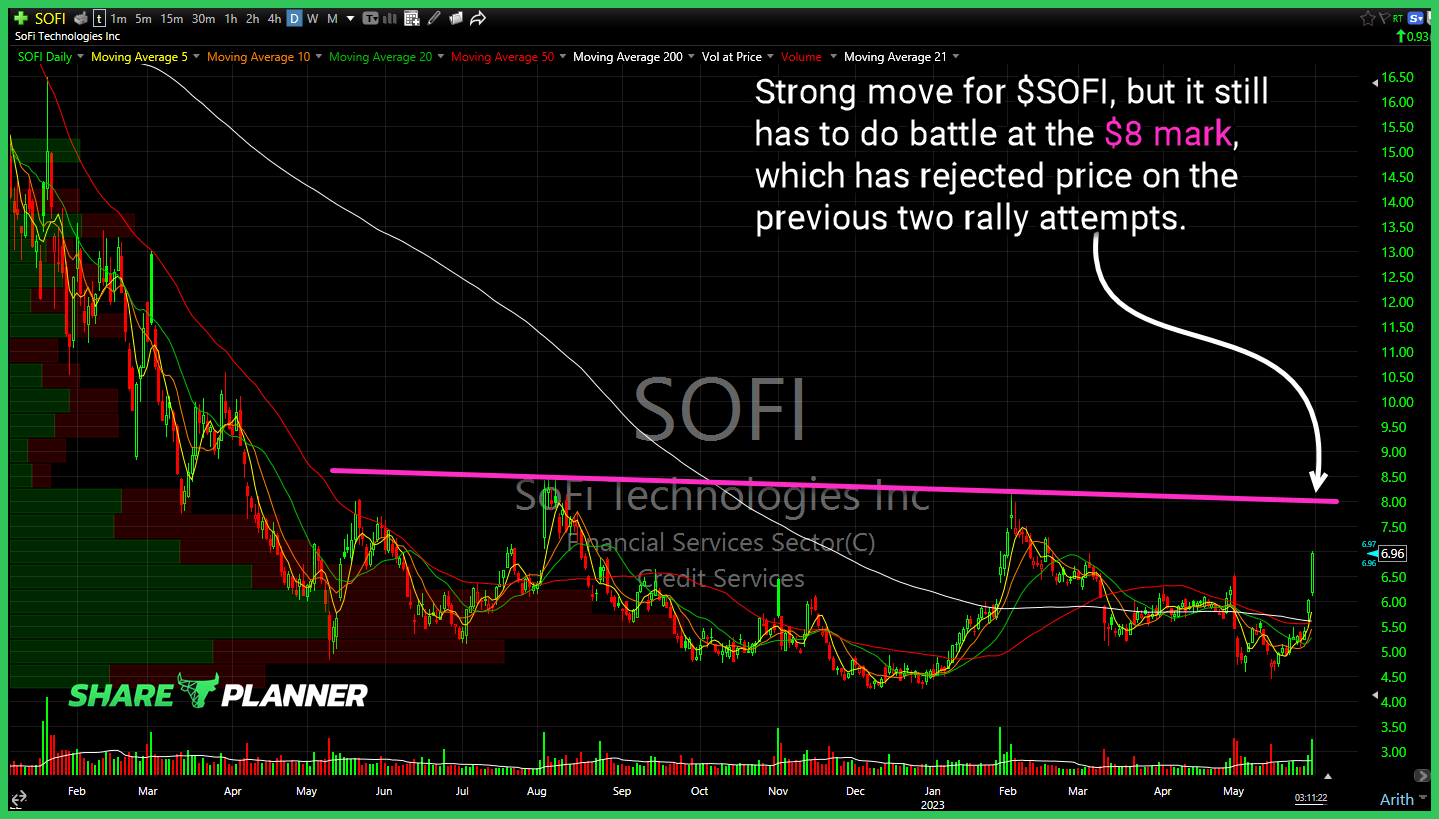

Strong move for $SOFI, but it still has to do battle at the $8 mark, which has rejected price on the previous two rally attempts. $NVDA gap closed, but the effort to bounce it after that failed. Watch for an attempt at filling the second gap. $UNH price action still a struggle, but if it