Profit taking finally hitting the market, after a huge run up. The last two days have been brutal for the bulls, with the Volatility Index (VIX) hitting its highest level since August 17th. That’s five months to be exact.

My Swing Trading Approach Tighten my stops, and sit tight. The key here isn’t to fight the market but to wait for favorable market conditions for trading. Indicators

January has been amazing month for trading in the stock market. So far we have yet to see the market crack. Each dip continues to get bought back up with undeniable ferocity.

How much more depressing can these bearish watch lists become?

Give it a few hours, the market will bounce right back up! That’s the mentality of traders these days, and it is brutal from the standpoint of getting any real momentum to the downside. Today, just like we saw on October 25th, and again on November 2nd, 9th and today, we have the intraday sell-off

Stock Market Crash Paranoia or even just fears of a correction, can result in bad decision-making for a trader. Traders and investors more than ever, are suffering from stock market crash paranoia and when the house of cards will finally come crashing down.

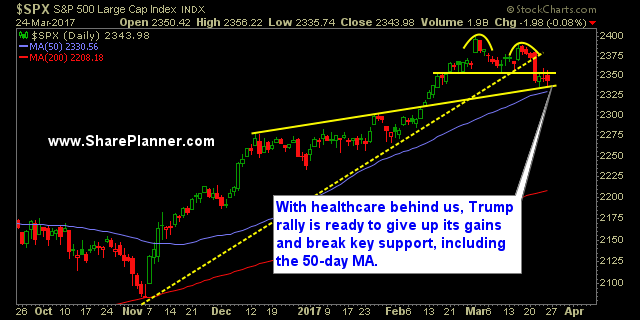

My Swing Trading Approach Raise the stops on existing long positions, and maintain the flexibility to get short as I have done over the past week of trading. Short setups are in play, if the weakness doesn’t immediately get bought up at the open. Indicators

Not a stock market crash based on historical sell offs Obviously! But the sell-off that we are seeing this morning before the equity market has even opened, is far greater than what we have become used to seeing. One thing I will add here is that, based on my experience and years of observations, the