Is the stock market going to crash, or do we just BTFD and Buy the dip once again? The stock market is in a bubble mode here where anyone and everyone is wanting a piece of the action and as a result the market just keeps rising. At some point this comes to and end,

President Donald Trump is facing a likely impeachment in the House of Representatives and people are wondering if it will crash the stock market. In my video, I will discuss what you can expect the Trump impeachment will have on stocks going forward and whether the stock market will crash as a result of it.

I'm doing the technical analysis trade updates for the latest and hottest stocks and what you should be buying vs selling, and what stocks you should be staying away from all together. In this video I cover: $FB $AMZN $AAPL $GOOGL $TLT $SHOP $BABA $JPM $BAC $OSTK $BLDP $APRN $AMD $CARS $AVGO $SPX $VIX.

The trade war with China is creating a massive amount of tension in the stock market, as is the Federal Reserve and its comments out of Jackson Hole. Add to it the Trump tweets that are driving the market lower without warning, and you have a market in chaos and possibly on the brink of

The stock market is showing volatility once again but not everyone knows how to protect their capital and profit when the market starts to crash. In this video you will learn the simple swing-trading steps that I take to protect my capital and increase my profits in the most volatile and uncertain market conditions.

The stock market is instilling fears of another crash similar to what we saw in May, possibly as bad as what was seen in Q4 of 2019, or maybe even worse - who knows! In this podcast, I go over my strategy for managing you trades and approaching the stock market in a way that

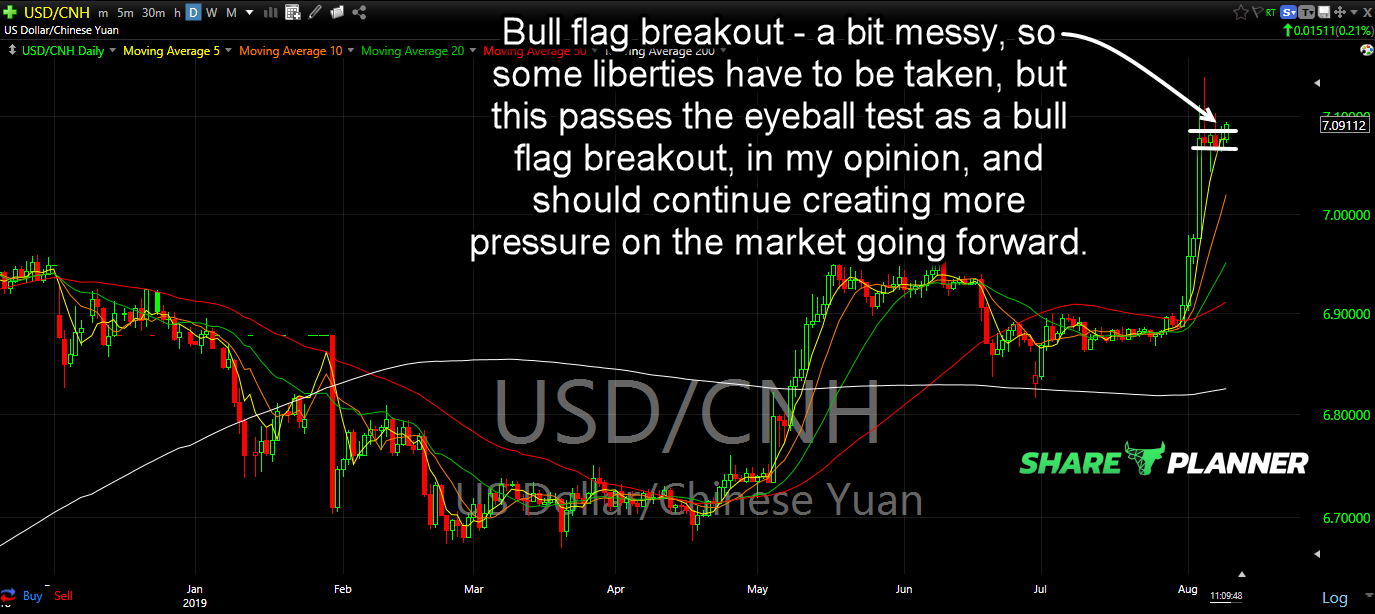

USD/Chinese Yuan chart – this is what’s causing the most pressure for the stock market, and embodies the ongoing trade war. The higher the yuan climbs (i.e. weakens against the US dollar) the more pressure it puts on US producers in their efforts to sell their products to the Chinese (it takes more Yuan to

The stock market is selling off hard and fast this week, and we are seeing volatility levels that haven't been seen since Q4 of last year when the market pulled back over 20%. Is now the time to be scared? Should you be selling your stocks? How do you get through such a difficult period?

That is pretty much the only semi-reason to short this market right now. Yes it is a dull market (until today), but you never want to short a dull market. It’ll take you to the cleaners every time. Now today, the bears are getting squeezed into covering their positions as the market continues marching