The Market must have known it was the day I post my bearish swing-trading list. Because the endless bid has disappeared and the bears are using the low volume nature of the market today to drive prices lower. I haven’t gotten short on any of these positions, but they are worth getting familiar with as

The Massive Market sell-off from two weeks ago meant nothing. I’ll be honest, that threw me off, not the sell-off itself, but the fact the market paid little mind to it thereafter. It is already a mute point with stocks now contemplating a run back up to all-time highs. I’ve put together a list of

A stock market correction today happens faster than ever. The stock market today can crash incredibly fast, and then put in a bounce in the form a v-shape that is much quicker than anything we have ever seen before. In this podcast, I address how stock market corrections have evolved over the years with electronic

A stock market correction today happens faster than ever. The stock market today can crash incredibly fast, and then put in a bounce in the form a v-shape that is much quicker than anything we have ever seen before. In this video, I address how stock market corrections have evolved over the years with electronic

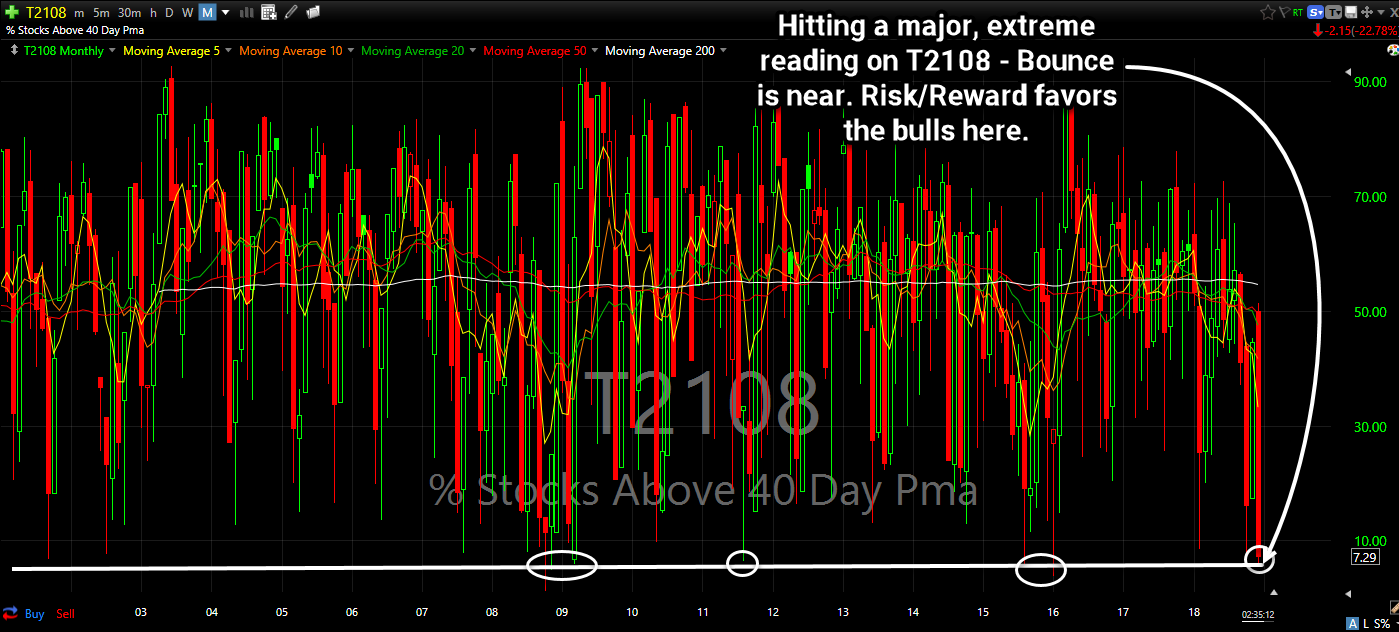

It takes a lot to get the market this oversold, and usually it comes on the heels of the bulls becoming completely exasperated. And that is what happened today when the bears drove this market another 65 points down on the S&P 500 following yesterday’s Fed sell-off, which happened to be the worst reaction ever

The stock market has been crashing over the last three months. Do you buy when everyone is selling, or do you wait, or should you sell what you have. That is the question everyone is wrestling with, and I discuss my approach and what I am doing in this video.

The stock market has experienced a lot of selling of late, and for swing-traders the prospect of knowing whether to hold a trade over night or multiple trades for that matter is very difficult. But this video has been put together to help you determine how to trade these difficult markets and to know when

My Swing Trading Approach I am coming back from a two day-hiatus from trading - one of my firsts in a very long time. I'm coming in 100% cash, and will look to deploy some of it, should the market provide some direction. I am careful here about getting overly zealous to the long side

My Swing Trading Approach I added three new trades to the portfolio yesterday, while being stopped out by another. Right now they are all positioned well, to add to their gains from yesterday's rally. However, caution is warranted as this market has proved plenty of times this past month that it doesn't like to hold

My Swing Trading Approach The bulls were unable to hold any of the early morning profits yesterday, which ultimately was nothing more than a sell-fest immediately following the market open. The potential for a bounce here in the market here looms very large, and likely to see it this week at some point. Morale among