My Swing Trading Approach I spent last week positioning myself, with a set of new long positions to be ready for an eventual bounce that looks to be unfolding today. I may add one additional long position if the rally continues to hold up, but early on, I will be letting my positions that were

If my aim is to be totally PC about all of this, I would answer with “I don’t know” or the classic economic line of “it depends”. What I personally think though, is that this market is clearly as oversold as it has been in ages. A full month of non-stop selling. In fact there

My Swing Trading Approach This is a tough market, too oversold to short, but not enouch conviction for a sustained bounce. In fact, there hasn’t been a single day of back-to-back gains since September 20th. That’s incredible really. Despite the huge, negative earnings reaction out of AMZN yesterday, and the market’s weakness today, either

My Swing Trading Approach I have identified some key trade setups that I want to take a stab at right out of the gate this morning. Should this bounce hold today, and in the days ahead, the potential for a 100 to 150 point move for SPX looms very, very large and could be

My Swing Trading Approach Stopped out of two of my long trades, but quickly hopped back in once the market showed signs of bottoming and rallying. I may add one additional long position today if the market can put together a convincing rally, but more likely than not, I’ll be watching from the sidelines and

My Swing Trading Approach Put my stops in on my current trade setups, look for a washout in the market that allows for a possible bounce from there. Otherwise, I don’t plan to trade this market at all today, unless a bottom can be put in place first. The potential for a very nasty market

It is one thing to spot a stock market bottom, it is a totally different skill set that requires you to trade it in a manner that curbs risk, and maximizes profits. In this episode, I go into great details about how I swing-trade a stock market bottom, while minimizing the potential for losses along

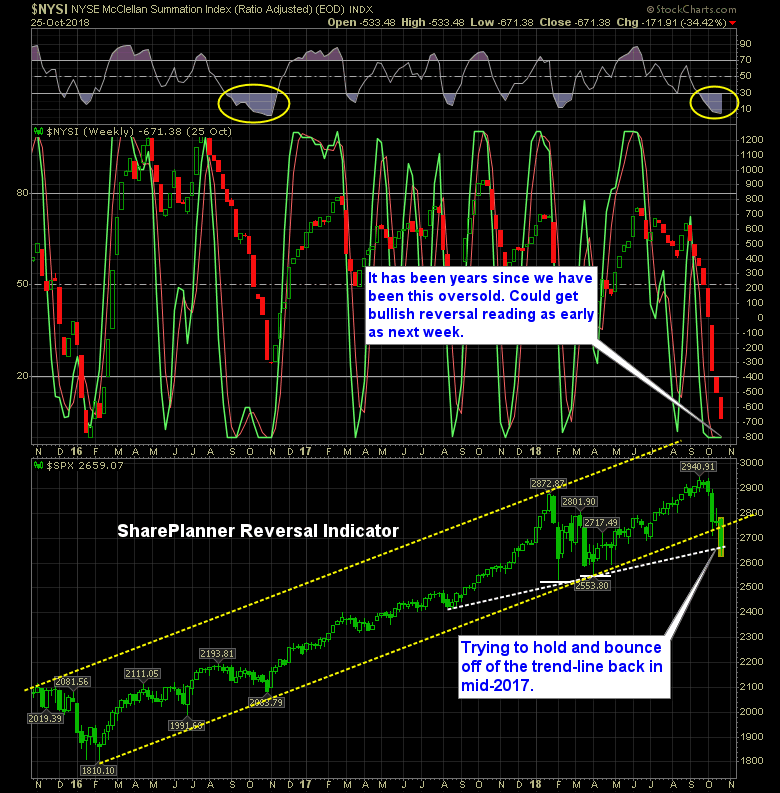

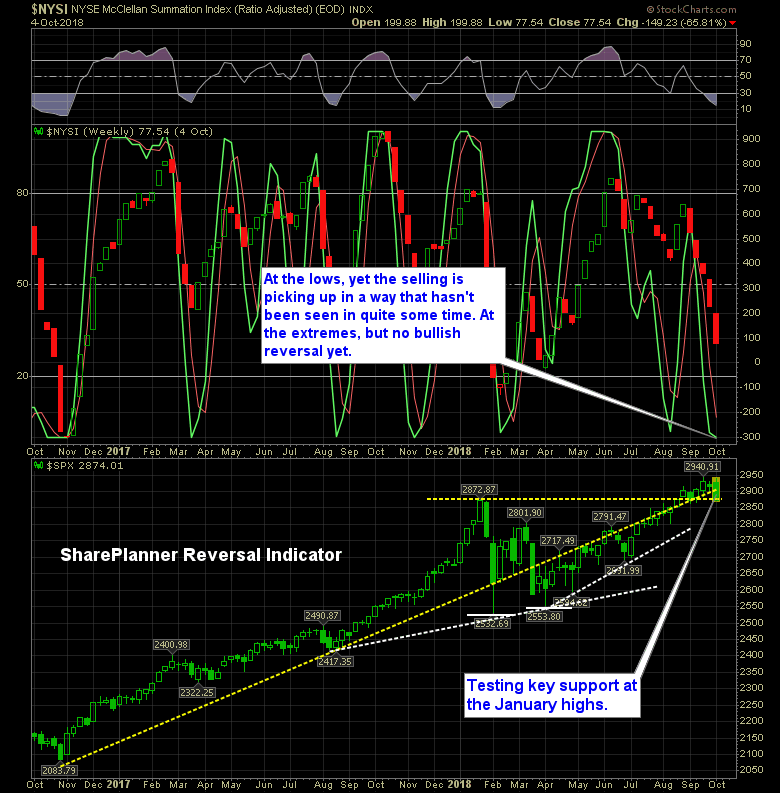

We were at extreme readings last week on the SharePlanner Reversal Indicator. This week…even more so.

‘Da Bears are back in in charge. And just like that we are looking at another test of the 200-day moving average on the S&P 500 (SPX). On the Nasdaq 100 (NDX), you have a head and shoulders pattern forming, though not yet confirmed.

Stock Market has yet to see anyone even remotely try and buy the dip There isn’t insane volume sweeping the market today, like what we saw back in February, but the extent of this sell-off is quite extreme, especially for one day. There is plenty of news headlines hitting the market hard today, which is